Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Russel Industries has just completed construction of an oil drilling facility at a cost of $10 million. The facility has a useful life of

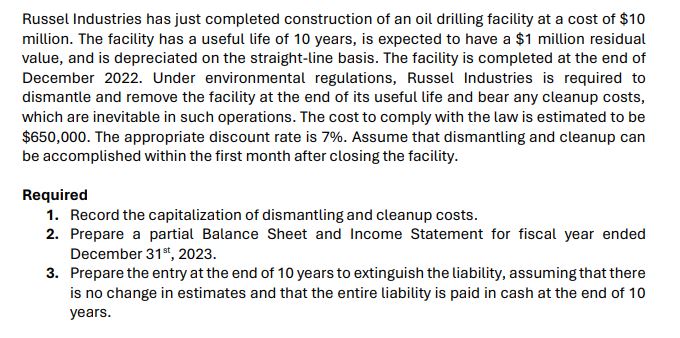

Russel Industries has just completed construction of an oil drilling facility at a cost of $10 million. The facility has a useful life of 10 years, is expected to have a $1 million residual value, and is depreciated on the straight-line basis. The facility is completed at the end of December 2022. Under environmental regulations, Russel Industries is required to dismantle and remove the facility at the end of its useful life and bear any cleanup costs, which are inevitable in such operations. The cost to comply with the law is estimated to be $650,000. The appropriate discount rate is 7%. Assume that dismantling and cleanup can be accomplished within the first month after closing the facility. Required 1. Record the capitalization of dismantling and cleanup costs. 2. Prepare a partial Balance Sheet and Income Statement for fiscal year ended December 31st, 2023. 3. Prepare the entry at the end of 10 years to extinguish the liability, assuming that there is no change in estimates and that the entire liability is paid in cash at the end of 10 years.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Sure I can analyze the text in the image and help you solve the accounting problem Record the capitalization of dismantling and cleanup costs Since Russel Industries is required by law to dismantle an...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started