Question: Royal Paints has a merchandising range that includes a variety of cosmetic and promotional yoga products. A 2-year contract between Henry and Megan Marvel (HMM)

Royal Paints has a merchandising range that includes a variety of cosmetic and promotional yoga products. A 2-year contract between Henry and Megan Marvel (HMM) Pty Ltd and Royal Paints was signed in January 2019.?

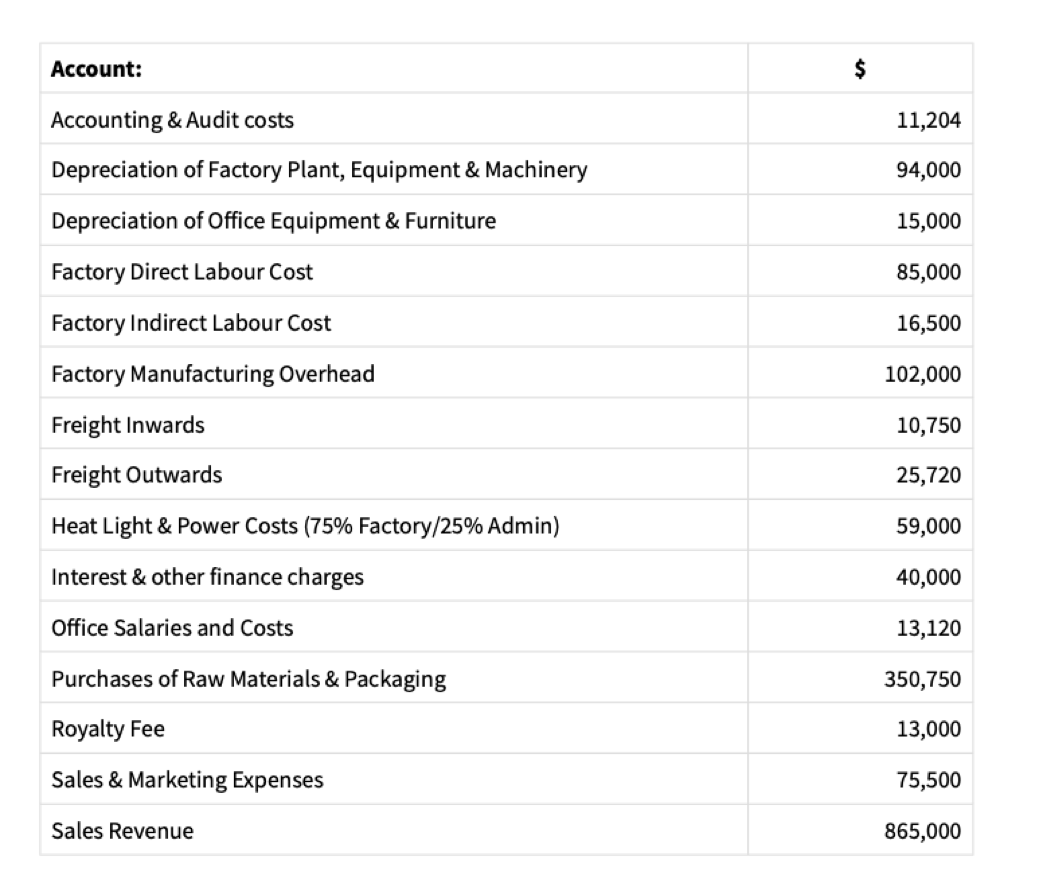

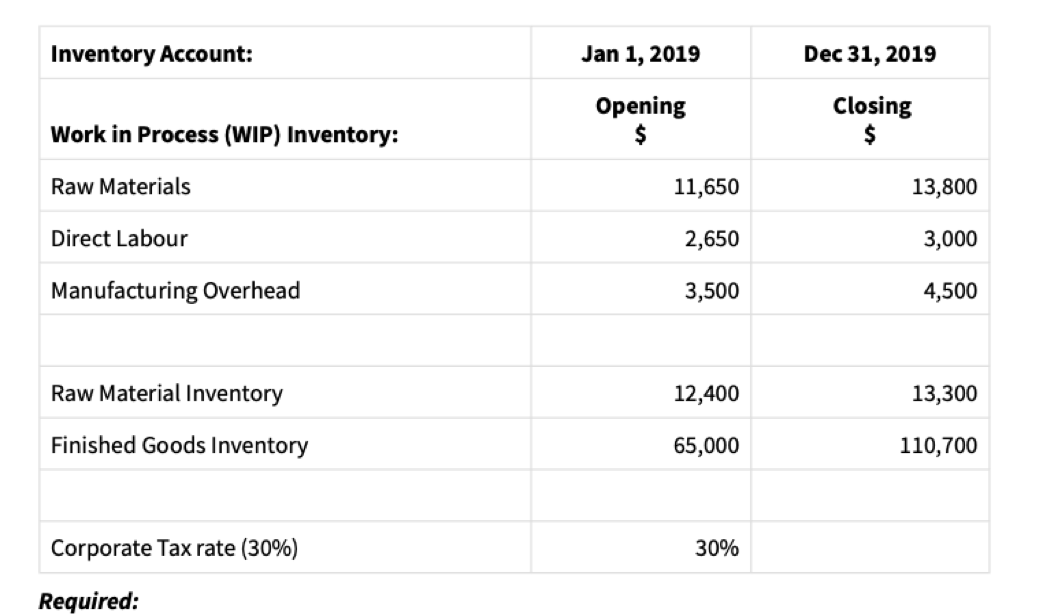

The agreement allowed Royal Paints to use copyrighted photographs and logo graphics from HMM Pty Ltd in return for a royalty fee, no pun intended! The management accountant from Royal Paints just resigned due to the latest negative press the royal family has received. You have been asked to finalise the reporting for Royal Paints' line of 'HMM Pty Ltd' yoga products. Before the management accountant resigned he wa you that the result would not be favourable. The following information has been emailed through to for the 2019 calendar year:

1. Schedule of Cost of Goods Manufactured?

2. Schedule of Cost of Goods Sold?

3. An after-tax income statement for Royal Paints for the 2015 calendar year.

Account: Accounting & Audit costs Depreciation of Factory Plant, Equipment & Machinery Depreciation of Office Equipment & Furniture Factory Direct Labour Cost Factory Indirect Labour Cost Factory Manufacturing Overhead Freight Inwards Freight Outwards Heat Light & Power Costs (75% Factory/25% Admin) Interest & other finance charges Office Salaries and Costs Purchases of Raw Materials & Packaging Royalty Fee Sales & Marketing Expenses Sales Revenue $ 11,204 94,000 15,000 85,000 16,500 102,000 10,750 25,720 59,000 40,000 13,120 350,750 13,000 75,500 865,000 Inventory Account: Work in Process (WIP) Inventory: Raw Materials Direct Labour Manufacturing Overhead Raw Material Inventory Finished Goods Inventory Corporate Tax rate (30%) Required: Jan 1, 2019 Opening $ 11,650 2,650 3,500 12,400 65,000 30% Dec 31, 2019 Closing $ 13,800 3,000 4,500 13,300 110,700

Step by Step Solution

3.33 Rating (141 Votes )

There are 3 Steps involved in it

To complete the required financial statements follow these calculations for each step 1 Schedule of Cost of Goods Manufactured Calculate Total Manufac... View full answer

Get step-by-step solutions from verified subject matter experts