Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Rural Esthetics Inc. provides esthetics services to a variety of clients. The owner of this business decided to handle the bookkeeping on his own,

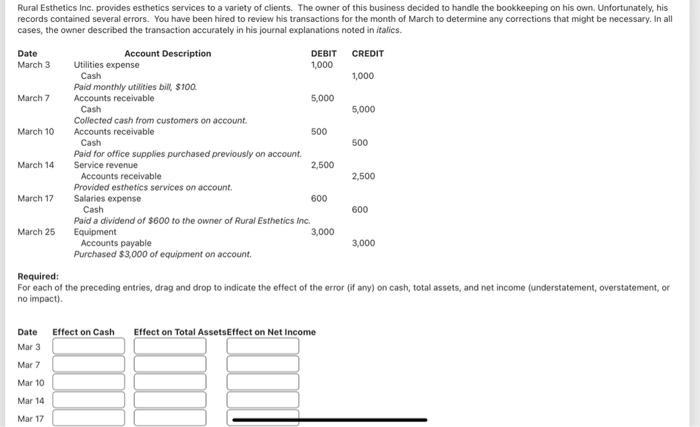

Rural Esthetics Inc. provides esthetics services to a variety of clients. The owner of this business decided to handle the bookkeeping on his own, Unfortunately, his records contained several errors. You have been hired to review his transactions for the month of March to determine any corrections that might be necessary. In all cases, the owner described the transaction accurately in his journal explanations noted in italics. CREDIT 1,000 Date March 3 March 7 March 10 March 14 March 17 March 25 Date Mar 3 Mar 7 Mar 10 Mar 14 Mar 17 Account Description Utilities expense Cash Paid monthly utilities bill $100. Accounts receivable Cash Collected cash from customers on account. Accounts receivable Cash Paid for office supplies purchased previously on account. Service revenue Accounts receivable Provided esthetics services on account. Salaries expense DEBIT 1,000 Effect on Cash 5,000 500 2,500 600 Cash Paid a dividend of $600 to the owner of Rural Esthetics Inc. Equipment 3,000 Accounts payable Purchased $3,000 of equipment on account. 5,000 Effect on Total Assets Effect on Net Income 500 2,500 Required: For each of the preceding entries, drag and drop to indicate the effect of the error (if any) on cash, total assets, and net income (understatement, overstatement, or no impact). 600 3,000

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Requirement asked Date Effect on Cash Effect on Total Assets Effect on Net Income 03Mar Understated ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started