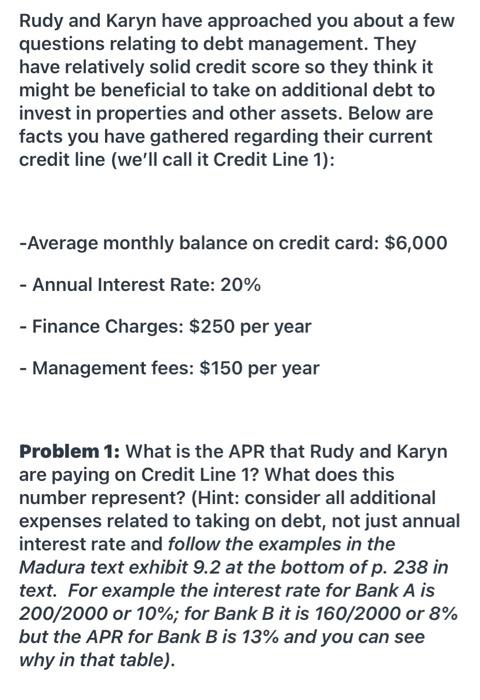

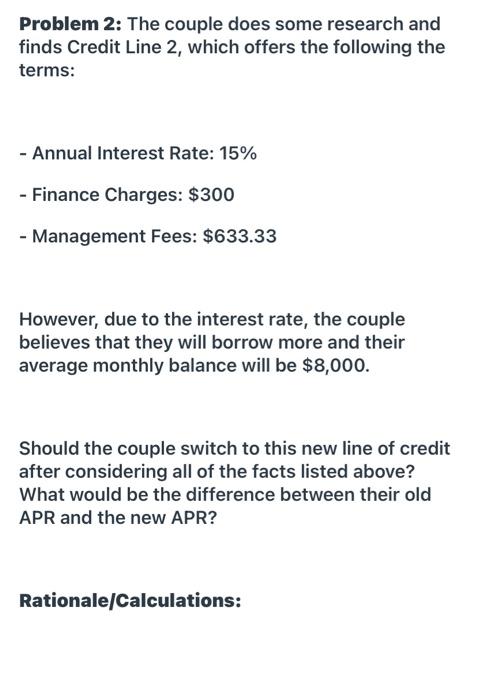

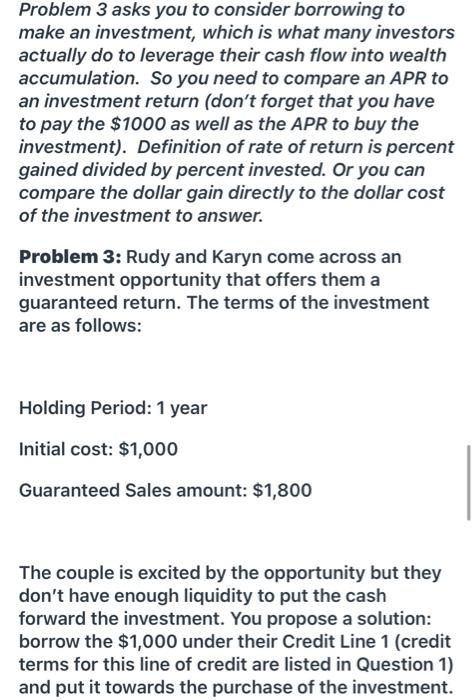

Rudy and Karyn have approached you about a few questions relating to debt management. They have relatively solid credit score so they think it might be beneficial to take on additional debt to invest in properties and other assets. Below are facts you have gathered regarding their current credit line (we'll call it Credit Line 1): -Average monthly balance on credit card: $6,000 - Annual Interest Rate: 20% - Finance Charges: $250 per year - Management fees: $150 per year Problem 1: What is the APR that Rudy and Karyn are paying on Credit Line 1? What does this number represent? (Hint: consider all additional expenses related to taking on debt, not just annual interest rate and follow the examples in the Madura text exhibit 9.2 at the bottom of p. 238 in text. For example the interest rate for Bank A is 200/2000 or 10%; for Bank B it is 160/2000 or 8% but the APR for Bank B is 13% and you can see why in that table). Rationale/Calculations: Solution/Final Recommendation: Problem 2: The couple does some research and finds Credit Line 2, which offers the following the terms: - Annual Interest Rate: 15% - Finance Charges: $300 - Management Fees: $633.33 However, due to the interest rate, the couple believes that they will borrow more and their average monthly balance will be $8,000. Should the couple switch to this new line of credit after considering all of the facts listed above? What would be the difference between their old APR and the new APR? Rationale Calculations: Solution/Final Recommendation: You'll discover that your answer will depend on what you think the goals of the borrowers are or should be, so you can answer as you like on that basis only. . Problem 3 asks you to consider borrowing to make an investment, which is what many investors actually do to leverage their cash flow into wealth accumulation. So you need to compare an APR to an investment return (don't forget that you have to pay the $1000 as well as the APR to buy the investment). Definition of rate of return is percent gained divided by percent invested. Or you can compare the dollar gain directly to the dollar cost of the investment to answer. Problem 3: Rudy and Karyn come across an investment opportunity that offers them a guaranteed return. The terms of the investment are as follows: Holding Period: 1 year Initial cost: $1,000 Guaranteed Sales amount: $1,800 The couple is excited by the opportunity but they don't have enough liquidity to put the cash forward the investment. You propose a solution: borrow the $1,000 under their Credit Line 1 (credit terms for this line of credit are listed in Question 1) and put it towards the purchase of the investment. forward the investment. You propose a solution: borrow the $1,000 under their Credit Line 1 (credit terms for this line of credit are listed in Question 1) and put it towards the purchase of the investment. In one year, sell the investment for the guaranteed amount, collect the cash, and pay off the balance of the debt. Assume at this time that the investment amount is the only debt that the couple has taken on. How can you justify your proposal? What would be the net return of your proposal? Ignore the effect of taxes. (Hint: consider how the rate of return on the investment compares to the cost of borrowing money under this specific credit line) Rationale/Calculations: Needs for Life Insurance Rudy and Karyn also have questions about life insurance for you. Currently, they each are paying premiums for $100,000 of life insurance offered through their employer. They are listed as the primary beneficiary on each other's policies and their 2 kids, Kelsey and Jacob, are listed as the contingent beneficiaries. Listed below is the information that you have gathered from them: Yearly Income: $80,000 each (Household income $160,000) Yearly Household expenses (including emergency & retirement savings): $125,000 $15,000 in credit card debt $300,000 total in current savings Future expected Expenses: o $100,000 for each child for college expenses $150,000 in remaining mortgage debt on house Problem 4: Based on the income method, what is the total amount of insurance that Rudy and Karyn would need to cover their survivors' income needs for 5 years? For 10 years? Assume this is for the children if they both were to die together in an accident. (Hint: the income method is based solely on income; expenses and debts or plans to spend "specifics" are disregarded under this method. Read Madura text p. 384 to get oriented to do this and remember that the purchase of life insurance is to cover the loss of earnings so that when buying we need to decide how many years of earnings loss we want to replace.) Solution/Final Recommendation: Rudy and Karyn have approached you about a few questions relating to debt management. They have relatively solid credit score so they think it might be beneficial to take on additional debt to invest in properties and other assets. Below are facts you have gathered regarding their current credit line (we'll call it Credit Line 1): -Average monthly balance on credit card: $6,000 - Annual Interest Rate: 20% - Finance Charges: $250 per year - Management fees: $150 per year Problem 1: What is the APR that Rudy and Karyn are paying on Credit Line 1? What does this number represent? (Hint: consider all additional expenses related to taking on debt, not just annual interest rate and follow the examples in the Madura text exhibit 9.2 at the bottom of p. 238 in text. For example the interest rate for Bank A is 200/2000 or 10%; for Bank B it is 160/2000 or 8% but the APR for Bank B is 13% and you can see why in that table). Rationale/Calculations: Solution/Final Recommendation: Problem 2: The couple does some research and finds Credit Line 2, which offers the following the terms: - Annual Interest Rate: 15% - Finance Charges: $300 - Management Fees: $633.33 However, due to the interest rate, the couple believes that they will borrow more and their average monthly balance will be $8,000. Should the couple switch to this new line of credit after considering all of the facts listed above? What would be the difference between their old APR and the new APR? Rationale Calculations: Solution/Final Recommendation: You'll discover that your answer will depend on what you think the goals of the borrowers are or should be, so you can answer as you like on that basis only. . Problem 3 asks you to consider borrowing to make an investment, which is what many investors actually do to leverage their cash flow into wealth accumulation. So you need to compare an APR to an investment return (don't forget that you have to pay the $1000 as well as the APR to buy the investment). Definition of rate of return is percent gained divided by percent invested. Or you can compare the dollar gain directly to the dollar cost of the investment to answer. Problem 3: Rudy and Karyn come across an investment opportunity that offers them a guaranteed return. The terms of the investment are as follows: Holding Period: 1 year Initial cost: $1,000 Guaranteed Sales amount: $1,800 The couple is excited by the opportunity but they don't have enough liquidity to put the cash forward the investment. You propose a solution: borrow the $1,000 under their Credit Line 1 (credit terms for this line of credit are listed in Question 1) and put it towards the purchase of the investment. forward the investment. You propose a solution: borrow the $1,000 under their Credit Line 1 (credit terms for this line of credit are listed in Question 1) and put it towards the purchase of the investment. In one year, sell the investment for the guaranteed amount, collect the cash, and pay off the balance of the debt. Assume at this time that the investment amount is the only debt that the couple has taken on. How can you justify your proposal? What would be the net return of your proposal? Ignore the effect of taxes. (Hint: consider how the rate of return on the investment compares to the cost of borrowing money under this specific credit line) Rationale/Calculations: Needs for Life Insurance Rudy and Karyn also have questions about life insurance for you. Currently, they each are paying premiums for $100,000 of life insurance offered through their employer. They are listed as the primary beneficiary on each other's policies and their 2 kids, Kelsey and Jacob, are listed as the contingent beneficiaries. Listed below is the information that you have gathered from them: Yearly Income: $80,000 each (Household income $160,000) Yearly Household expenses (including emergency & retirement savings): $125,000 $15,000 in credit card debt $300,000 total in current savings Future expected Expenses: o $100,000 for each child for college expenses $150,000 in remaining mortgage debt on house Problem 4: Based on the income method, what is the total amount of insurance that Rudy and Karyn would need to cover their survivors' income needs for 5 years? For 10 years? Assume this is for the children if they both were to die together in an accident. (Hint: the income method is based solely on income; expenses and debts or plans to spend "specifics" are disregarded under this method. Read Madura text p. 384 to get oriented to do this and remember that the purchase of life insurance is to cover the loss of earnings so that when buying we need to decide how many years of earnings loss we want to replace.) Solution/Final Recommendation