Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Round to 3 Decimal Places Answer A through D Homework: M3: Chapter 8 Homework Save Score: 0 of 1 pt 9 of 12 (3 complete

Round to 3 Decimal Places

Answer A through D

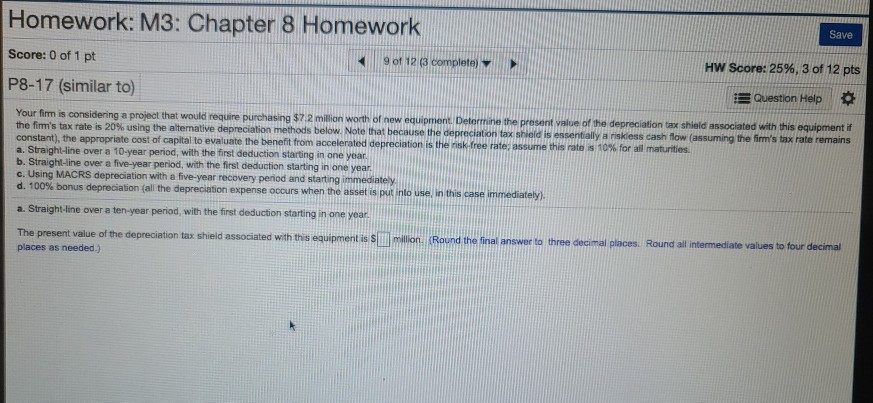

Homework: M3: Chapter 8 Homework Save Score: 0 of 1 pt 9 of 12 (3 complete HW Score: 25%, 3 of 12 pts P8-17 (similar to) Question Help Your firm is considering a project that would require purchasing $ 2 million worth of new equipment. Determine the present value of the depreciation tax shield associated with this equipment if the firm's tax rate is 20% using the alternative depreciation methods below. Note that because the depreciation tax shield is essentially a riskiess cash flow (assuming the firm's tax rate remains constant), the appropriate cost of capital to evaluate the benefit from accelerated depreciation is the risk free rate assume this rate is 10% for all maturities a. Straight-line over a 10-year period, with the first deduction starting in one year. b. Straight-line over a five-year period, with the first deduction starting in one year c. Using MACRS depreciation with a five-year recovery period and starting immediately d. 100% bonus depreciation (all the depreciation expense occurs when the asset is put into use, in this case immediately) a. Straight-line over a ten-year period, with the first deduction starting in one year. The present value of the depreciation tax shield associated with this equipment is S million Round the final answer to three decimal places. Round all intermediate values to four decimal places as needed.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started