Answered step by step

Verified Expert Solution

Question

1 Approved Answer

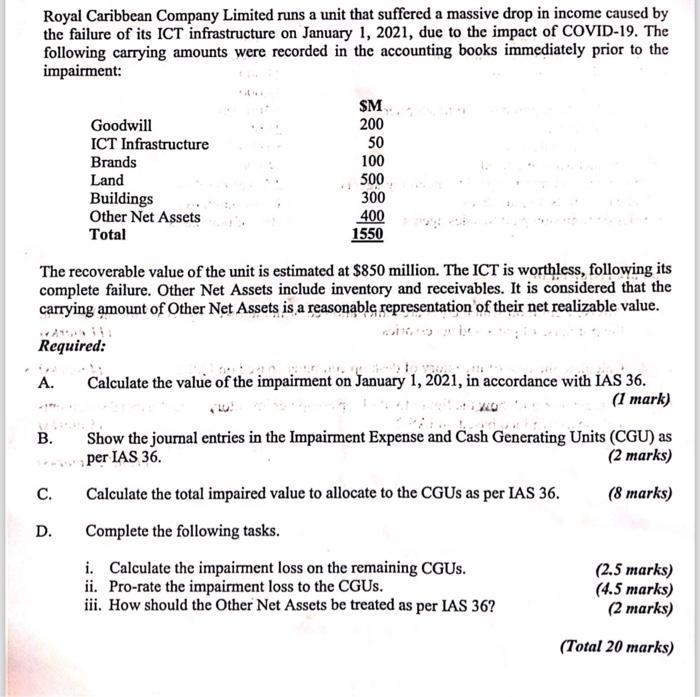

Royal Caribbean Company Limited runs a unit that suffered a massive drop in income caused by the failure of its ICT infrastructure on January

Royal Caribbean Company Limited runs a unit that suffered a massive drop in income caused by the failure of its ICT infrastructure on January 1, 2021, due to the impact of COVID-19. The following carrying amounts were recorded in the accounting books immediately prior to the impairment: 5,2 A. B. The recoverable value of the unit is estimated at $850 million. The ICT is worthless, following its complete failure. Other Net Assets include inventory and receivables. It is considered that the carrying amount of Other Net Assets is a reasonable representation of their net realizable value. Required: C. Goodwill ICT Infrastructure Brands Land D. Buildings Other Net Assets Total SM... 200 50 100 500 300 400 1550 Calculate the value of the impairment on January 1, 2021, in accordance with IAS 36. (1 mark) Show the journal entries in the Impairment Expense and Cash Generating Units (CGU) as per IAS 36. (2 marks) Calculate the total impaired value to allocate to the CGUS as per IAS 36. (8 marks) Complete the following tasks. i. Calculate the impairment loss on the remaining CGUS. ii. Pro-rate the impairment loss to the CGUS. iii. How should the Other Net Assets be treated as per IAS 36? (2.5 marks) (4.5 marks) (2 marks) (Total 20 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A To calculate the value of the impairment on January 1 2021 in accordance with IAS 36 we compare the carrying amount of the unit Cash Generating Unit or CGU with its recoverable ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started