Answered step by step

Verified Expert Solution

Question

1 Approved Answer

RTI Company's master budget calls for production and sale of 19,300 units for $98,430, variable costs of $44,390, and fixed costs of $18,600. During

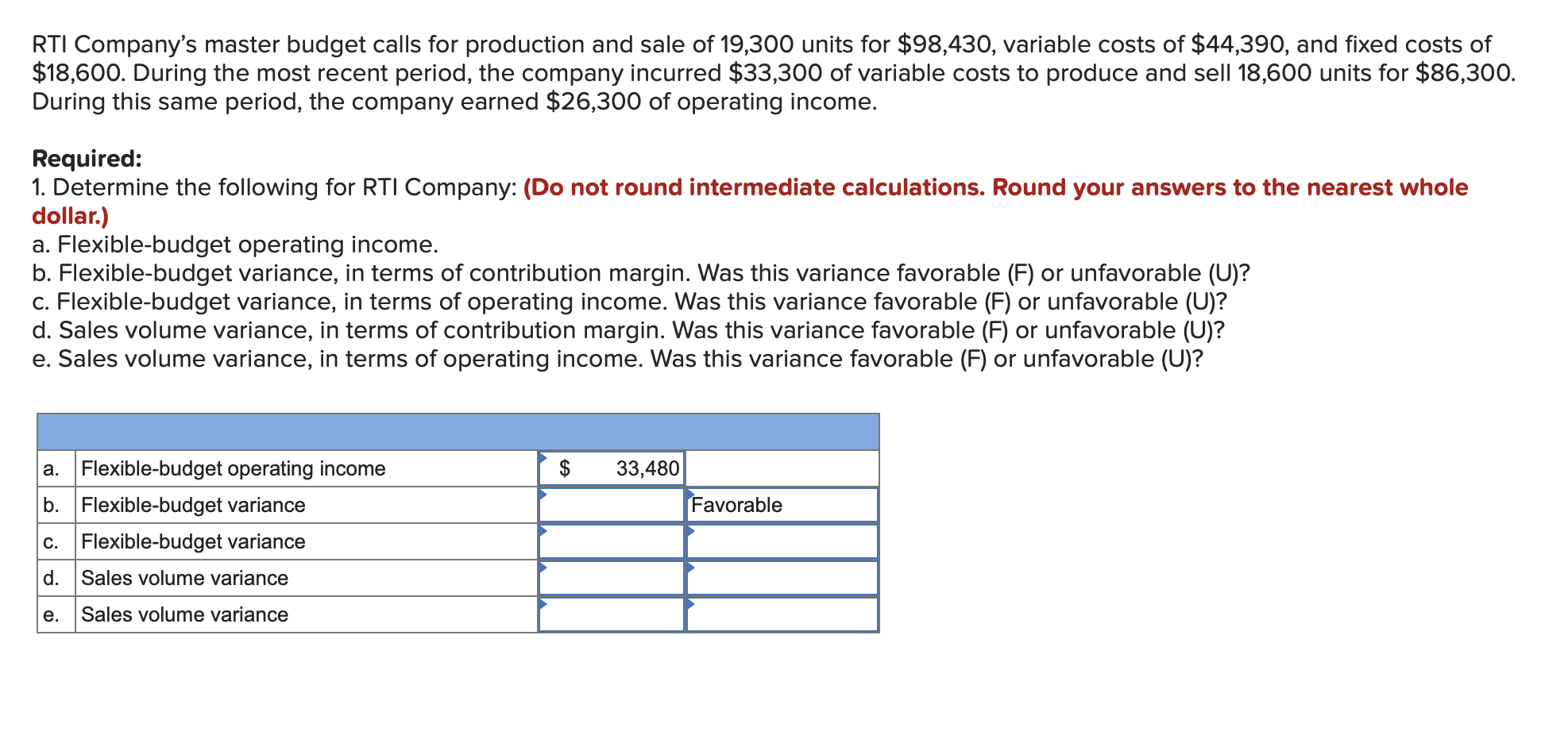

RTI Company's master budget calls for production and sale of 19,300 units for $98,430, variable costs of $44,390, and fixed costs of $18,600. During the most recent period, the company incurred $33,300 of variable costs to produce and sell 18,600 units for $86,300. During this same period, the company earned $26,300 of operating income. Required: 1. Determine the following for RTI Company: (Do not round intermediate calculations. Round your answers to the nearest whole dollar.) a. Flexible-budget operating income. b. Flexible-budget variance, in terms of contribution margin. Was this variance favorable (F) or unfavorable (U)? c. Flexible-budget variance, in terms of operating income. Was this variance favorable (F) or unfavorable (U)? d. Sales volume variance, in terms of contribution margin. Was this variance favorable (F) or unfavorable (U)? e. Sales volume variance, in terms of operating income. Was this variance favorable (F) or unfavorable (U)? a. Flexible-budget operating income b. Flexible-budget variance c. Flexible-budget variance d. Sales volume variance e. Sales volume variance 33,480 Favorable

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Flexiblebudget operating income The flexible budget operating income can be calculated using the formula Flexiblebudget operating income Flexiblebud...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started