Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Rough Cut Diamond Pty Ltd is a regional supplier of commercial-grade diamonds in Asia Pacific. The company is considering to secure its supply chain

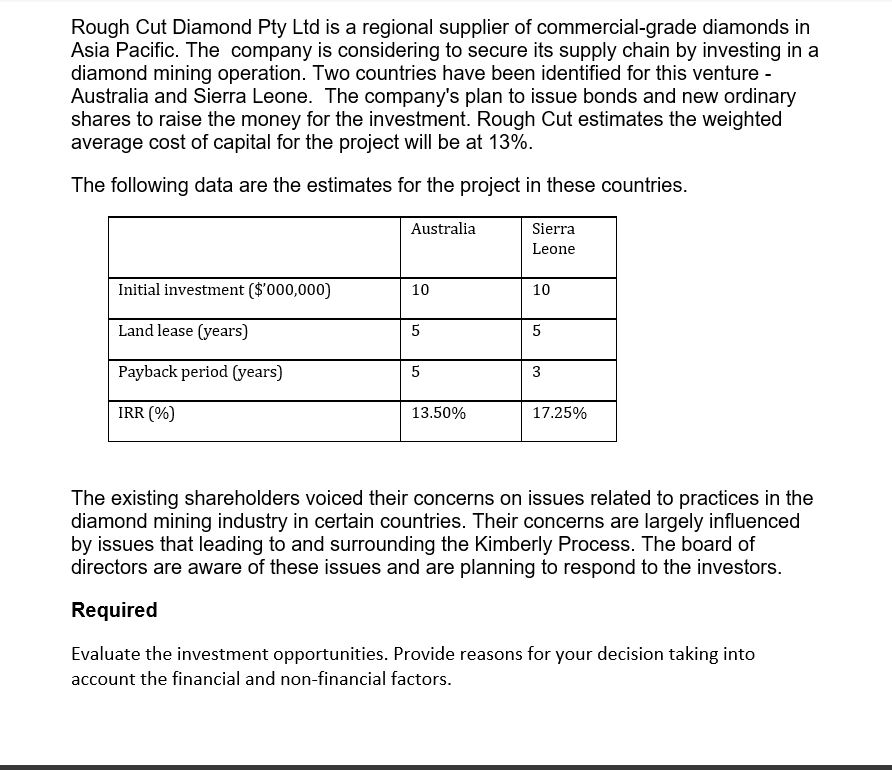

Rough Cut Diamond Pty Ltd is a regional supplier of commercial-grade diamonds in Asia Pacific. The company is considering to secure its supply chain by investing in a diamond mining operation. Two countries have been identified for this venture - Australia and Sierra Leone. The company's plan to issue bonds and new ordinary shares to raise the money for the investment. Rough Cut estimates the weighted average cost of capital for the project will be at 13%. The following data are the estimates for the project in these countries. Australia Initial investment ($'000,000) Land lease (years) Payback period (years) IRR (%) 10 5 5 13.50% Sierra Leone 10 5 3 17.25% The existing shareholders voiced their concerns on issues related to practices in the diamond mining industry in certain countries. Their concerns are largely influenced by issues that leading to and surrounding the Kimberly Process. The board of directors are aware of these issues and are planning to respond to the investors. Required Evaluate the investment opportunities. Provide reasons for your decision taking into account the financial and non-financial factors.

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To evaluate the investment opportunities in Australia and Sierra Leone for Rough Cut Diamond Pty Ltd we need to consider both financial and nonfinancial factors especially given the concerns of existi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started