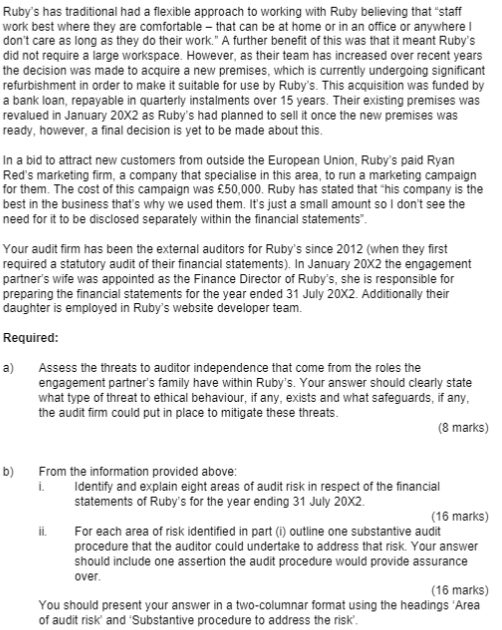

Ruby Ltd (Ruby's) Ruby's is a software company based in the north-east of England that specialises in creating websites for a range of clients across the world. The company was founded by 15 years ago by Ruby Red in partnership with her brother Ryan. Initially, the shares were held equally, although Ryan has never been involved in the day to day running of the business. In a desire to raise significant additional funds to enable them to expand Ruby's created a new share issue in April 20X2, all the shares were purchased by Ruby and Ryan's father Richard Red. As a result of this issue Ruby and Ryan own 40% of the shares each and Richard the remaining 20%. Ruby's specialises in creating websites for a range of clients across the world. All work performed is carried out under short term fixed-price contracts and all clients are invoiced in Sterling (f). Ruby's employees design the website to customer's specification, at times this includes the purchasing of software from suppliers both the UK and internationally. International suppliers invoice Ruby's in a range of currencies. The contract price is agreed with the customer before any work is started by Ruby's. The terms of payment require an initial payment of 50% of the contract value before the commencement of any work and the balance following the customer confirming they are satisfied with the completed website. Ruby's terms of trade require payment within 30 days of invoice for both initial and final instalments. One customer, Wizard Ltd, is withholding its final instalment of 500,000 as it claims that the website is not operating effectively. This figure is considered to be material by the audit manager. All direct costs relating to each contract are recorded in Ruby's job costing system, which is integrated with the purchases and payroll systems. The finance director uses the cost records to calculate the value of work in progress for the monthly management accounts and the year-end financial statements. For the valuation of work in progress a small percentage is added to direct costs to cover overheads. Provision is made for contract losses where appropriate. The prior year audit identified a number of weaknesses in this job costing system. Ruby's has faced an increase in demand in recent years and to meet this demand they have subcontracted work to a pool of self-employed individuals and made payments gross without deducting income tax. The tax authorities have questioned whether the individuals who are sub-contracted to Ruby's are, in reality, employed. This would mean that income tax should be deducted from payments to them (salaries), and then paid over to the tax authorities. In this case Ruby's would become liable to pay additional tax backdated for six years plus possible interest and penalties. An official investigation is underway. The directors of Ruby's are fully co-operating with the tax authorities. An expert has advised your audit team that if the tax authorities rule that these individuals have the status of employees and not sub-contractors, the ultimate liability to the tax authorities could be between fnil and 5 million. However, the advice is that the outcome cannot be calculated with any degree of accuracy and that Gordon could appeal against any unfavourable ruling. Ruby's has traditional had a flexible approach to working with Ruby believing that "staff work best where they are comfortable - that can be at home or in an office or anywhere I don't care as long as they do their work." A further benefit of this was that it meant Ruby's did not require a large workspace. However, as their team has increased over recent years the decision was made to acquire a new premises, which is currently undergoing significant refurbishment in order to make it suitable for use by Ruby's. This acquisition was funded by a bank loan, repayable in quarterly instalments over 15 years. Their existing premises was revalued in January 202 as Ruby's had planned to sell it once the new premises was ready, however, a final decision is yet to be made about this. In a bid to attract new customers from outside the European Union, Ruby's paid Ryan Red's marketing firm, a company that specialise in this area, to run a marketing campaign for them. The cost of this campaign was 50,000. Ruby has stated that "his company is the best in the business that's why we used them. It's just a small amount so I don't see the need for it to be disclosed separately within the financial statements". Your audit firm has been the external auditors for Ruby's since 2012 (when they first required a statutory audit of their financial statements). In January 202 the engagement partner's wife was appointed as the Finance Director of Ruby's, she is responsible for preparing the financial statements for the year ended 31 July 202. Additionally their daughter is employed in Ruby's website developer team. Required: a) Assess the threats to auditor independence that come from the roles the engagement partner's family have within Ruby's. Your answer should clearly state what type of threat to ethical behaviour, if any, exists and what safeguards, if any, the audit firm could put in place to mitigate these threats. (8 marks) b) From the information provided above: i. Identify and explain eight areas of audit risk in respect of the financial statements of Ruby's for the year ending 31 July 202. (16 marks) ii. For each area of risk identified in part (i) outline one substantive audit procedure that the auditor could undertake to address that risk. Your answer should include one assertion the audit procedure would provide assurance over. (16 marks) You should present your answer in a two-columnar format using the headings 'Area of audit risk' and 'Substantive procedure to address the risk'. Ruby Ltd (Ruby's) Ruby's is a software company based in the north-east of England that specialises in creating websites for a range of clients across the world. The company was founded by 15 years ago by Ruby Red in partnership with her brother Ryan. Initially, the shares were held equally, although Ryan has never been involved in the day to day running of the business. In a desire to raise significant additional funds to enable them to expand Ruby's created a new share issue in April 20X2, all the shares were purchased by Ruby and Ryan's father Richard Red. As a result of this issue Ruby and Ryan own 40% of the shares each and Richard the remaining 20%. Ruby's specialises in creating websites for a range of clients across the world. All work performed is carried out under short term fixed-price contracts and all clients are invoiced in Sterling (f). Ruby's employees design the website to customer's specification, at times this includes the purchasing of software from suppliers both the UK and internationally. International suppliers invoice Ruby's in a range of currencies. The contract price is agreed with the customer before any work is started by Ruby's. The terms of payment require an initial payment of 50% of the contract value before the commencement of any work and the balance following the customer confirming they are satisfied with the completed website. Ruby's terms of trade require payment within 30 days of invoice for both initial and final instalments. One customer, Wizard Ltd, is withholding its final instalment of 500,000 as it claims that the website is not operating effectively. This figure is considered to be material by the audit manager. All direct costs relating to each contract are recorded in Ruby's job costing system, which is integrated with the purchases and payroll systems. The finance director uses the cost records to calculate the value of work in progress for the monthly management accounts and the year-end financial statements. For the valuation of work in progress a small percentage is added to direct costs to cover overheads. Provision is made for contract losses where appropriate. The prior year audit identified a number of weaknesses in this job costing system. Ruby's has faced an increase in demand in recent years and to meet this demand they have subcontracted work to a pool of self-employed individuals and made payments gross without deducting income tax. The tax authorities have questioned whether the individuals who are sub-contracted to Ruby's are, in reality, employed. This would mean that income tax should be deducted from payments to them (salaries), and then paid over to the tax authorities. In this case Ruby's would become liable to pay additional tax backdated for six years plus possible interest and penalties. An official investigation is underway. The directors of Ruby's are fully co-operating with the tax authorities. An expert has advised your audit team that if the tax authorities rule that these individuals have the status of employees and not sub-contractors, the ultimate liability to the tax authorities could be between fnil and 5 million. However, the advice is that the outcome cannot be calculated with any degree of accuracy and that Gordon could appeal against any unfavourable ruling. Ruby's has traditional had a flexible approach to working with Ruby believing that "staff work best where they are comfortable - that can be at home or in an office or anywhere I don't care as long as they do their work." A further benefit of this was that it meant Ruby's did not require a large workspace. However, as their team has increased over recent years the decision was made to acquire a new premises, which is currently undergoing significant refurbishment in order to make it suitable for use by Ruby's. This acquisition was funded by a bank loan, repayable in quarterly instalments over 15 years. Their existing premises was revalued in January 202 as Ruby's had planned to sell it once the new premises was ready, however, a final decision is yet to be made about this. In a bid to attract new customers from outside the European Union, Ruby's paid Ryan Red's marketing firm, a company that specialise in this area, to run a marketing campaign for them. The cost of this campaign was 50,000. Ruby has stated that "his company is the best in the business that's why we used them. It's just a small amount so I don't see the need for it to be disclosed separately within the financial statements". Your audit firm has been the external auditors for Ruby's since 2012 (when they first required a statutory audit of their financial statements). In January 202 the engagement partner's wife was appointed as the Finance Director of Ruby's, she is responsible for preparing the financial statements for the year ended 31 July 202. Additionally their daughter is employed in Ruby's website developer team. Required: a) Assess the threats to auditor independence that come from the roles the engagement partner's family have within Ruby's. Your answer should clearly state what type of threat to ethical behaviour, if any, exists and what safeguards, if any, the audit firm could put in place to mitigate these threats. (8 marks) b) From the information provided above: i. Identify and explain eight areas of audit risk in respect of the financial statements of Ruby's for the year ending 31 July 202. (16 marks) ii. For each area of risk identified in part (i) outline one substantive audit procedure that the auditor could undertake to address that risk. Your answer should include one assertion the audit procedure would provide assurance over. (16 marks) You should present your answer in a two-columnar format using the headings 'Area of audit risk' and 'Substantive procedure to address the risk