Question

Rusape (Pty) Ltd has 215176 non-redeemable preference shares which were issued at a price of R48 each. Preference dividends are payable annually in arrears.

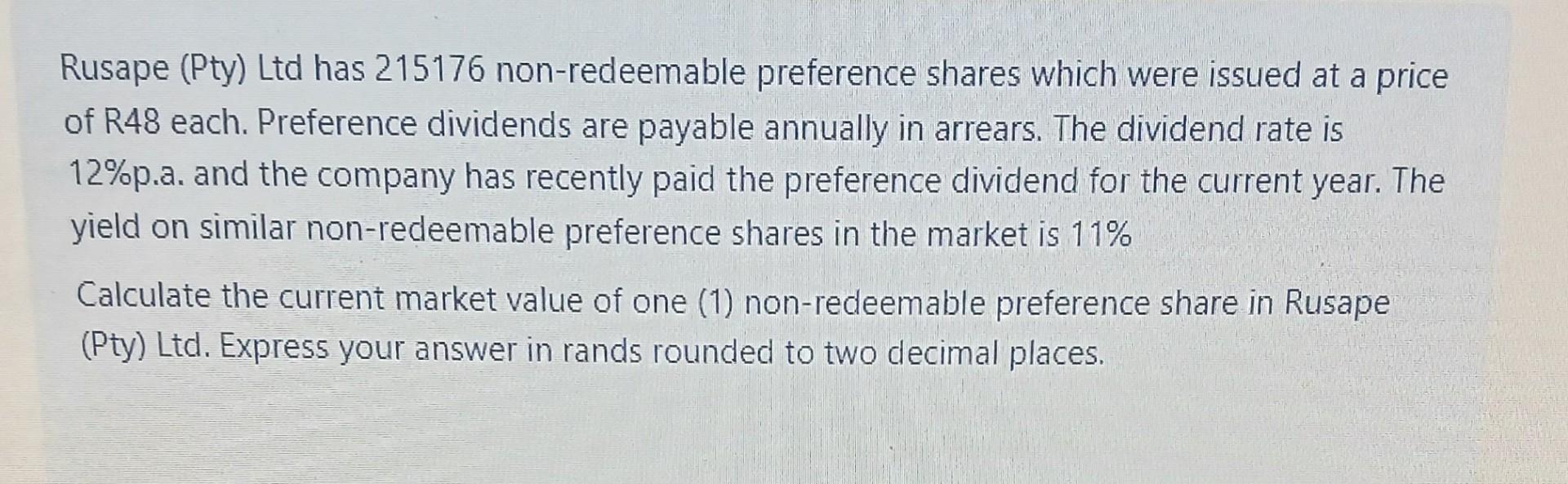

Rusape (Pty) Ltd has 215176 non-redeemable preference shares which were issued at a price of R48 each. Preference dividends are payable annually in arrears. The dividend rate is 12%p.a. and the company has recently paid the preference dividend for the current year. The yield on similar non-redeemable preference shares in the market is 11% Calculate the current market value of one (1) non-redeemable preference share in Rusape (Pty) Ltd. Express your answer in rands rounded to two decimal places.

Step by Step Solution

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the current market value of one nonredeemable preference share ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamental Accounting

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit

7th Edition

1485112117, 9781485112112

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App