Question: Royal Dutch Shell PLC (ticker: RDS) is a large, multinational oil company. The firm is preparing to purchase a semi-submersible oil production platform for $17

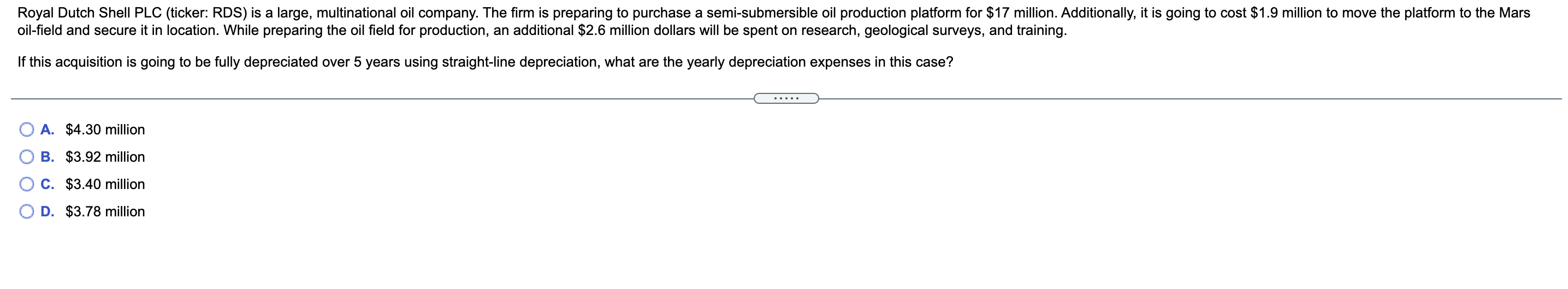

Royal Dutch Shell PLC (ticker: RDS) is a large, multinational oil company. The firm is preparing to purchase a semi-submersible oil production platform for $17 million. Additionally, it is going to cost $1.9 million to move the platform to the Mars oil-field and secure it in location. While preparing the oil field for production, an additional $2.6 million dollars will be spent on research, geological surveys, and training. If this acquisition is going to be fully depreciated over 5 years using straight-line depreciation, what are the yearly depreciation expenses in this case? A. $4.30 million B. $3.92 million C. $3.40 million D. $3.78 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts