Question

Rudyard Corporation had 220,000 shares of common stock and 22,000 shares of 8%, $100 par convertible preferred stock outstanding during the year. Net income

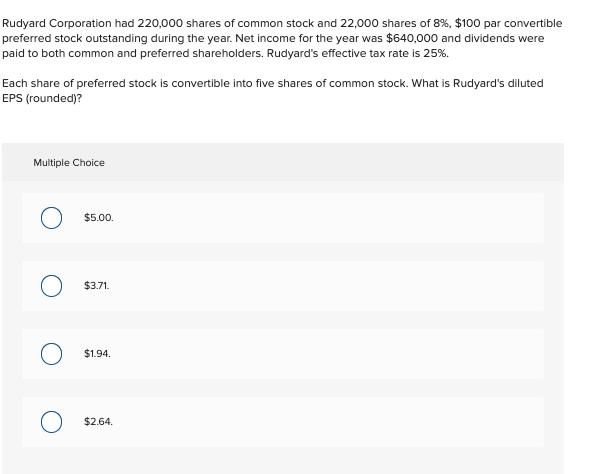

Rudyard Corporation had 220,000 shares of common stock and 22,000 shares of 8%, $100 par convertible preferred stock outstanding during the year. Net income for the year was $640,000 and dividends were paid to both common and preferred shareholders. Rudyard's effective tax rate is 25%. Each share of preferred stock is convertible into five shares of common stock. What is Rudyard's diluted EPS (rounded)? Multiple Choice $5.00. $3.71. $1.94. $2.64.

Step by Step Solution

3.45 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

OPTION 194 Diluted EPS Earnings available to ordina...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting Reporting and Analysis

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach

2nd edition

9781305727557, 1285453824, 9781337116619, 130572755X, 978-1285453828

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App