Answered step by step

Verified Expert Solution

Question

1 Approved Answer

round to 4 decimal places = Homework: Chapte... Question 10, P14-15 (si... Part 1 of 13 HW Score: 9.09%, 1 of 11 points O Points:

round to 4 decimal places

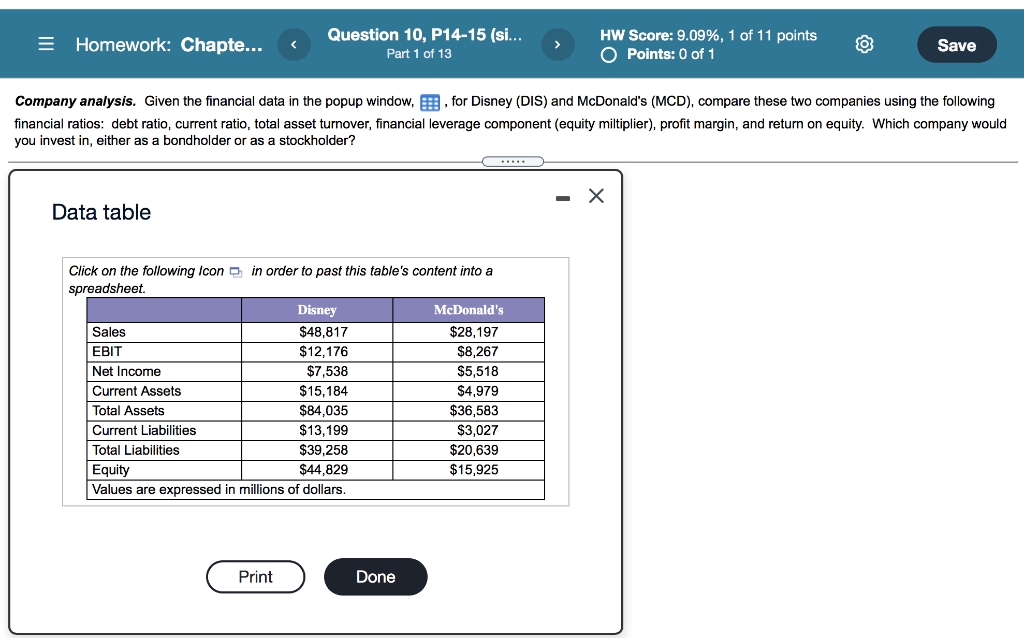

= Homework: Chapte... Question 10, P14-15 (si... Part 1 of 13 HW Score: 9.09%, 1 of 11 points O Points: 0 of 1 Save Company analysis. Given the financial data in the popup window, . for Disney (DIS) and McDonald's (MCD), compare these two companies using the following financial ratios: debt ratio, current ratio, total asset turnover, financial leverage component (equity miltiplier), profit margin, and return on equity. Which company would you invest in, either as a bondholder or as a stockholder? ... Data table Click on the following Icon in order to past this table's content into a spreadsheet Disney McDonald's Sales $48,817 $28,197 EBIT $12.176 $8,267 Net Income $7,538 $5,518 Current Assets $15,184 $4,979 Total Assets $84,035 $36,583 Current Liabilities $13,199 $3,027 Total Liabilities $39,258 $20,639 Equity $44,829 $15,925 Values are expressed in millions of dollars. Print DoneStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started