Answered step by step

Verified Expert Solution

Question

1 Approved Answer

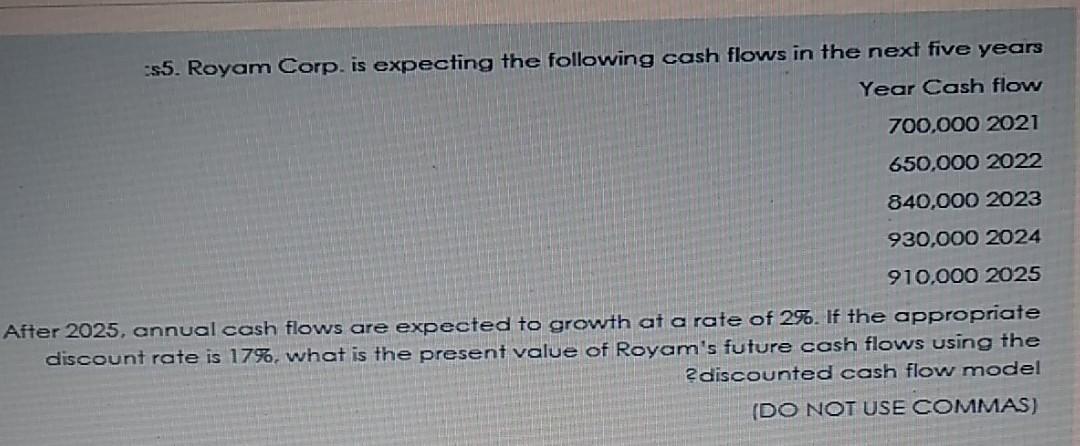

Royam Corp. is expecting the following cash flows in the next five years: Year Cash flow 2021 700,000 2022 650,000 2023 840,000 2024 930,000 2025

Royam Corp. is expecting the following cash flows in the next five years: Year Cash flow

2021 700,000

2022 650,000

2023 840,000

2024 930,000

2025 910,000 After 2025, annual cash flows are expected to growth at a rate of 2%. If the appropriate discount rate is 17%, what is the present value of Royams future cash flows using the discounted cash flow model? (DO NOT USE COMMAS)

55. Royam Corp. is expecting the following cash flows in the next five years Year Cash flow 700,000 2021 650,000 2022 840,000 2023 930,000 2024 910,000 2025 After 2025, annual cash flows are expected to growth at a rate of 2%. If the appropriate discount rate is 17%, what is the present value of Royam's future cash flows using the 2discounted cash flow model (DO NOT USE COMMAS)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started