Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ruestions from no . 9 to no . 1 1 are based on the following fact. Boulder, Inc, obtained 9 0 percent of Rock Corporation

Ruestions from no to no are based on the following fact. Boulder, Inc, obtained percent of Rock Corporation on January Annual amortization of $ is applicable on the allocations of Rock's acquisitiondate business fair value. On January Rock acquired percent of Stone Company's voting stock. Excess business fairvalue amortization on this second acquisition amounted to $ per year. For each of the three companies reported the following information accumulated by its separate accounting system. Separate operating income figures do not include any investment or dividend income: What is consolidated net income for A$ B$ C$ D$ E$ What is the noncontrolling interest in Stone's Income? A$ B$ C$ D$ E$ What is the total net income attributable to noncontrolling interests? A$ B$ C$ D$ E$ Questions from no to no are based on the following fact.

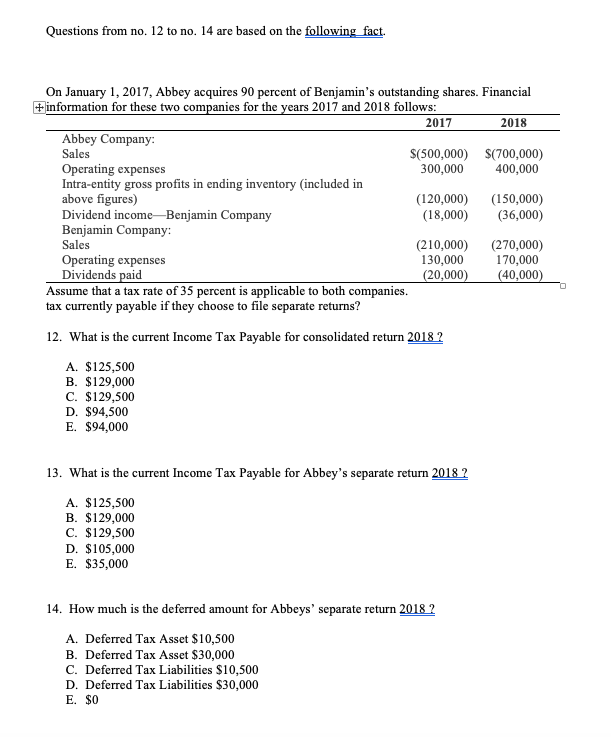

On January Abbey acquires percent of Benjamin's outstanding shares. Financial

$ information for these two companies for the years and follows:

Assume that a tax rate of percent is applicable to both companies.

tax currently payable if they choose to file separate returns?

What is the current Income Tax Payable for consolidated return

A $

B $

C $

D $

E $

What is the current Income Tax Payable for Abbey's separate return

A $

B $

C $

D $

E $

How much is the deferred amount for Abbeys' separate return

A Deferred Tax Asset $

B Deferred Tax Asset $

C Deferred Tax Liabilities $

D Deferred Tax Liabilities $

E $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started