Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Rustafson Corporation is a diversified manufacturer of consumer goods. The companys activity based costing systsem has the following seven activity cost pools: 2. Computer the

Rustafson Corporation is a diversified manufacturer of consumer goods. The companys activity based costing systsem has the following seven activity cost pools:

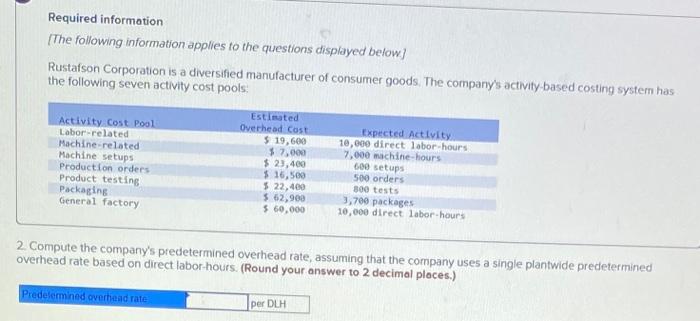

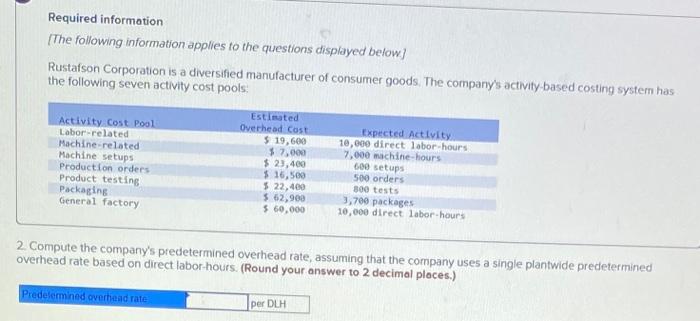

Required information (The following information applies to the questions displayed below] Rustafson Corporation is a diversified manufacturer of consumer goods. The company's activity based costing system has the following seven activity cost pools Activity Cost Pool Labor-related Machine-related Machine setups Production orders Product testing Packaging General factory Estimated Overhead cost $ 19,600 $7,000 $ 23,400 $ 16,500 $ 22,400 5.62,900 $ 60,000 Expected Activity 10,000 direct labor hours 7,000 machine-hours 609 setups 500 orders 300 tests 3,700 packages 10,000 direct labor-hours 2. Compute the company's predetermined overhead rate, assuming that the company uses a single plantwide predetermined overhead rate based on direct labor-hours. (Round your answer to 2 decimal places.) Predelermined overhead rate per DLH 2 Compute the company's predetermined overhead rate, assuming that the company uses a single plantwide predetermined overhead rate based on direct labor-hours (Round your answer to 2 decimal places.) Prodotermined ovethesdato per DLH 2. Computer the companys predetermined overhead rate assuming that the company uses a single client why predetermined overhead rate based on direct labor hours( round your answer to two decimal places)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started