Answered step by step

Verified Expert Solution

Question

1 Approved Answer

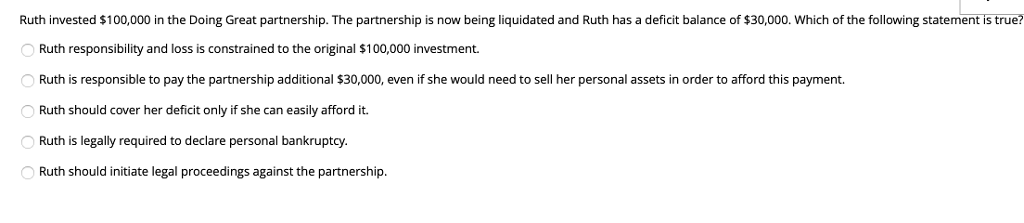

Ruth invested $100,000 in the Doing Great partnership. The partnership is now being liquidated and Ruth has a deficit balance of $30,000. Which of the

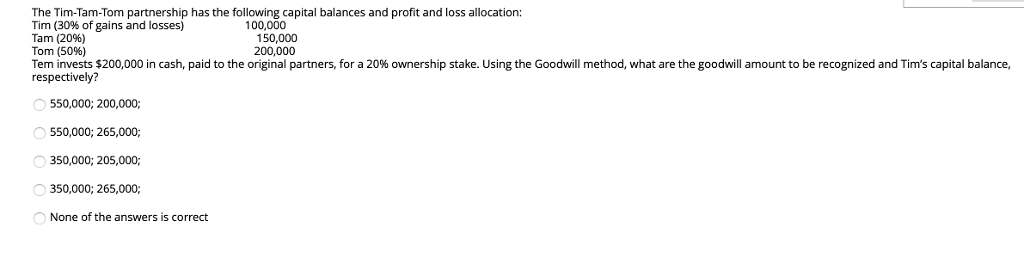

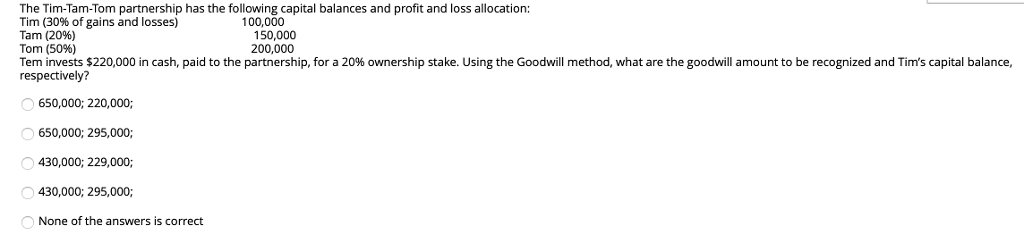

Ruth invested $100,000 in the Doing Great partnership. The partnership is now being liquidated and Ruth has a deficit balance of $30,000. Which of the following statement is true? Ruth responsibility and loss is constrained to the original $100,000 investment. Ruth is responsible to pay the partnership additional $30,000, even if she would need to sell her personal assets in order to afford this payment. Ruth should cover her deficit only if she can easily afford it. Ruth is legally required to declare personal bankruptcy Ruth should initiate legal proceedings against the partnership The Tim-Tam-Tom partnership has the following capital balances and profit and loss allocation: Tim (30% of gains and losses) Tam (2096) Tom (50%) Tem invests $200,000 in cash, paid to the original partners, for a 20% ownership stake. Using the Goodwill method, what are the goodwill amount to be recognized and Tim's capital balance, respectively? 100,000 150,000 200,000 550,000; 200,000; 550,000; 265,000; 350,000; 205,000; 350,000; 265,000; None of the answers is correct The Tim-Tam-Tom partnership has the following capital balances and profit and loss allocation: Tim (30% of gains and losses) Tam (20%) Tom (50%) Tem vests $220 000 cash, paid to the partnership, for a 20% ownership stake usin the Goodi ill m respectively? 100,000 150,000 200,000 o what are good il ann unt e rec e and Tints a l balance, 650,000; 220,000; 650,000; 295,000; 430,000; 229,000; 430,000; 295,000; None of the answers is correct The Tim-Tam-Tom partnership has the following capital balances and profit and loss allocation: Tim (30% of gains and losses) Tam (20%) Tom (50%) Tem invests $250,000 in cash, paid to the original partners, for a 20% ownership stake. Using the bonus method, after the transaction what is Tom's capital balance? 100,000 150,000 200,000 180,000 250,000 255,000 280,000 None of the answers is correct

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started