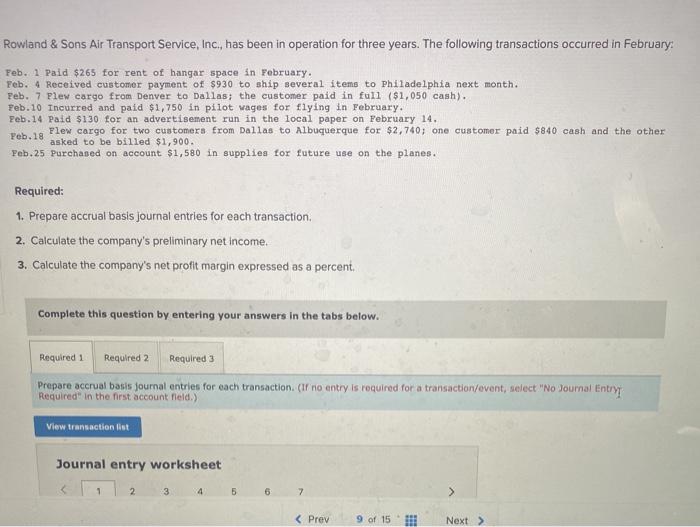

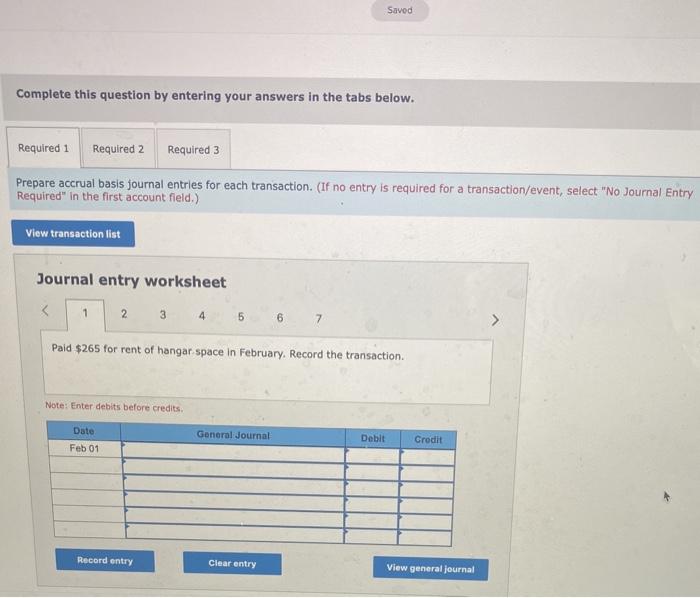

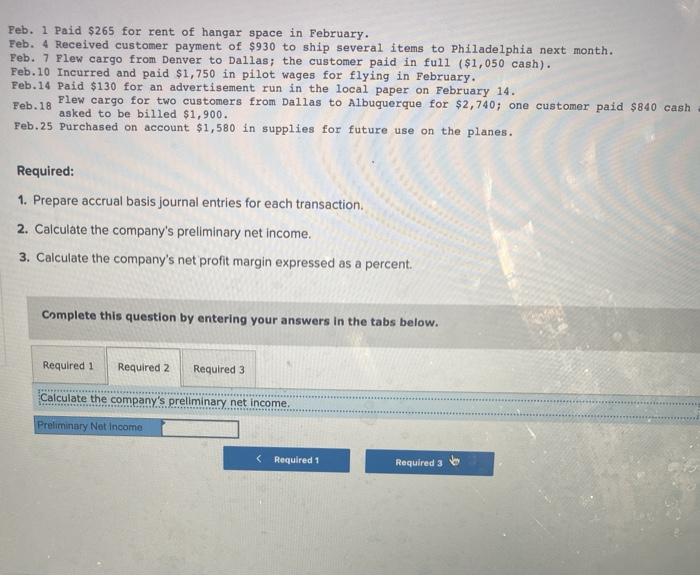

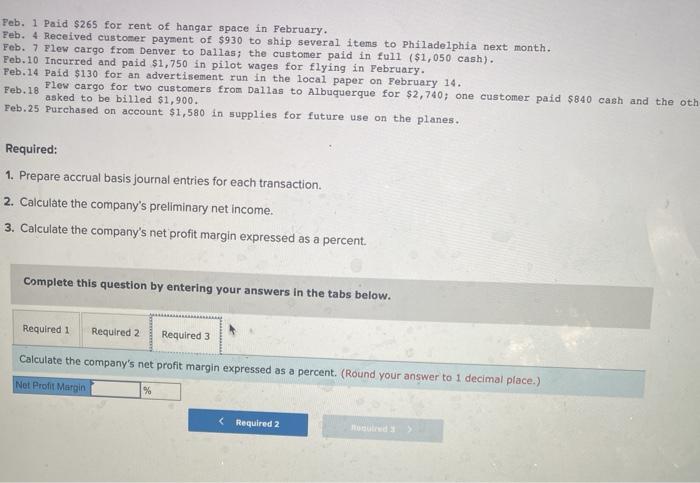

Rowland & Sons Air Transport Service, Inc., has been in operation for three years. The following transactions occurred in February Feb. 1 Paid $265 for rent of hangar space in February. Feb. 4 Received customer payment of $930 to ship several items to Philadelphia next month. Feb. 7 Plew cargo from Denver to Dallas; the customer paid in full ($1,050 cash). Feb.10 Incurred and paid $1,750 in pilot vages for flying in February. Feb. 14 Paid $130 for an advertisement run in the local paper on February 14. Feb. 18 Flew cargo for two customers from Dallas to Albuquerque for $2,740; one customer paid $840 cash and the other asked to be billed $1,900. Feb.25 Purchased on account $1,580 in supplies for future use on the planes. Required: 1. Prepare accrual basis journal entries for each transaction 2. Calculate the company's preliminary net income. 3. Calculate the company's net profit margin expressed as a percent. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare accrual basis journal entries for each transaction. (If no entry is required for a transaction/event, select "No Soumal Entry Required in the first account neid.) View transaction lit Journal entry worksheet 112 3 4 6 7 Saved Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare accrual basis journal entries for each transaction. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 1 2 3 4 5 6 7 Paid $265 for rent of hangar space in February. Record the transaction. Note: Enter debits before credits General Journal Date Feb 01 Debit Credit Record entry Clear entry View general journal Peb. 1 Paid $265 for rent of hangar space in February. Feb. 4 Received customer payment of $930 to ship several items to Philadelphia next month. Feb. 7 Flew cargo from Denver to Dallas; the customer paid in full ($1,050 cash). Feb.10 Incurred and paid $1,750 in pilot wages for flying in February. Feb. 14 Paid $130 for an advertisement run in the local paper on February 14. Flew cargo for two customers from Dallas to Albuquerque for $2,740; one customer paid $840 cash Feb. 18 asked to be billed $1,900. Feb.25 Purchased on account $1,580 in supplies for future use on the planes. Required: 1. Prepare accrual basis journal entries for each transaction. 2. Calculate the company's preliminary net income. 3. Calculate the company's net profit margin expressed as a percent Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 *** ***** Calculate the company's preliminary net income. Preliminary Net Income