Answered step by step

Verified Expert Solution

Question

1 Approved Answer

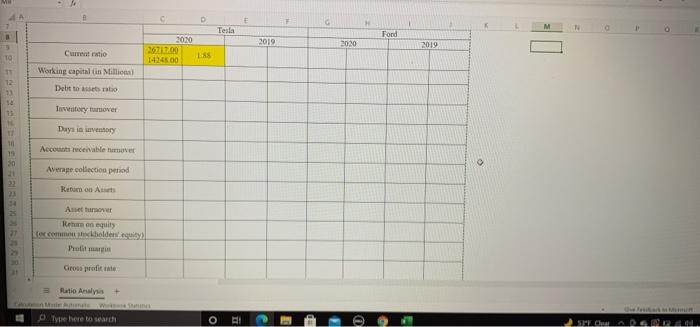

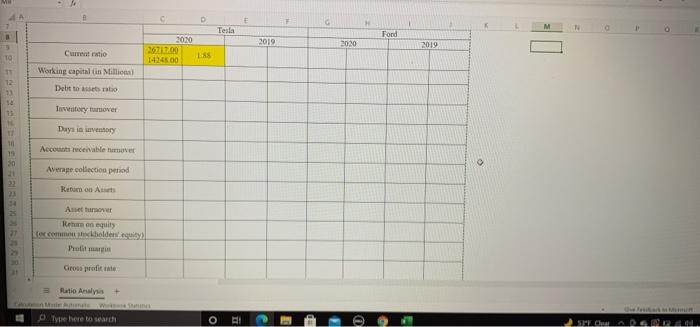

Round up you calculation to two decimal points except for working capital and free cash flows. Round to the nearest millions for working capital and

Round up you calculation to two decimal points except for working capital and free cash flows. Round to the nearest millions for working capital and free cash flows.

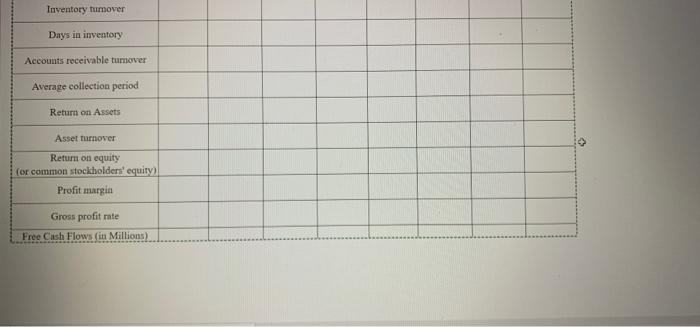

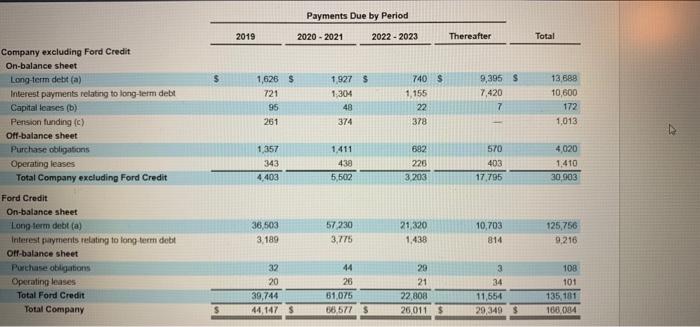

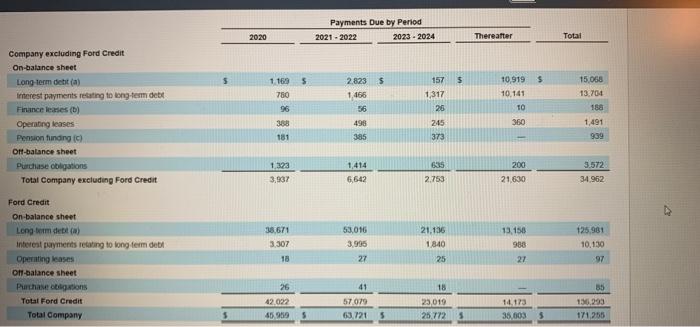

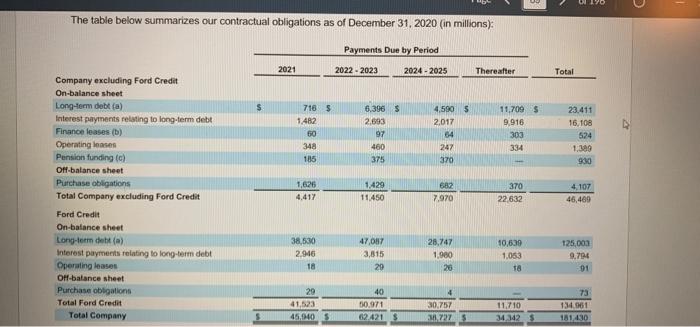

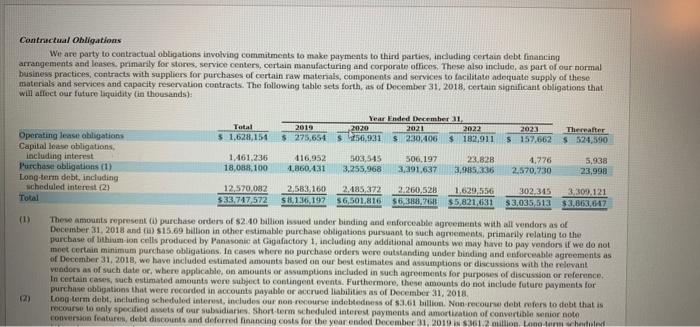

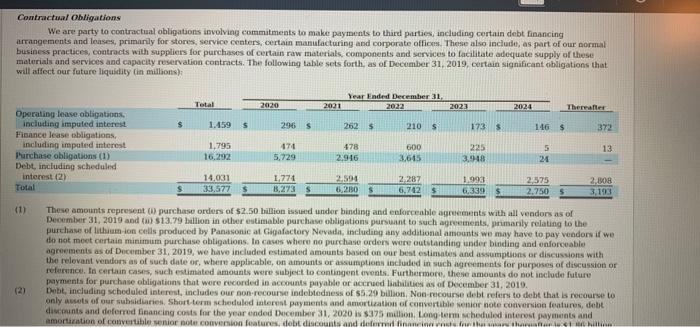

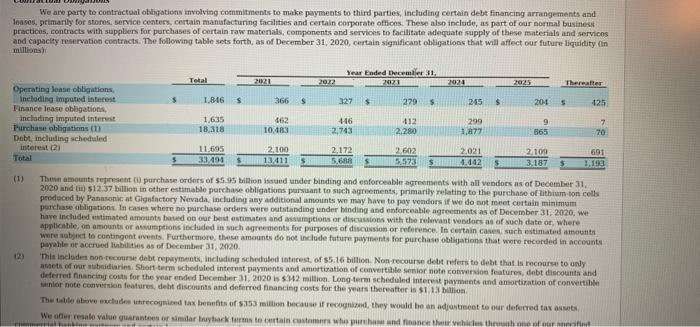

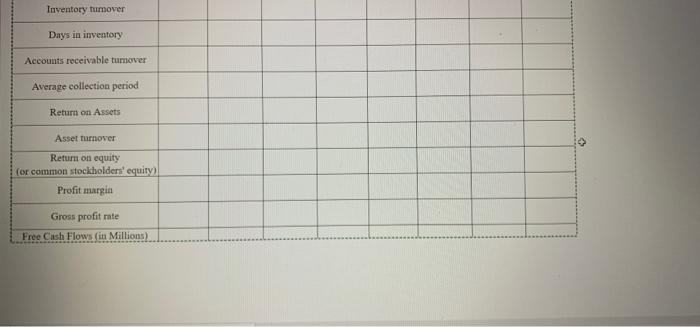

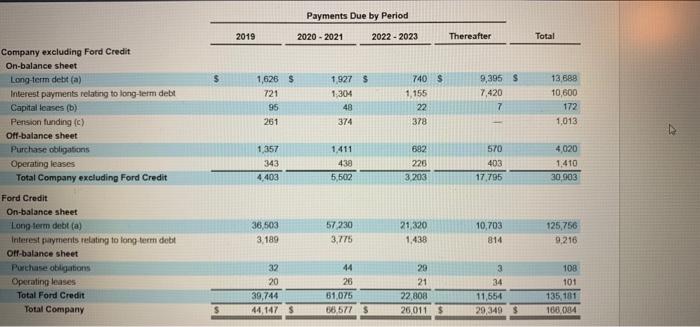

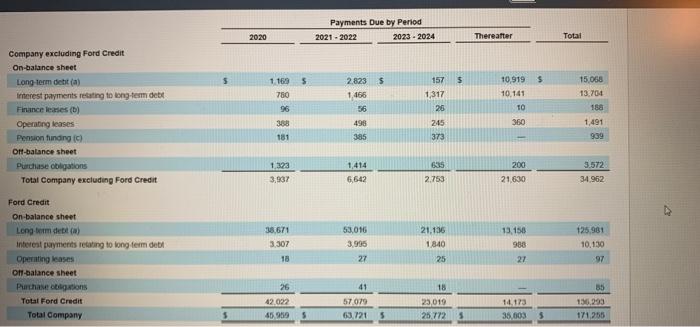

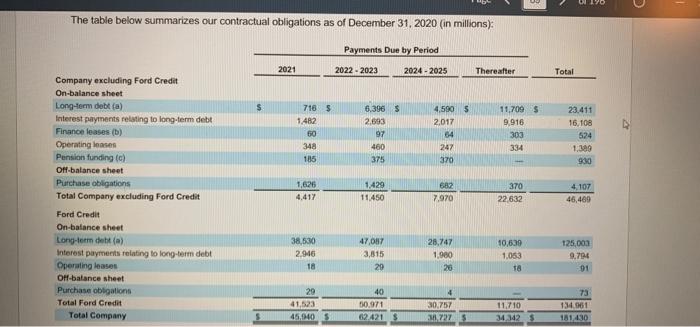

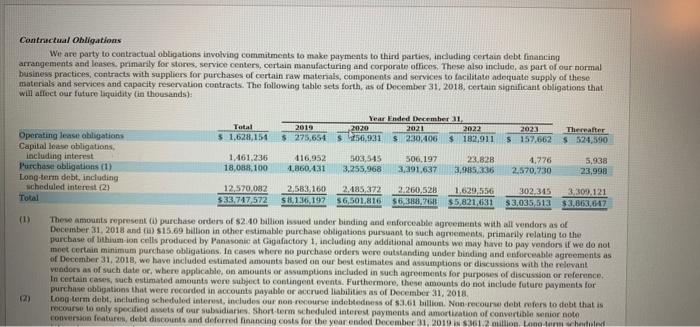

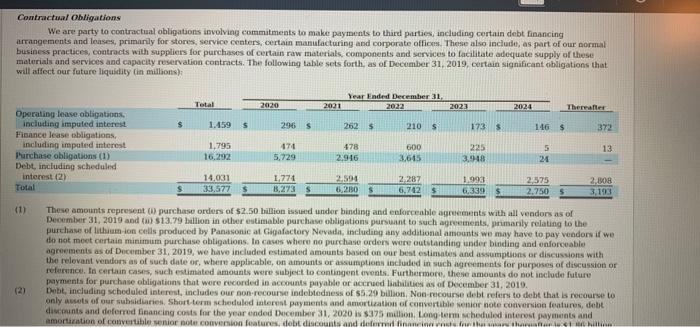

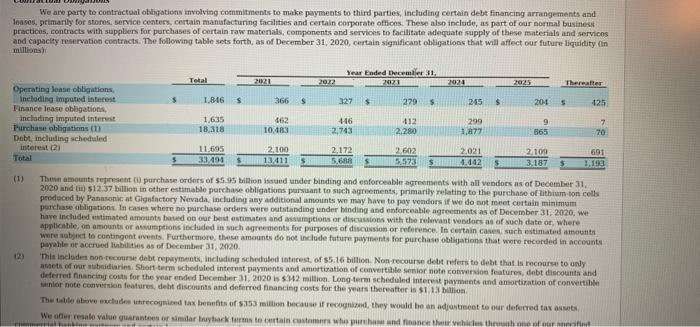

C D G M Tesla Ford 2019 2020 2019 3 TO Current ratio 2020 26717.00 14245.00 LAS 12 Working capital in Milliona Debt to set to Tovestory tumover 11 16 19 30 Days is very Accounts receivable herever Average collection period 22 Rem on A 34 Austurmer Ranity for comme holder equity) Pro Gross profile Ratio Analys 0 Type here to search GOL Inventory tumover Days in inventory Accounts receivable tumover Average collection period Return on Assets Asset turnover > Retum on equity (or common stockholders' equity) Profit margin Gross profit rate Free Cash Flows (in Millions) Payments Due by Period 2020-2021 2022 - 2023 2019 Thereafter Total 5 1,626 $ 721 95 261 1.927 $ 1:304 48 374 740 S 1.155 22 378 9,395 $ 7,420 7 13 689 10,600 172 1,013 1.357 343 4.403 Company excluding Ford Credit On-balance sheet Long-term debt (a) Interest payments relating to long-term debt Capital leases (b) Pension funding (c) Off-balance sheet Purchase obligations Operating leases Total Company excluding Ford Credit Ford Credit On-balance sheet Long term debt (a) Interest payments relating to long term debit Off-balance sheet Purchase obligations Operating leases Total Ford Credit Total Company 1.411 438 5,502 692 226 3.203 570 403 17.795 4020 1410 30 903 36,503 3.189 57 230 3,775 21,320 1,438 10,703 814 125,756 9.216 32 20 39,744 44,147 $ RE 44 26 51,075 56,577 5 29 21 22 808 26,011 $ 3 34 11,554 29,349 $ 108 101 135, 181 160.004 Payments Due by Period 2021-2022 2023 2024 2020 Thereafter Total 1 169 5 $ 5 $ 10.919 10.141 750 157 1,317 26 56 2823 1.466 56 498 385 Company excluding Ford Credit On-balance sheet Long-term detta) Interest payments relating to long-term dett Finance leases (1) Operating teases Pension funding ) Of-balance sheet Purchase obligations Total Company excluding Ford Credit TO 15.068 13,701 188 1.491 939 308 245 360 181 373 1323 1,414 635 2.753 200 21 630 3.572 34 962 3,937 6,642 Ford Credit On-balance sheet Long term detta Interest payments relating to long term del Operating lases Of-balance sheet Parchas bons Total Ford Credit Total Company 38 671 3.307 18 53.016 3.995 27 21.136 1840 25 13.156 988 27 125 981 10.130 97 26 41 18 23019 42.022 45.969 57,079 63.721 35 156,293 171.255 14.173 35.003 5 25772 5 5 The table below summarizes our contractual obligations as of December 31, 2020 (in millions): Payments Due by Period 2021 2022 2023 2024 - 2025 Thereafter Total $ 7185 1482 60 348 185 6.396 2.693 97 460 375 4,500 5 2.017 64 247 370 11,7095 9,916 303 334 23.411 16,108 524 1.380 930 62 Company excluding Ford Credit On-balance sheet Long-term debt (a) Interest payments relating to long-term debit Finance leases (b) Operating lases Pension funding ) Off-balance sheet Purchase obligations Total Company excluding Ford Credit Ford Credit On-balance sheet Long-term detta) Interest payments relating to long-term debt Operating lases Off-balance sheet Purchase obligations Total Ford Credit Total Company 1,625 4.417 1.429 11.450 370 22.632 4.107 46,489 7.970 38,530 2.946 18 47,087 3,815 29 28.747 1.980 20 10,639 1.063 125,003 9,794 91 TA 20 41,523 45,940 40 30.971 62 421 30.757 1.727 11.710 34 342 73 134,961 181430 Contractual Obligations We are party to contractual obligations involving commitments to make payments to third parties, including certain debt financing arrangements and lases, primarily for stores, service centers, certain manufacturing and corporate offices. These also include, as part of our normal business practices, contracts with suppliers for purchases of certain raw materials, components and services to facilitate adequate supply of these materials and services and capacity reservation contracts. The following table set forth, as of December 31, 2018, certain significant obligations that will affect our future liquidity (in thousands): Total $1,628,154 Year Ended December 11 2019 2020 2021 2022 $275,654 S 5,931 $ 230,406 $ 182,911 416,952 503,543 506,197 23.828 1,860,431 3.255,968 3,391,637 3,185,336 2023 Thereafter $ 157.662 S 524,390 Operating lease obligations Capital los obligations including interest Purchase obligations (1) Long-term debt, including scheduled interest (2) Total 1.461.236 18,038,100 1.776 2.570,730 5,938 23,998 12,570,082 533.747 572 2,583,160 2.185,372 58136192 6,501,816 2.260,528 $6,308, 2011 1,629,536 $5,821,031 302,345 $3,035,513 3,300 121 $3,301.047 These amounts represent) purchase orders of $2.40 billion issued under binding and enforceable agreements with all vendors as of December 31, 2018 and 15,69 billion other estimable purchase obligations pursuant to such agrements, primarily relating to the purchase of lithium-ion cells produced by Panasonic at Gigafactory 1, including any additional amounts we may have to pay vendors if we do not moet certain minimum purchase obligations. In cases where no purchase orders were outstanding under binding and enforceable agreements as of December 31, 2018, we have included estimated amounts based on our best estimates and assumptions or discussions with the relevant vendors as of such date or, where applicable, on amounts or assumptions included in such agrements for purposes of discussion or reference In certain cases, such estimated amounts were subject to contingent events. Furthermore, these amounts do not include future payments for purchase obligations that were recorded in accounts payable or accrued liabilities as of December 31, 2018 Loog-term debt, including scheduled interest, includes our non course indebtedness of $3.61 billion. Non recourse debt refers to do it that is recourse to only specified sets of our subsidiaries Short-term scheduled interest payments and amortization of convertible senior not conversion feature, debt discounts and deferred financing costs for the year ended December 31, 2019 361.2 million. Long term hade 2) Contractual Obligations We are party to contractual obligations involving commitments to make payments to third parties, including certain debt financing arrangements and leases, primarily for stores, service centers, certain manufacturing and corporate office. These also include, as part of our normal business practices, contracts with suppliers for purchases of certain raw materials components and services to facilitate adequate supply of these materials and services and capacity reservation contracts. The following table set forth, as of December 31, 2019, certain significant obligations that will affect our future liquidity in millions): Total 2020 Year Ended December 31 2022 2021 2023 2024 Thereafter 1.459 $ 296 $ 262 5 210 5 173 $ 116 $ 372 Operating lease obligations including imputed interest Finance lease obligations, including impated interest Purchase obligations (1) Debt, including scheduled interest (2) Total 1,795 16,292 4740 5.729 478 2,916 600 2,645 225 3.948 13 5 22 1.993 14.031 33.577 1.774 B,273 2.591 6,2130 2,287 6.742 S 63395 2,575 2.750 2,808 3,193 (1) These amounts represent purchase orders of $2.50 billion issued under binding and enforceable agreements with all vendors as of December 31, 2010 and $13.79 billion in other estimable purchase obligations pursuant to such agreements, primarily relating to the purchase of lithium-ion cells produced by Panasonic at Gigafactory Nevada, including any additional amounts we may have to pay vendors if we do not meet certain minimum purchase obligations. In cases where no purchase orders were outstanding under binding and enforceable agreements as of December 31, 2019, we have included estimated amounts based on our best estimates and assumptions or discussions with the relevant vendors as of such date or, where applicable, on amounts or assumptions included in such agreements for purposes of discussion or reference. In certain cases, such estimated amounts were subject to contingent events. Furthermore, there amounts do not include future payments for purchase obligations that were recorded in accounts payable or accredibilities as of December 31, 2019. Debt, including scheduled interest, includes our non recourse indebtedness of $5.29 billion, Non-recourse debt refers to debt that is recourse to only assots of our subsidiaries Short term scheduled interest payments and amortization of convertible senior note conversion features, debt discounts and deferred financing costs for the year ended December 31, 2020 $375 million. Long-term scheduled interest payments and amortization of convertible senior note convention features, debt discounts and definither than (2) We are party to contractual obligations involving commitments to make payments to third parties, including certain debt financing arrangements and losos, primarily for stores, service centers, certain manufacturing facilities and certain corporate offices. These also include, as part of our normal business practices, contracts with suppliers for purchases of certain raw materials, components and servions to facilitate adequate supply of these materials and services and capacity reservation contracts. The following table set forth, as of December 31, 2020, curtain significant obligations that will affect our future liquidity (in millions Year Ended December 31, Total 2021 20.12 2021 2024 2025 Thereafter 1.846 $ 366 $ 327 279 $ 245 $ 20+ 5 125 Operating Sonse obligations including imputed interest Finance lease obligations including imputed interest Purchase obligations Debt, including scheduled interest (2) Total 1.635 18,318 462 10.183 446 2,743 412 2.280 299 1,877 9 365 7 70 11 695 33.494 2.100 13.411 2.172 5.688 2.502 5.573 2,021 S4.142 2.100 3.187 5 S 691 1,190 (1) The amounts represent purchase orders of $5.95 billion issued under binding and enforceable agreements with all vendors as of December 31 2020 land (11) 12:37 billion in other estimable purchase obligations pursuant to sich agreements, primarily relating to the purchase of lithium-ion cells produced by Panasonic at Gigafactory Nevada, including any additional amounts we may have to pay vendors if we do not meet certain minimum purchase obligation. In cases where no purchase orders were outstanding under binding and enforceable agreements as of December 31, 2020. we have inchided estimated amounts based on our best estimates and assumptions or discussions with the relevant vendors as of such date or where applicable, on amounts or asumptions included in such agrements for purposes of discussion or reference in certain cases, such estimated amounts were subject to contingent events. Furthermore, these amounts do not include future payments for purchase obligations that were recorded in accounts payable or accrued liabilities as of December 31, 2020 "This includes non recordebt repayments, including scheduled interest of $5.16 billion. Non recoue debt refers to debit that is recourse to only amets of our subsidiaries Short-term scheduled interest payments and amortization of convertible senior not conversion features, debt discounts and deferred financing costs for the year ended December 31, 2020 is $12 million. Long term scheduled interest payments and amortization of convertible wnior note conversion features, debt discounts and deferred financing costs for the years thereafter is $1.13 billion The table above excludes recognized tax befits of 355 million because if recognized, they would be an adjustment to our deferred tax ans We other resale value guarantees or similar buybackterms to certain customers who purchase and finance the vehicles throue one of our and C D G M Tesla Ford 2019 2020 2019 3 TO Current ratio 2020 26717.00 14245.00 LAS 12 Working capital in Milliona Debt to set to Tovestory tumover 11 16 19 30 Days is very Accounts receivable herever Average collection period 22 Rem on A 34 Austurmer Ranity for comme holder equity) Pro Gross profile Ratio Analys 0 Type here to search GOL Inventory tumover Days in inventory Accounts receivable tumover Average collection period Return on Assets Asset turnover > Retum on equity (or common stockholders' equity) Profit margin Gross profit rate Free Cash Flows (in Millions) Payments Due by Period 2020-2021 2022 - 2023 2019 Thereafter Total 5 1,626 $ 721 95 261 1.927 $ 1:304 48 374 740 S 1.155 22 378 9,395 $ 7,420 7 13 689 10,600 172 1,013 1.357 343 4.403 Company excluding Ford Credit On-balance sheet Long-term debt (a) Interest payments relating to long-term debt Capital leases (b) Pension funding (c) Off-balance sheet Purchase obligations Operating leases Total Company excluding Ford Credit Ford Credit On-balance sheet Long term debt (a) Interest payments relating to long term debit Off-balance sheet Purchase obligations Operating leases Total Ford Credit Total Company 1.411 438 5,502 692 226 3.203 570 403 17.795 4020 1410 30 903 36,503 3.189 57 230 3,775 21,320 1,438 10,703 814 125,756 9.216 32 20 39,744 44,147 $ RE 44 26 51,075 56,577 5 29 21 22 808 26,011 $ 3 34 11,554 29,349 $ 108 101 135, 181 160.004 Payments Due by Period 2021-2022 2023 2024 2020 Thereafter Total 1 169 5 $ 5 $ 10.919 10.141 750 157 1,317 26 56 2823 1.466 56 498 385 Company excluding Ford Credit On-balance sheet Long-term detta) Interest payments relating to long-term dett Finance leases (1) Operating teases Pension funding ) Of-balance sheet Purchase obligations Total Company excluding Ford Credit TO 15.068 13,701 188 1.491 939 308 245 360 181 373 1323 1,414 635 2.753 200 21 630 3.572 34 962 3,937 6,642 Ford Credit On-balance sheet Long term detta Interest payments relating to long term del Operating lases Of-balance sheet Parchas bons Total Ford Credit Total Company 38 671 3.307 18 53.016 3.995 27 21.136 1840 25 13.156 988 27 125 981 10.130 97 26 41 18 23019 42.022 45.969 57,079 63.721 35 156,293 171.255 14.173 35.003 5 25772 5 5 The table below summarizes our contractual obligations as of December 31, 2020 (in millions): Payments Due by Period 2021 2022 2023 2024 - 2025 Thereafter Total $ 7185 1482 60 348 185 6.396 2.693 97 460 375 4,500 5 2.017 64 247 370 11,7095 9,916 303 334 23.411 16,108 524 1.380 930 62 Company excluding Ford Credit On-balance sheet Long-term debt (a) Interest payments relating to long-term debit Finance leases (b) Operating lases Pension funding ) Off-balance sheet Purchase obligations Total Company excluding Ford Credit Ford Credit On-balance sheet Long-term detta) Interest payments relating to long-term debt Operating lases Off-balance sheet Purchase obligations Total Ford Credit Total Company 1,625 4.417 1.429 11.450 370 22.632 4.107 46,489 7.970 38,530 2.946 18 47,087 3,815 29 28.747 1.980 20 10,639 1.063 125,003 9,794 91 TA 20 41,523 45,940 40 30.971 62 421 30.757 1.727 11.710 34 342 73 134,961 181430 Contractual Obligations We are party to contractual obligations involving commitments to make payments to third parties, including certain debt financing arrangements and lases, primarily for stores, service centers, certain manufacturing and corporate offices. These also include, as part of our normal business practices, contracts with suppliers for purchases of certain raw materials, components and services to facilitate adequate supply of these materials and services and capacity reservation contracts. The following table set forth, as of December 31, 2018, certain significant obligations that will affect our future liquidity (in thousands): Total $1,628,154 Year Ended December 11 2019 2020 2021 2022 $275,654 S 5,931 $ 230,406 $ 182,911 416,952 503,543 506,197 23.828 1,860,431 3.255,968 3,391,637 3,185,336 2023 Thereafter $ 157.662 S 524,390 Operating lease obligations Capital los obligations including interest Purchase obligations (1) Long-term debt, including scheduled interest (2) Total 1.461.236 18,038,100 1.776 2.570,730 5,938 23,998 12,570,082 533.747 572 2,583,160 2.185,372 58136192 6,501,816 2.260,528 $6,308, 2011 1,629,536 $5,821,031 302,345 $3,035,513 3,300 121 $3,301.047 These amounts represent) purchase orders of $2.40 billion issued under binding and enforceable agreements with all vendors as of December 31, 2018 and 15,69 billion other estimable purchase obligations pursuant to such agrements, primarily relating to the purchase of lithium-ion cells produced by Panasonic at Gigafactory 1, including any additional amounts we may have to pay vendors if we do not moet certain minimum purchase obligations. In cases where no purchase orders were outstanding under binding and enforceable agreements as of December 31, 2018, we have included estimated amounts based on our best estimates and assumptions or discussions with the relevant vendors as of such date or, where applicable, on amounts or assumptions included in such agrements for purposes of discussion or reference In certain cases, such estimated amounts were subject to contingent events. Furthermore, these amounts do not include future payments for purchase obligations that were recorded in accounts payable or accrued liabilities as of December 31, 2018 Loog-term debt, including scheduled interest, includes our non course indebtedness of $3.61 billion. Non recourse debt refers to do it that is recourse to only specified sets of our subsidiaries Short-term scheduled interest payments and amortization of convertible senior not conversion feature, debt discounts and deferred financing costs for the year ended December 31, 2019 361.2 million. Long term hade 2) Contractual Obligations We are party to contractual obligations involving commitments to make payments to third parties, including certain debt financing arrangements and leases, primarily for stores, service centers, certain manufacturing and corporate office. These also include, as part of our normal business practices, contracts with suppliers for purchases of certain raw materials components and services to facilitate adequate supply of these materials and services and capacity reservation contracts. The following table set forth, as of December 31, 2019, certain significant obligations that will affect our future liquidity in millions): Total 2020 Year Ended December 31 2022 2021 2023 2024 Thereafter 1.459 $ 296 $ 262 5 210 5 173 $ 116 $ 372 Operating lease obligations including imputed interest Finance lease obligations, including impated interest Purchase obligations (1) Debt, including scheduled interest (2) Total 1,795 16,292 4740 5.729 478 2,916 600 2,645 225 3.948 13 5 22 1.993 14.031 33.577 1.774 B,273 2.591 6,2130 2,287 6.742 S 63395 2,575 2.750 2,808 3,193 (1) These amounts represent purchase orders of $2.50 billion issued under binding and enforceable agreements with all vendors as of December 31, 2010 and $13.79 billion in other estimable purchase obligations pursuant to such agreements, primarily relating to the purchase of lithium-ion cells produced by Panasonic at Gigafactory Nevada, including any additional amounts we may have to pay vendors if we do not meet certain minimum purchase obligations. In cases where no purchase orders were outstanding under binding and enforceable agreements as of December 31, 2019, we have included estimated amounts based on our best estimates and assumptions or discussions with the relevant vendors as of such date or, where applicable, on amounts or assumptions included in such agreements for purposes of discussion or reference. In certain cases, such estimated amounts were subject to contingent events. Furthermore, there amounts do not include future payments for purchase obligations that were recorded in accounts payable or accredibilities as of December 31, 2019. Debt, including scheduled interest, includes our non recourse indebtedness of $5.29 billion, Non-recourse debt refers to debt that is recourse to only assots of our subsidiaries Short term scheduled interest payments and amortization of convertible senior note conversion features, debt discounts and deferred financing costs for the year ended December 31, 2020 $375 million. Long-term scheduled interest payments and amortization of convertible senior note convention features, debt discounts and definither than (2) We are party to contractual obligations involving commitments to make payments to third parties, including certain debt financing arrangements and losos, primarily for stores, service centers, certain manufacturing facilities and certain corporate offices. These also include, as part of our normal business practices, contracts with suppliers for purchases of certain raw materials, components and servions to facilitate adequate supply of these materials and services and capacity reservation contracts. The following table set forth, as of December 31, 2020, curtain significant obligations that will affect our future liquidity (in millions Year Ended December 31, Total 2021 20.12 2021 2024 2025 Thereafter 1.846 $ 366 $ 327 279 $ 245 $ 20+ 5 125 Operating Sonse obligations including imputed interest Finance lease obligations including imputed interest Purchase obligations Debt, including scheduled interest (2) Total 1.635 18,318 462 10.183 446 2,743 412 2.280 299 1,877 9 365 7 70 11 695 33.494 2.100 13.411 2.172 5.688 2.502 5.573 2,021 S4.142 2.100 3.187 5 S 691 1,190 (1) The amounts represent purchase orders of $5.95 billion issued under binding and enforceable agreements with all vendors as of December 31 2020 land (11) 12:37 billion in other estimable purchase obligations pursuant to sich agreements, primarily relating to the purchase of lithium-ion cells produced by Panasonic at Gigafactory Nevada, including any additional amounts we may have to pay vendors if we do not meet certain minimum purchase obligation. In cases where no purchase orders were outstanding under binding and enforceable agreements as of December 31, 2020. we have inchided estimated amounts based on our best estimates and assumptions or discussions with the relevant vendors as of such date or where applicable, on amounts or asumptions included in such agrements for purposes of discussion or reference in certain cases, such estimated amounts were subject to contingent events. Furthermore, these amounts do not include future payments for purchase obligations that were recorded in accounts payable or accrued liabilities as of December 31, 2020 "This includes non recordebt repayments, including scheduled interest of $5.16 billion. Non recoue debt refers to debit that is recourse to only amets of our subsidiaries Short-term scheduled interest payments and amortization of convertible senior not conversion features, debt discounts and deferred financing costs for the year ended December 31, 2020 is $12 million. Long term scheduled interest payments and amortization of convertible wnior note conversion features, debt discounts and deferred financing costs for the years thereafter is $1.13 billion The table above excludes recognized tax befits of 355 million because if recognized, they would be an adjustment to our deferred tax ans We other resale value guarantees or similar buybackterms to certain customers who purchase and finance the vehicles throue one of our and

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started