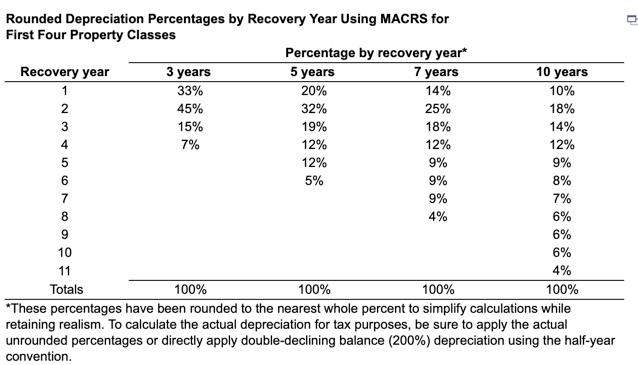

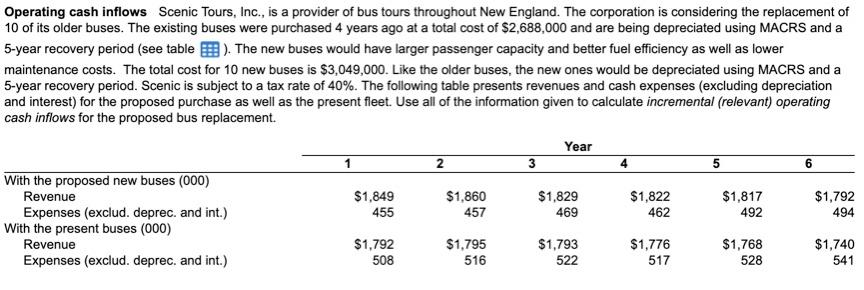

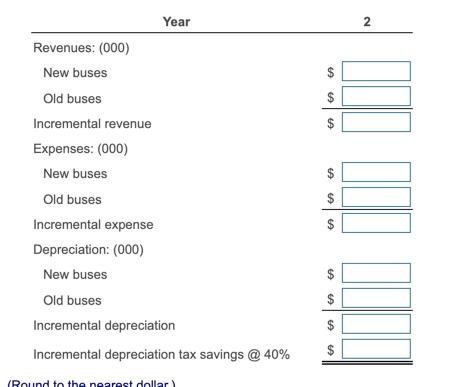

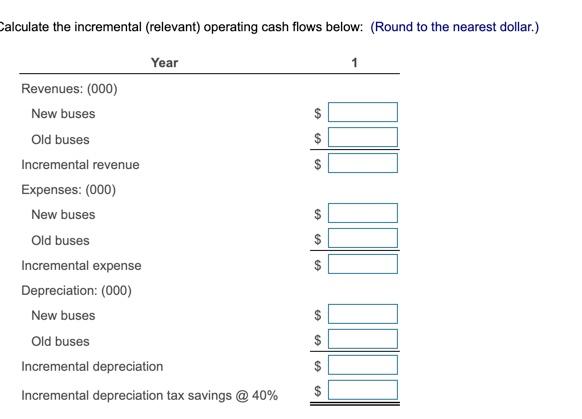

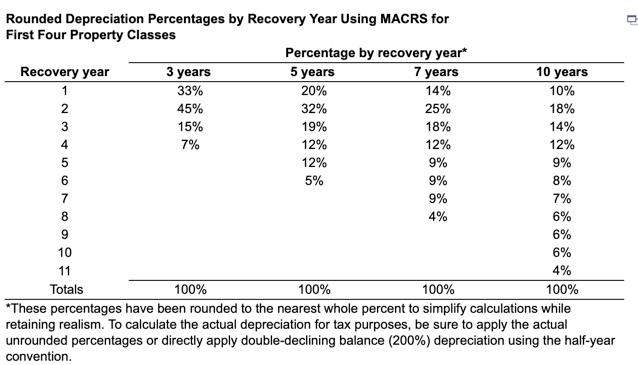

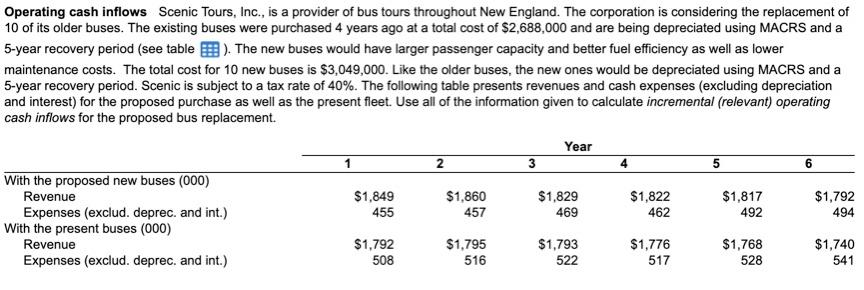

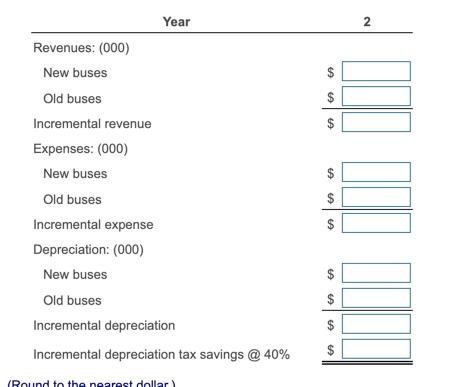

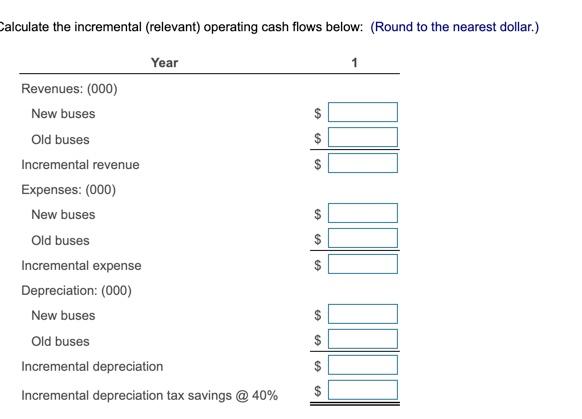

Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes Percentage by recovery year* Recovery year 3 years 5 years 7 years 10 years 1 33% 20% 14% 10% 2 45% 32% 25% 18% 15% 19% 18% 14% 7% 12% 12% 12% 12% 9% 9% 5% 9% 8% 9% 7% 8 4% 6% 9 6% 10 6% 11 4% Totals 100% 100% 100% 100% *These percentages have been rounded to the nearest whole percent to simplify calculations while retaining realism. To calculate the actual depreciation for tax purposes, be sure to apply the actual unrounded percentages or directly apply double-declining balance (200%) depreciation using the half-year convention. 234567 0 Operating cash inflows Scenic Tours, Inc., is a provider of bus tours throughout New England. The corporation is considering the replacement of 10 of its older buses. The existing buses were purchased 4 years ago at a total cost of $2,688,000 and are being depreciated using MACRS and a 5-year recovery period (see table). The new buses would have larger passenger capacity and better fuel efficiency as well as lower maintenance costs. The total cost for 10 new buses is $3,049,000. Like the older buses, the new ones would be depreciated using MACRS and a 5-year recovery period. Scenic is subject to a tax rate of 40%. The following table presents revenues and cash expenses (excluding depreciation and interest) for the proposed purchase as well as the present fleet. Use all of the information given to calculate incremental (relevant) operating cash inflows for the proposed bus replacement. Year 1 2 4 5 6 With the proposed new buses (000) Revenue $1,849 $1,822 $1,817 $1,860 457 Expenses (exclud. deprec. and int.) 455 462 492 With the present buses (000) Revenue $1,792 $1,795 $1,776 $1,768 508 Expenses (exclud. deprec. and int.) 516 517 528 $1,829 469 $1,793 522 $1,792 494 $1,740 541 Year Revenues: (000) New buses Old buses Incremental revenue Expenses: (000) New buses Old buses Incremental expense Depreciation: (000) New buses Old buses Incremental depreciation Incremental depreciation tax savings @ 40% (Round to the nearest dollar) GA $ LA SA 00 $ 69 2 69 00 $ $ $ Calculate the incremental (relevant) operating cash flows below: (Round to the nearest dollar.) Year 1 Revenues: (000) New buses Old buses Incremental revenue Expenses: (000) New buses Old buses Incremental expense Depreciation: (000) New buses Old buses Incremental depreciation Incremental depreciation tax savings @ 40% SA S SA 60 69 SA SA 69 SA SA