Answered step by step

Verified Expert Solution

Question

1 Approved Answer

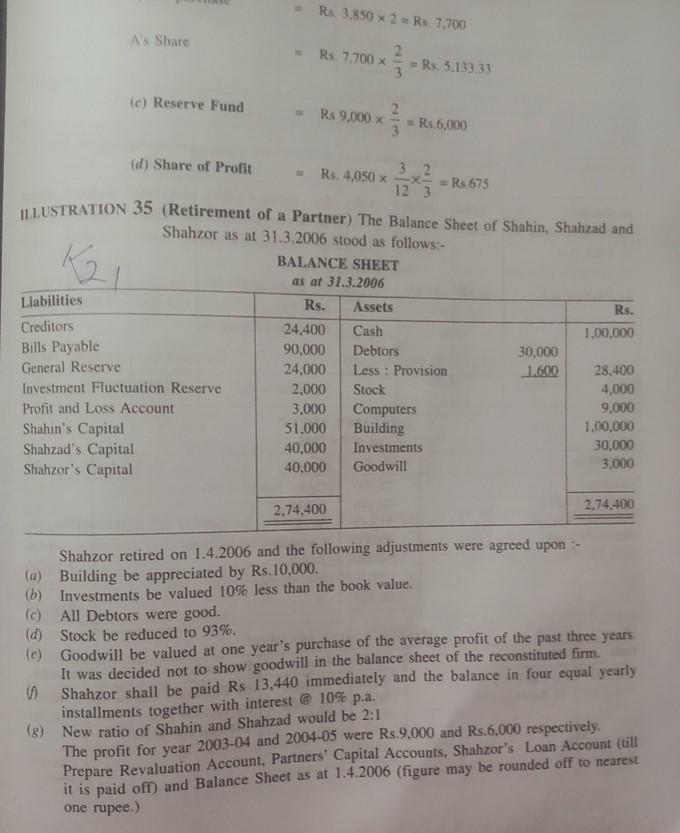

Rs 3.850 x 2 = Rs. 7.700 As Share Rs 7.700 Rs. 5.133 33 (c) Reserve Fund Rs 9,000 x = Rs.6.000 K2 (d) Share

Rs 3.850 x 2 = Rs. 7.700 As Share Rs 7.700 Rs. 5.133 33 (c) Reserve Fund Rs 9,000 x = Rs.6.000 K2 (d) Share of Profit Rs. 4,050 x 32 Rs 675 123 ILLUSTRATION 35 (Retirement of a Partner) The Balance Sheet of Shahin, Shahzad and Shahzor as at 31.3.2006 stood as follows:- BALANCE SHEET as at 31.3.2006 Liabilities Rs. Assets Rs. Creditors 24,400 Cash 1,00,000 Bills Payable 90.000 Debtors 30.000 General Reserve 24.000 Less : Provision 1.600 28,400 Investment Fluctuation Reserve 2.000 Stock 4,000 Profit and Loss Account 3.000 Computers 9,000 Shahin's Capital 51.000 Building 1,00,000 Shahzad's Capital 40,000 Investments 30,000 Shahzor's Capital 40.000 Goodwill 3.000 2.74,400 2.74.400 Shahzor retired on 1.4.2006 and the following adjustments were agreed upon (a) Building be appreciated by Rs.10,000. (b) Investments be valued 10% less than the book value. (c) All Debtors were good. (d) Stock be reduced to 93%. (e) Goodwill be valued at one year's purchase of the average profit of the past three years. It was decided not to show goodwill in the balance sheet of the reconstituted firm. Shahzor shall be paid Rs 13,440 immediately and the balance in four equal yearly installments together with interest @ 10% p.a. () New ratio of Shahin and Shahzad would be 2:1 The profit for year 2003-04 and 2004-05 were Rs.9.000 and Rs.6,000 respectively, Prepare Revaluation Account, Partners' Capital Accounts, Shahzor's Loan Account (till it is paid off) and Balance Sheet as at 1.4.2006 (figure may be rounded off to nearest one rupee.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started