Ruby works in the treasury department of a large airline company. Over the coming months the airline company expects to increase flights as countries

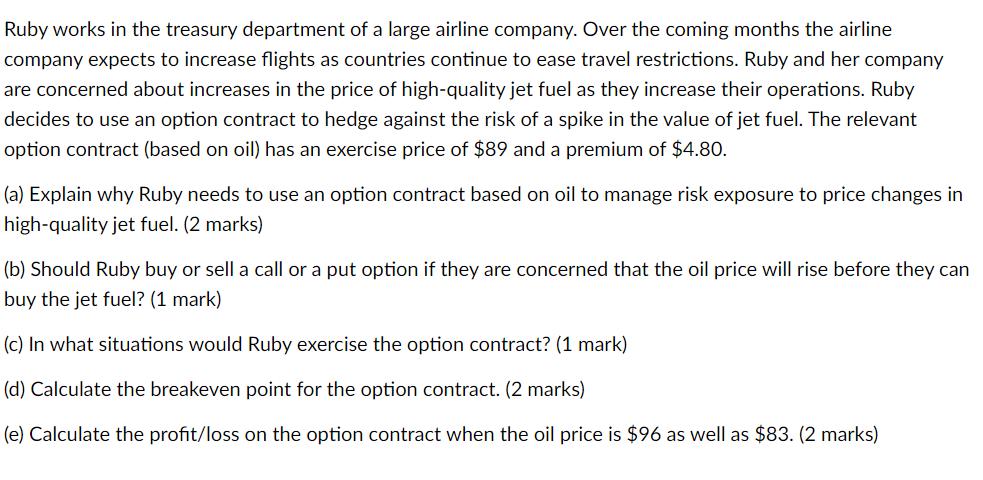

Ruby works in the treasury department of a large airline company. Over the coming months the airline company expects to increase flights as countries continue to ease travel restrictions. Ruby and her company are concerned about increases in the price of high-quality jet fuel as they increase their operations. Ruby decides to use an option contract to hedge against the risk of a spike in the value of jet fuel. The relevant option contract (based on oil) has an exercise price of $89 and a premium of $4.80. (a) Explain why Ruby needs to use an option contract based on oil to manage risk exposure to price changes in high-quality jet fuel. (2 marks) (b) Should Ruby buy or sell a call or a put option if they are concerned that the oil price will rise before they can buy the jet fuel? (1 mark) (c) In what situations would Ruby exercise the option contract? (1 mark) (d) Calculate the breakeven point for the option contract. (2 marks) (e) Calculate the profit/loss on the option contract when the oil price is $96 as well as $83. (2 marks)

Step by Step Solution

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

a Ruby needs to use an option contract based on oil to manage risk exposure to pr...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started