Answered step by step

Verified Expert Solution

Question

1 Approved Answer

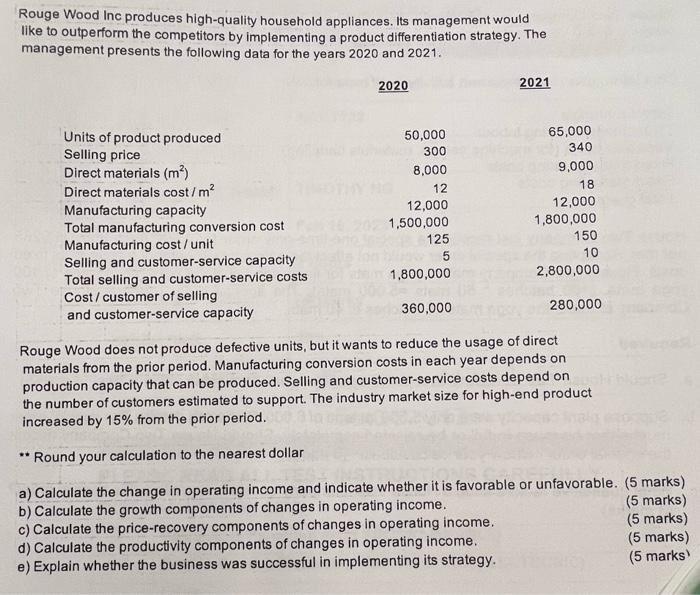

Rouge Wood Inc produces high-quality household appliances. Its management would like to outperform the competitors by implementing a product differentiation strategy. The management presents

Rouge Wood Inc produces high-quality household appliances. Its management would like to outperform the competitors by implementing a product differentiation strategy. The management presents the following data for the years 2020 and 2021. Units of product produced Selling price Direct materials (m) Direct materials cost/m Manufacturing capacity Total manufacturing conversion cost Manufacturing cost/ unit Selling and customer-service capacity Total selling and customer-service costs Cost/customer of selling. and customer-service capacity 2020 50,000 300 8,000 12 12,000 1,500,000 125 1,800,000 2021 65,000 340 9,000 18 12,000 1,800,000 150 10 2,800,000 280,000 360,000 Rouge Wood does not produce defective units, but it wants to reduce the usage of direct materials from the prior period. Manufacturing conversion costs in each year depends on production capacity that can be produced. Selling and customer-service costs depend on the number of customers estimated to support. The industry market size for high-end product increased by 15% from the prior period. ** Round your calculation to the nearest dollar a) Calculate the change in operating income and indicate whether it is favorable or unfavorable. (5 marks) b) Calculate the growth components of changes in operating income. (5 marks) c) Calculate the price-recovery components of changes in operating income. d) Calculate the productivity components of changes in operating income. e) Explain whether the business was successful in implementing its strategy. (5 marks) (5 marks) (5 marks)

Step by Step Solution

★★★★★

3.28 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the change in operating income we need to determine the operating income for each year and then compare them Operating income for 2020 Revenue Units of product produced Selling price 50...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started