Question

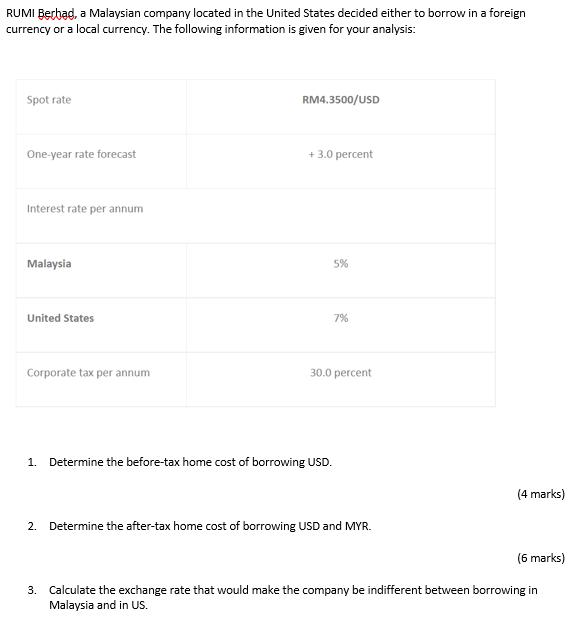

RUMI Berbad, a Malaysian company located in the United States decided either to borrow in a foreign currency or a local currency. The following

RUMI Berbad, a Malaysian company located in the United States decided either to borrow in a foreign currency or a local currency. The following information is given for your analysis: Spot rate One-year rate forecast Interest rate per annum Malaysia United States Corporate tax per annum RM4.3500/USD + 3.0 percent 5% 7% 30.0 percent 1. Determine the before-tax home cost of borrowing USD. 2. Determine the after-tax home cost of borrowing USD and MYR. (4 marks) (6 marks) 3. Calculate the exchange rate that would make the company be indifferent between borrowing in Malaysia and in US.

Step by Step Solution

3.34 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Lets calculate the beforetax home cost of borrowing USD the aftertax home cost of borrowing USD and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

International Financial Management

Authors: Geert Bekaert, Robert J. Hodrick

2nd edition

013299755X, 132162768, 9780132997553, 978-0132162760

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App