Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Round to 2 decimal places and answer $ amounts in millions ( for example 1 , 0 0 0 , 0 0 0 , 0

Round to decimal places and answer $ amounts in millions for example would be entered as

A company has current liabilities of $ Million, and its current ratio is What is the total of its current assets?

A company has current liabilities of $ Million, and its current ratio is If the firms quick ratio is how much inventory does it have?

A firm has annual sales of $ million, $ million of inventory, and $ million of accounts receivable. What is its inventory turnover ratio?

A firm has annual sales of $ million, $ million of inventory, and $ million of accounts receivable. What is its DSO?

A firm has an ROA of a profit margin, and an ROE of What is its total assets turnover?

A firm has an ROA of a profit margin, and an ROE of What is its equity multiplier?

Precious metal mining has $ million in sales, its ROE is and its total assets turnover is X Common equity on the firms balance sheet is of its total assets. What is its net income? Answer this problem without scaling ie do not answer in millions so that would be entered as and use for million in calculations

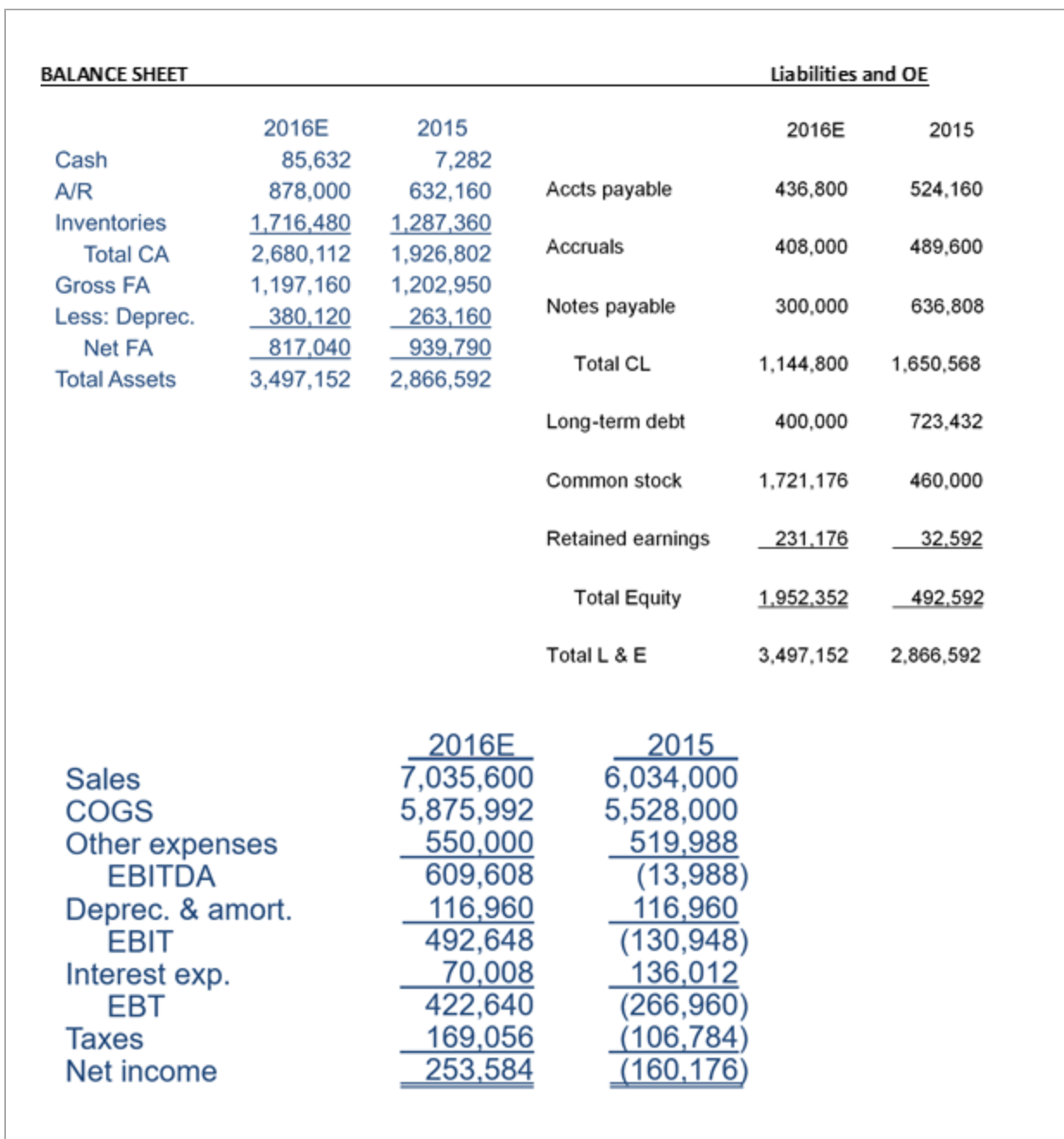

For the following questions, use the attached balance sheet.

What is DLeons Forecasted Current Ratio for

What is DLeons Forecasted Quick Ratio for

What is DLeons Inventory Turnover ratio for

What is DLeons DSO for

What is DLeons Fixed Asset turnover for

What is DLeons Total Asset turnover for

What is DLeons Debttocapital ratio for Answer in percentage form Ex: if your formula gives you you would answer without the

What is DLeons Timesinterest earned ratio for

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started