Answered step by step

Verified Expert Solution

Question

1 Approved Answer

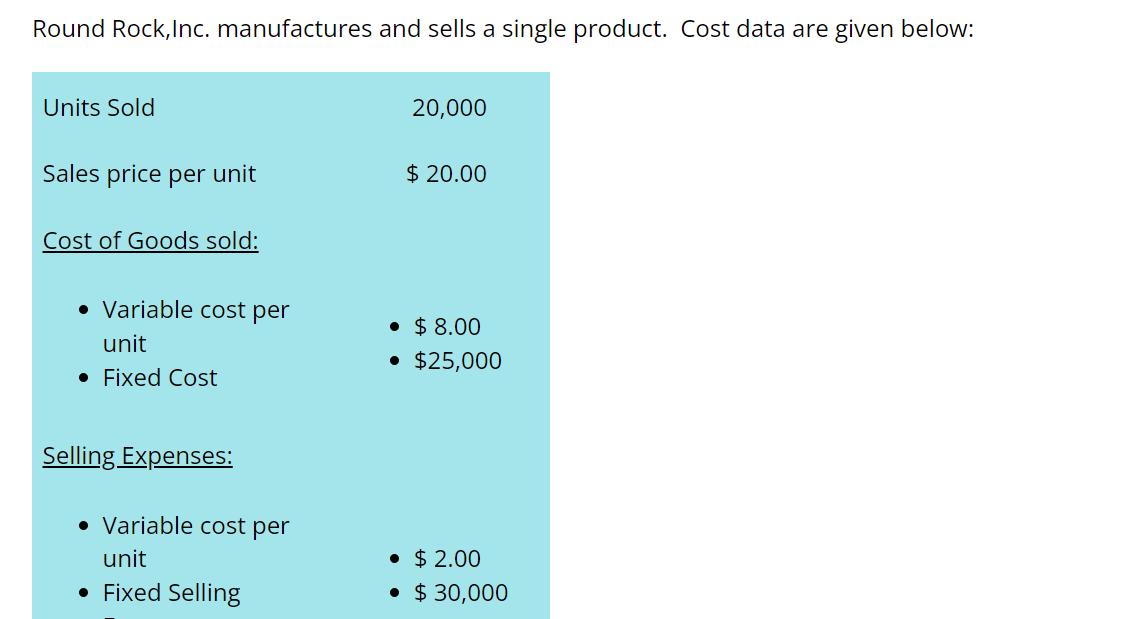

Round Rock, Inc. manufactures and sells a single product. Cost data are given below: Units Sold 20,000 Sales price per unit $ 20.00 Cost

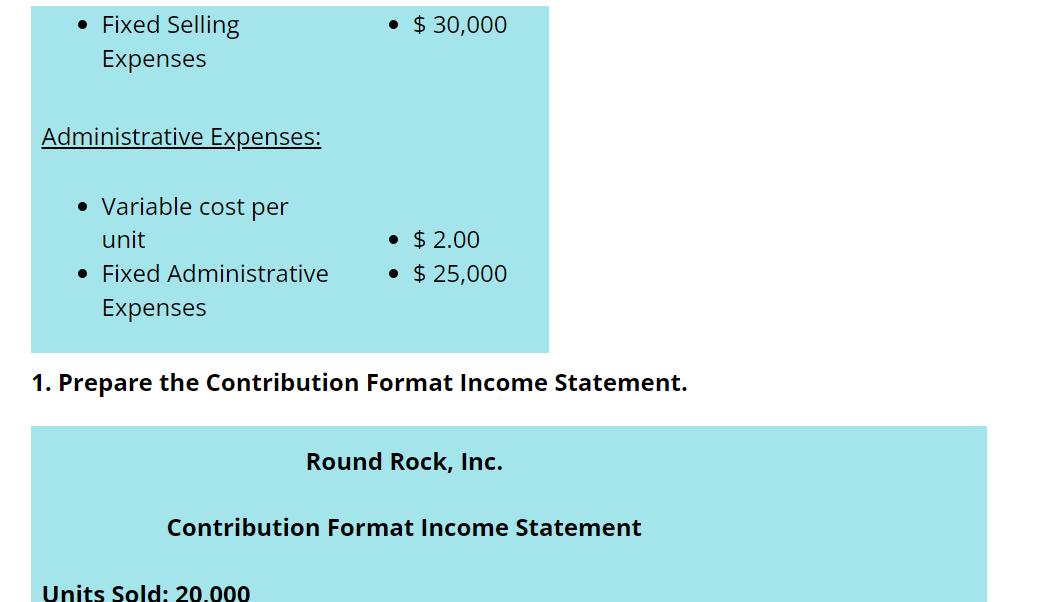

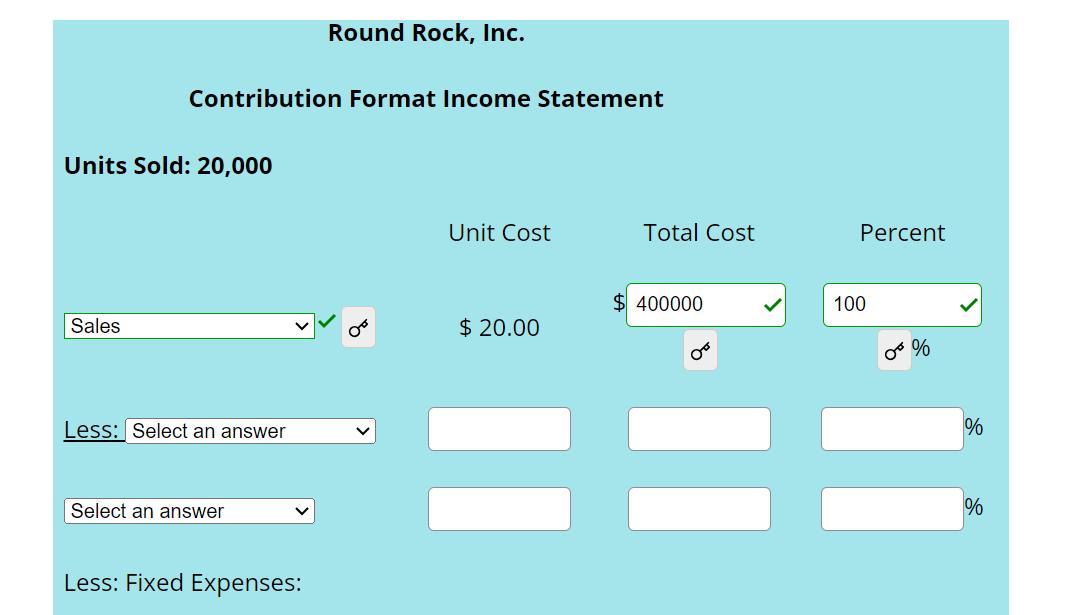

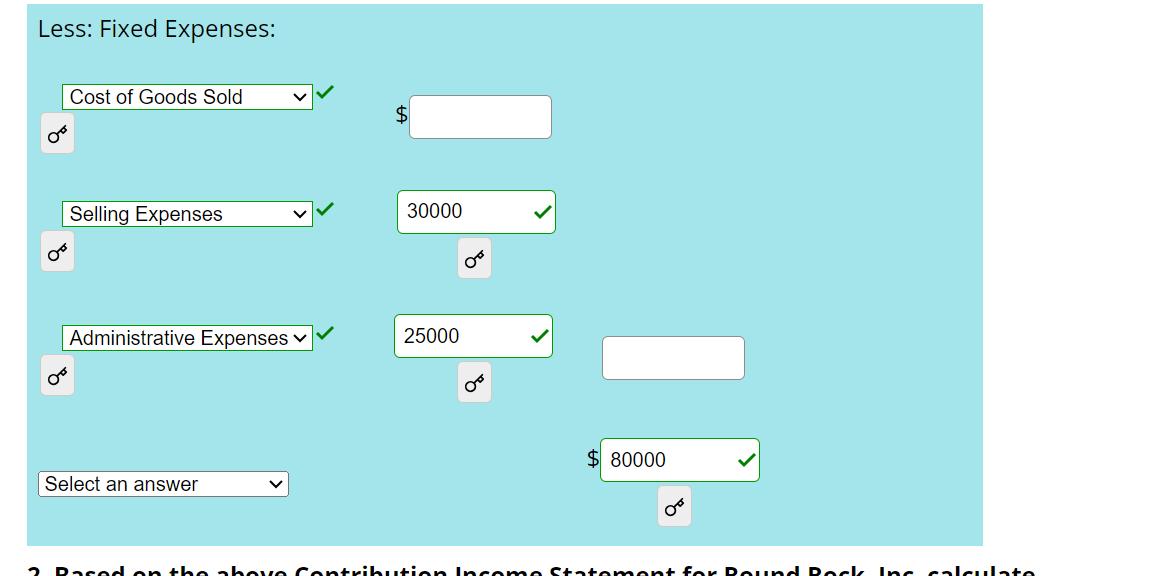

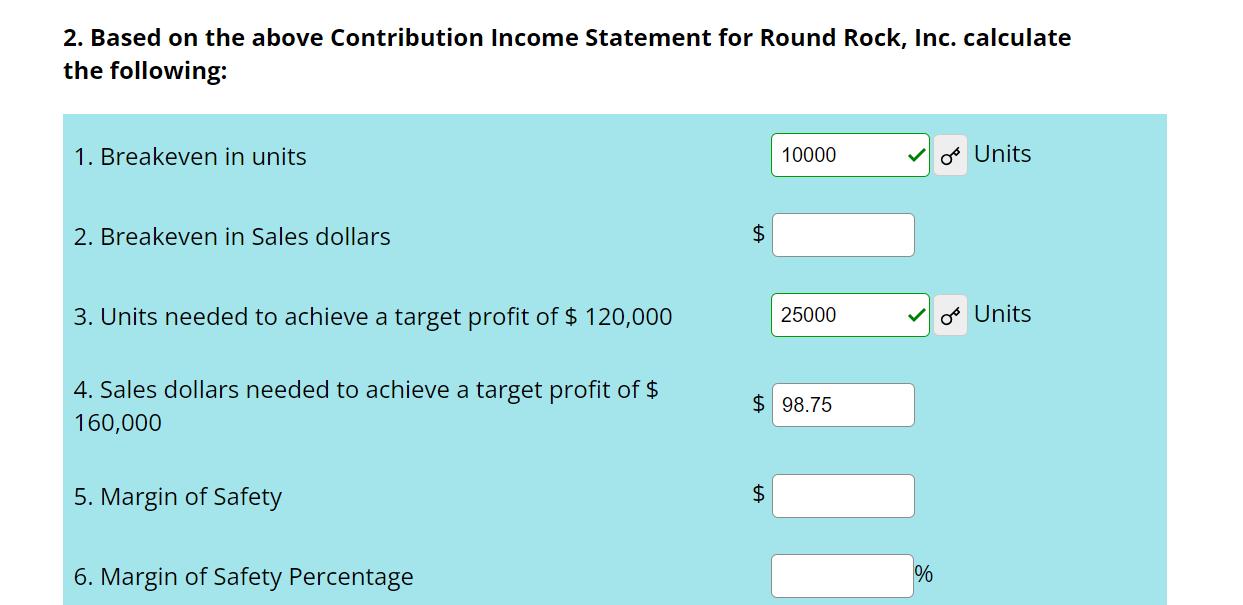

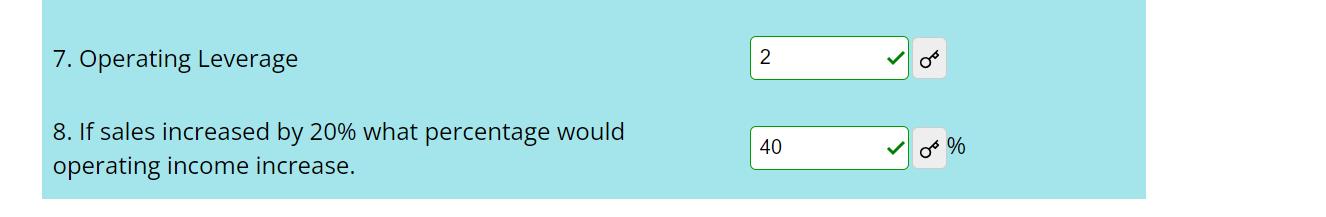

Round Rock, Inc. manufactures and sells a single product. Cost data are given below: Units Sold 20,000 Sales price per unit $ 20.00 Cost of Goods sold: Variable cost per unit Fixed Cost $ 8.00 $25,000 Selling Expenses: Variable cost per unit Fixed Selling $ 2.00 $ 30,000 Fixed Selling Expenses $30,000 Administrative Expenses: Variable cost per unit Fixed Administrative Expenses $ 2.00 $ 25,000 1. Prepare the Contribution Format Income Statement. Round Rock, Inc. Contribution Format Income Statement Units Sold: 20.000 Round Rock, Inc. Contribution Format Income Statement Units Sold: 20,000 Sales Less: Select an answer Select an answer Less: Fixed Expenses: Unit Cost Total Cost $400000 $ 20.00 Percent 100 *% % % Less: Fixed Expenses: Cost of Goods Sold $ Selling Expenses 30000 Administrative Expenses 25000 Select an answer $80000 Based on the above Contribution Income Statement for Round Rock Inc calculate 2. Based on the above Contribution Income Statement for Round Rock, Inc. calculate the following: 1. Breakeven in units 2. Breakeven in Sales dollars $ 10000 o Units 3. Units needed to achieve a target profit of $ 120,000 25000 Units 4. Sales dollars needed to achieve a target profit of $ 160,000 $ 98.75 5. Margin of Safety 6. Margin of Safety Percentage $ % 7. Operating Leverage 8. If sales increased by 20% what percentage would operating income increase. 2 40 %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the provided data to calculate the different metrics we should first calculate the contribution margin per unit which is sales price per unit ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started