Answered step by step

Verified Expert Solution

Question

1 Approved Answer

RWP12-4 (Static) Comparative Analysis Continuing Case: American Eagle Outfitters, Incorporated, vs. The Buckle, Incorporated Financial information for American Eagle is presented in Appendix A, and

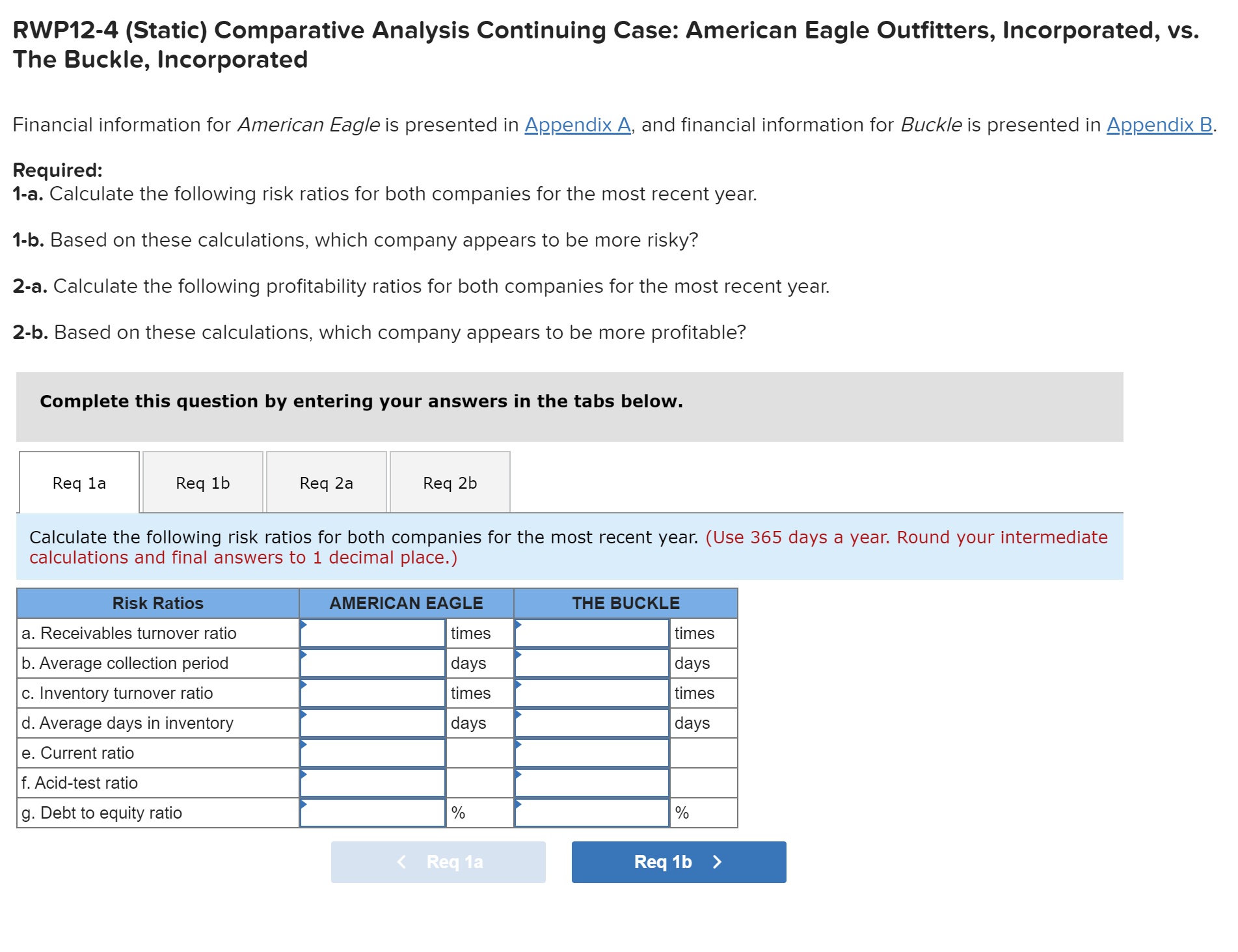

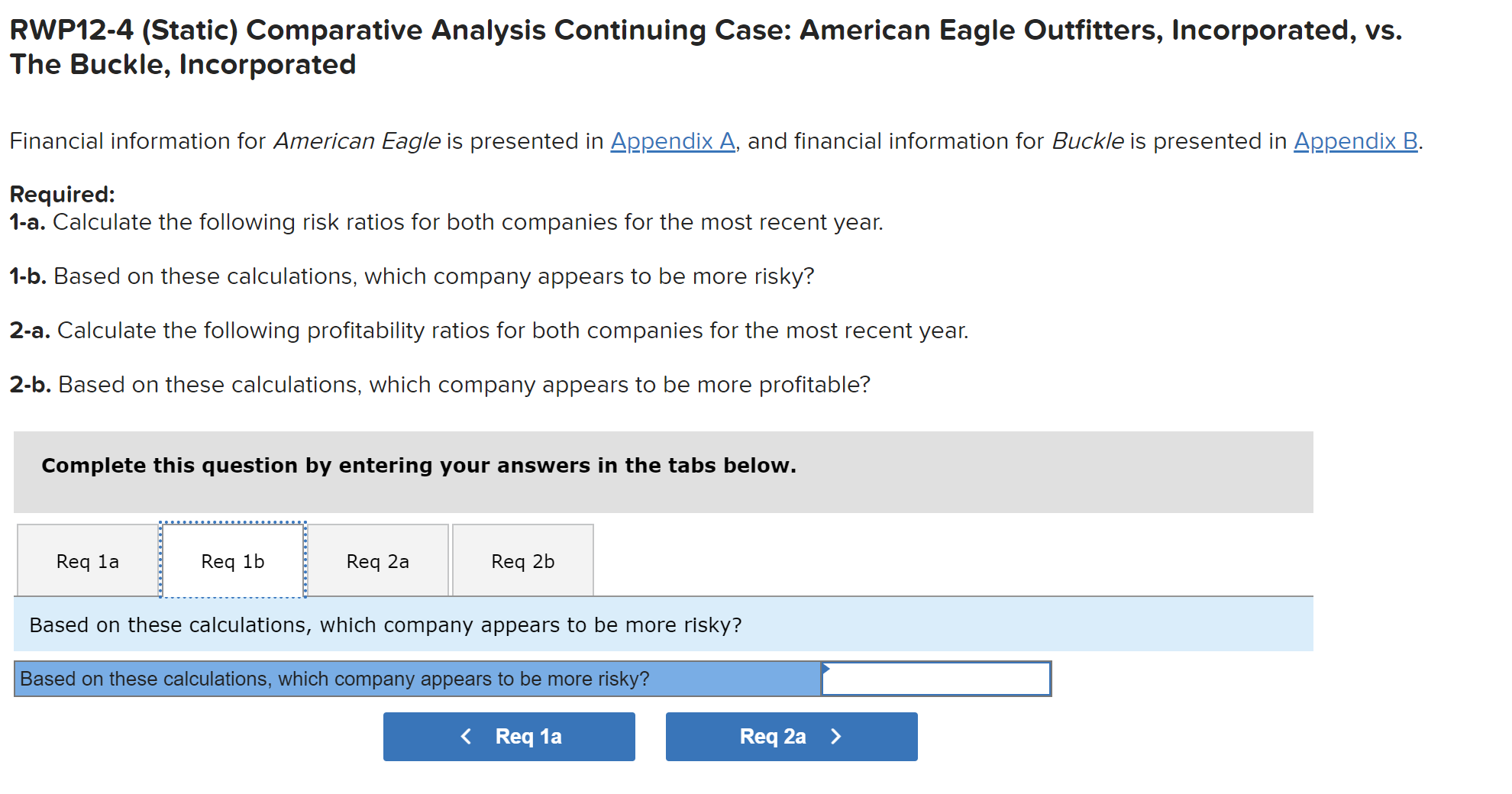

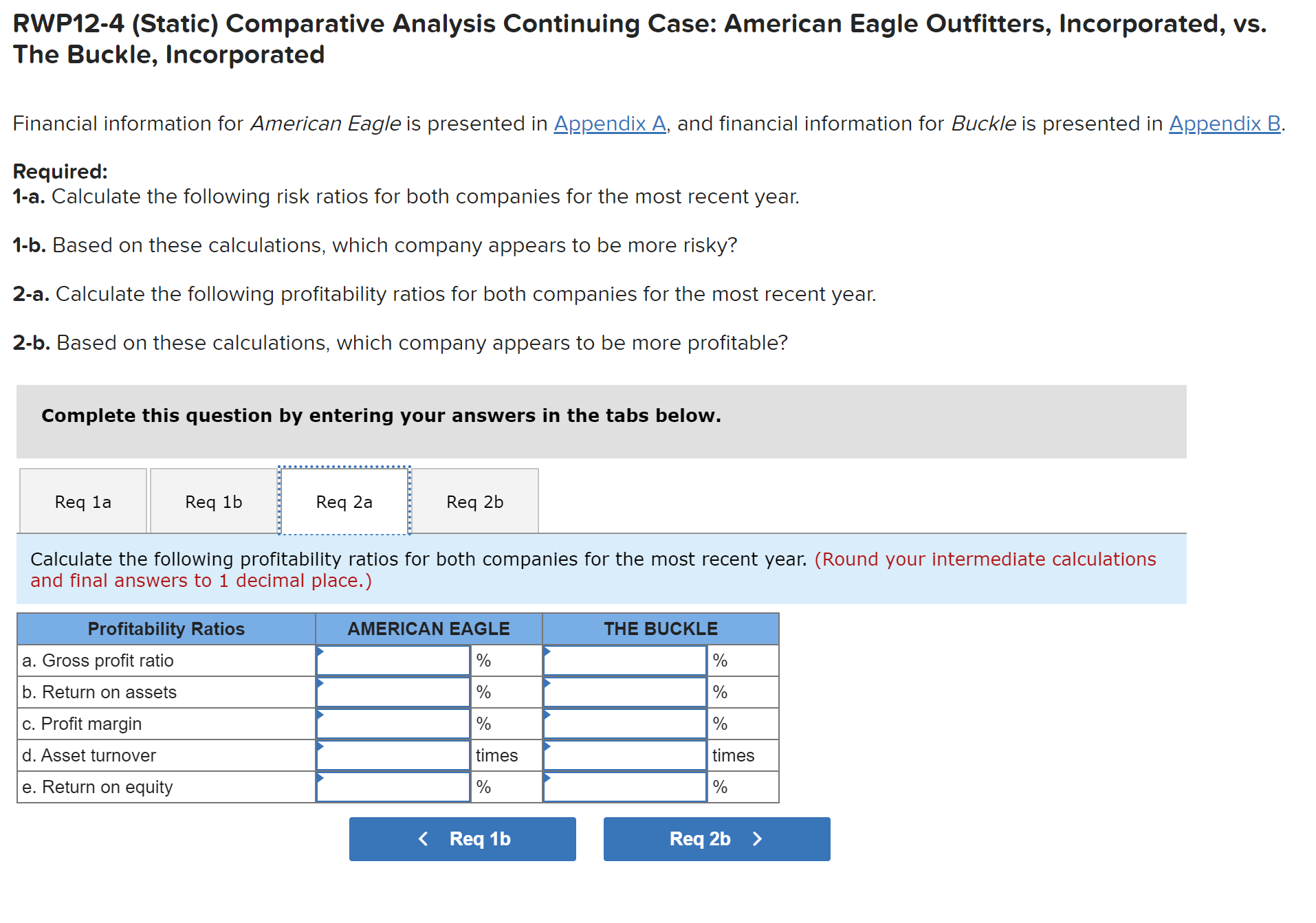

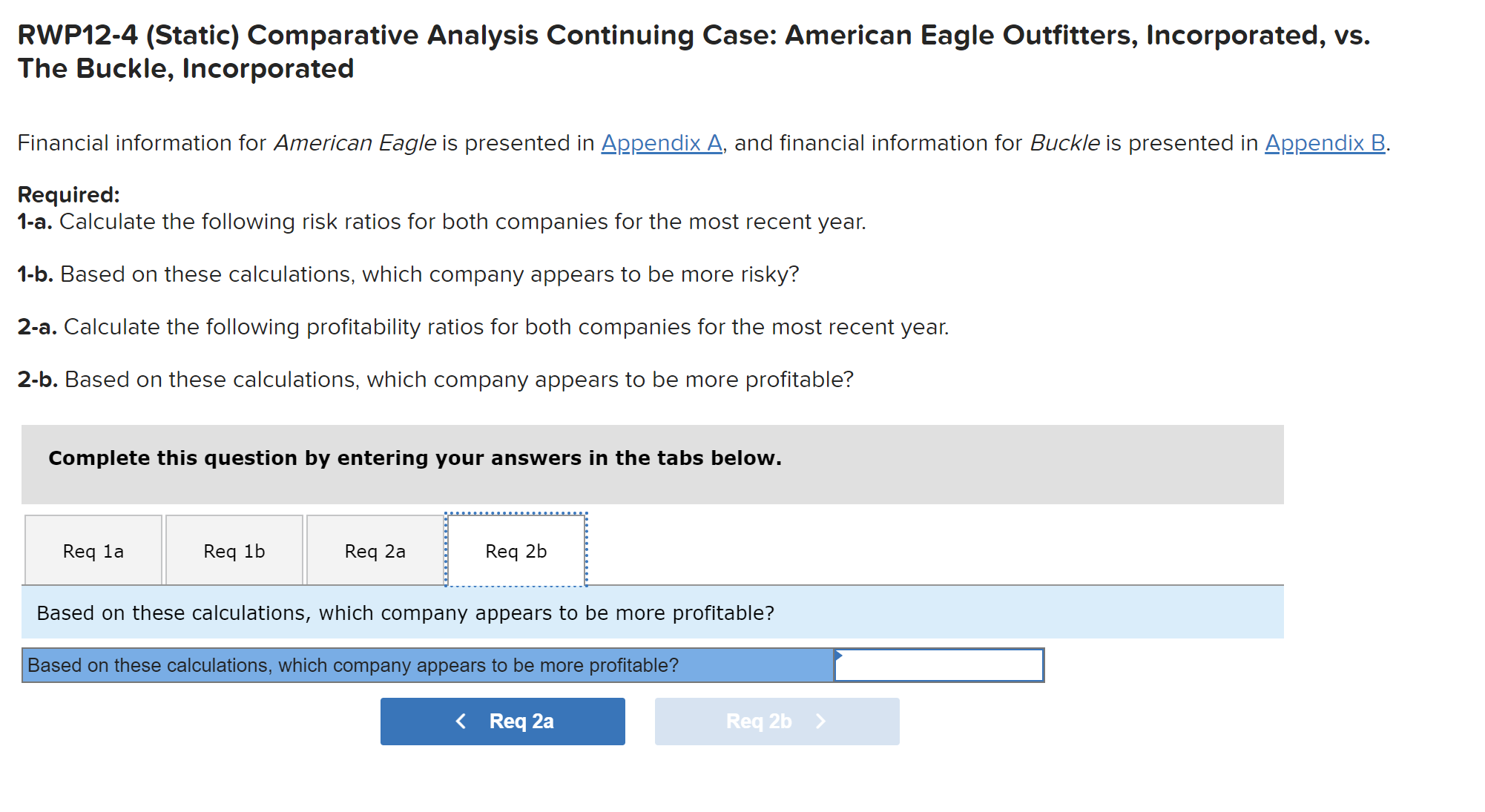

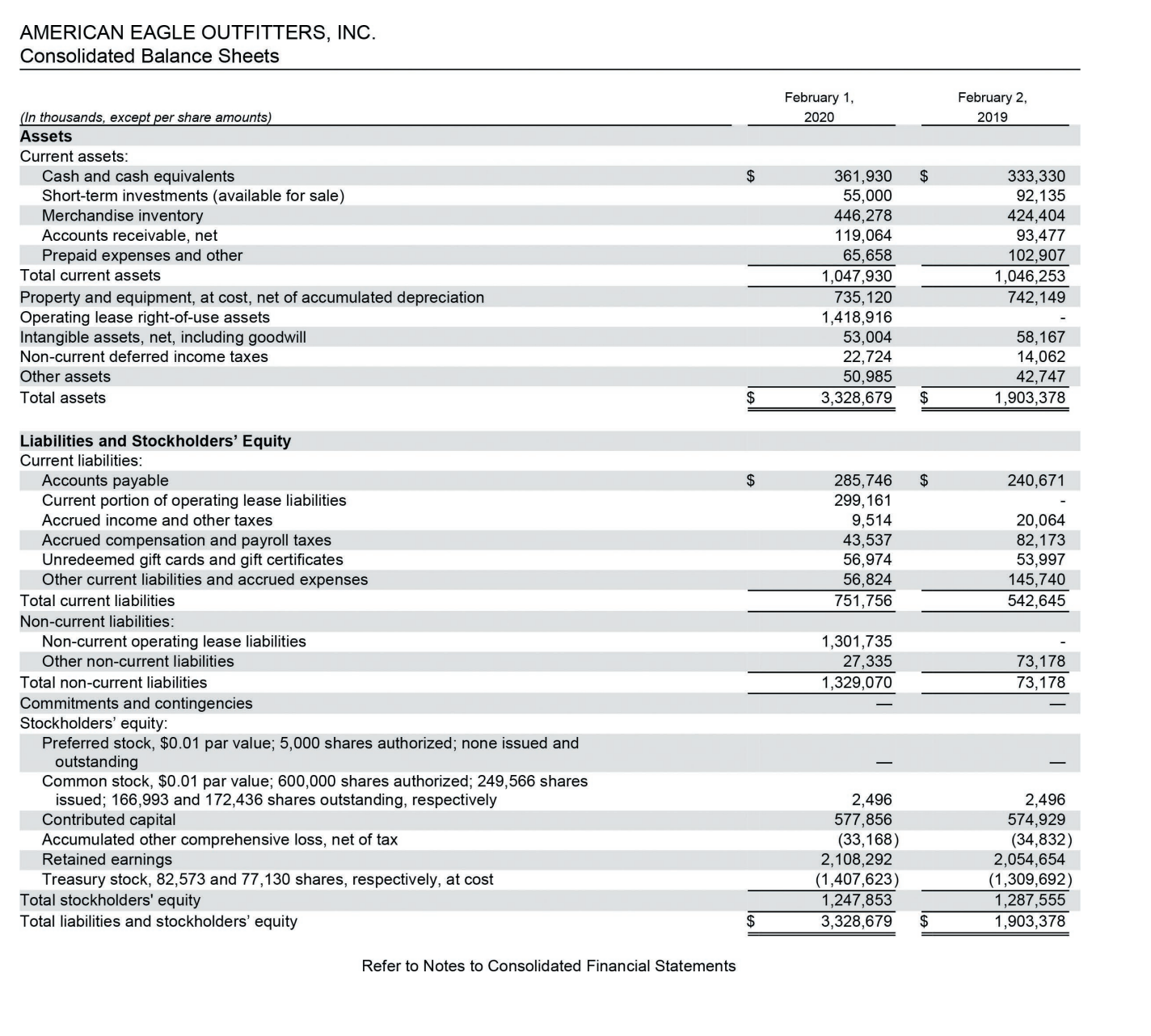

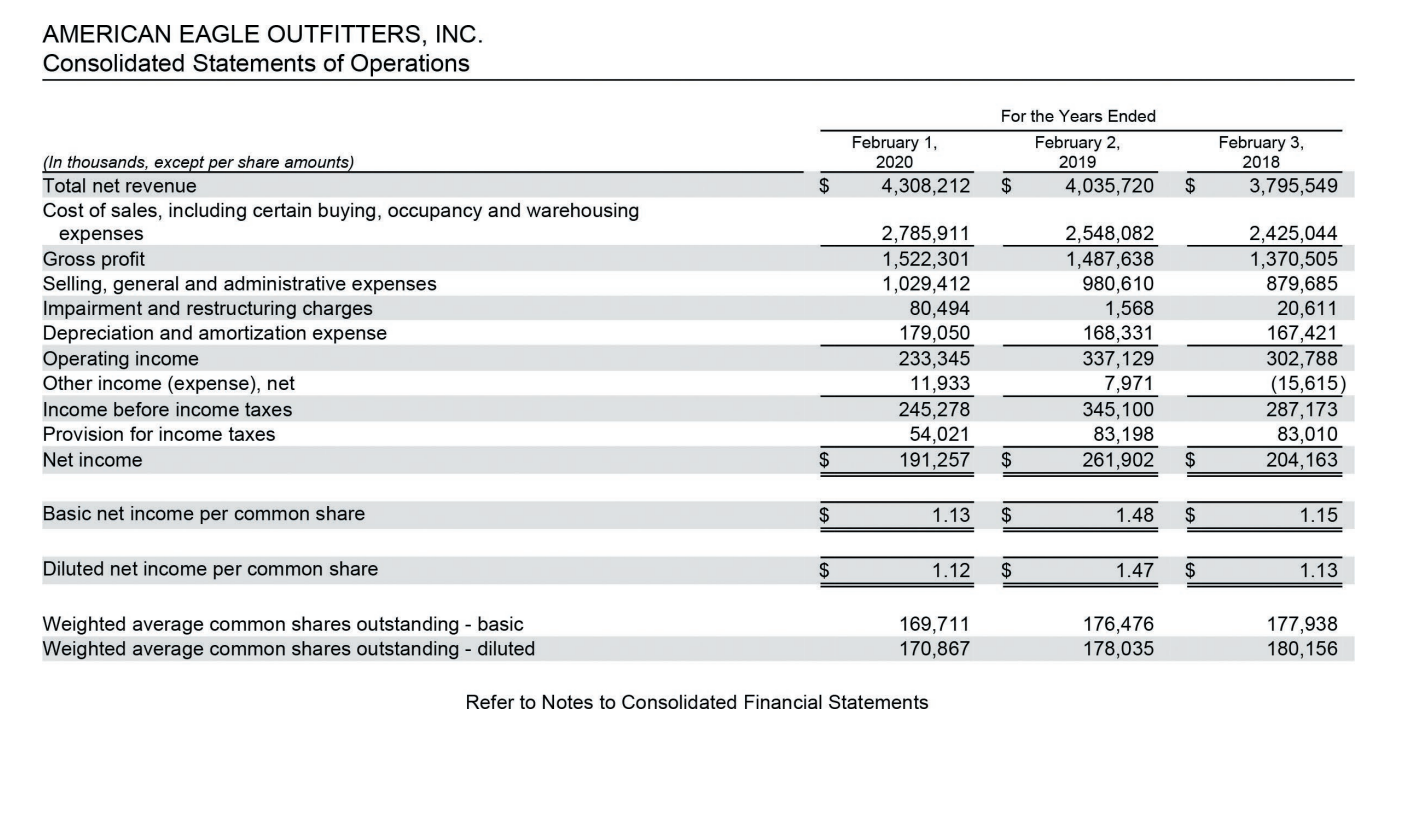

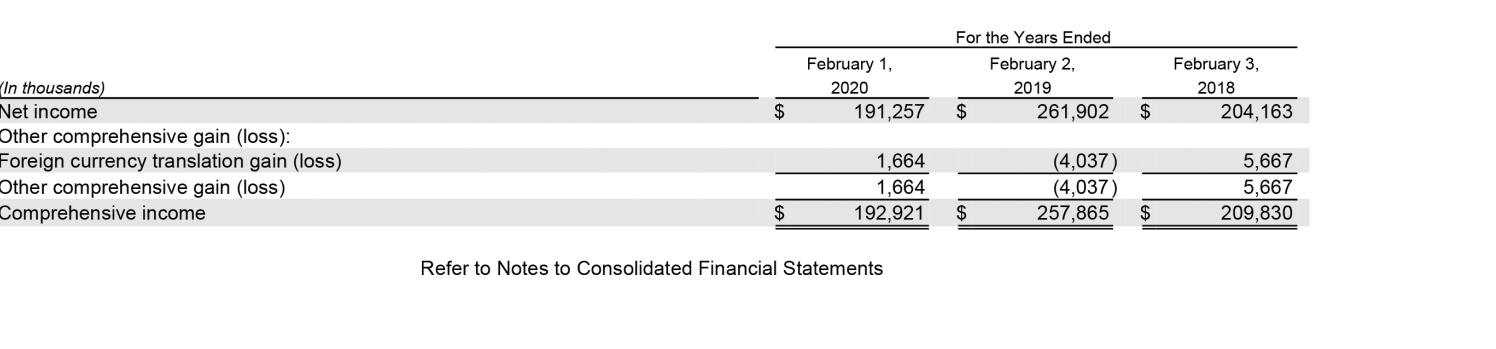

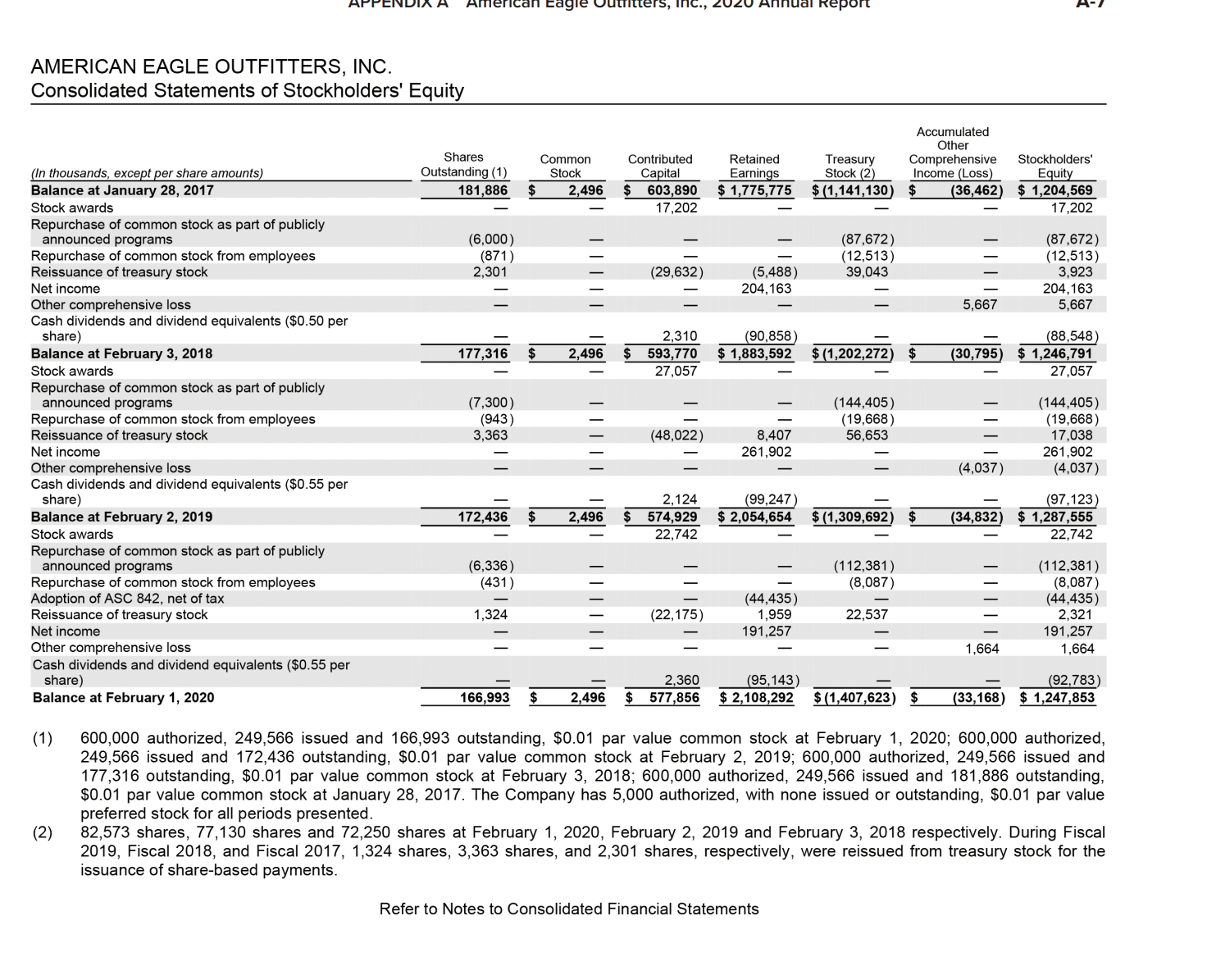

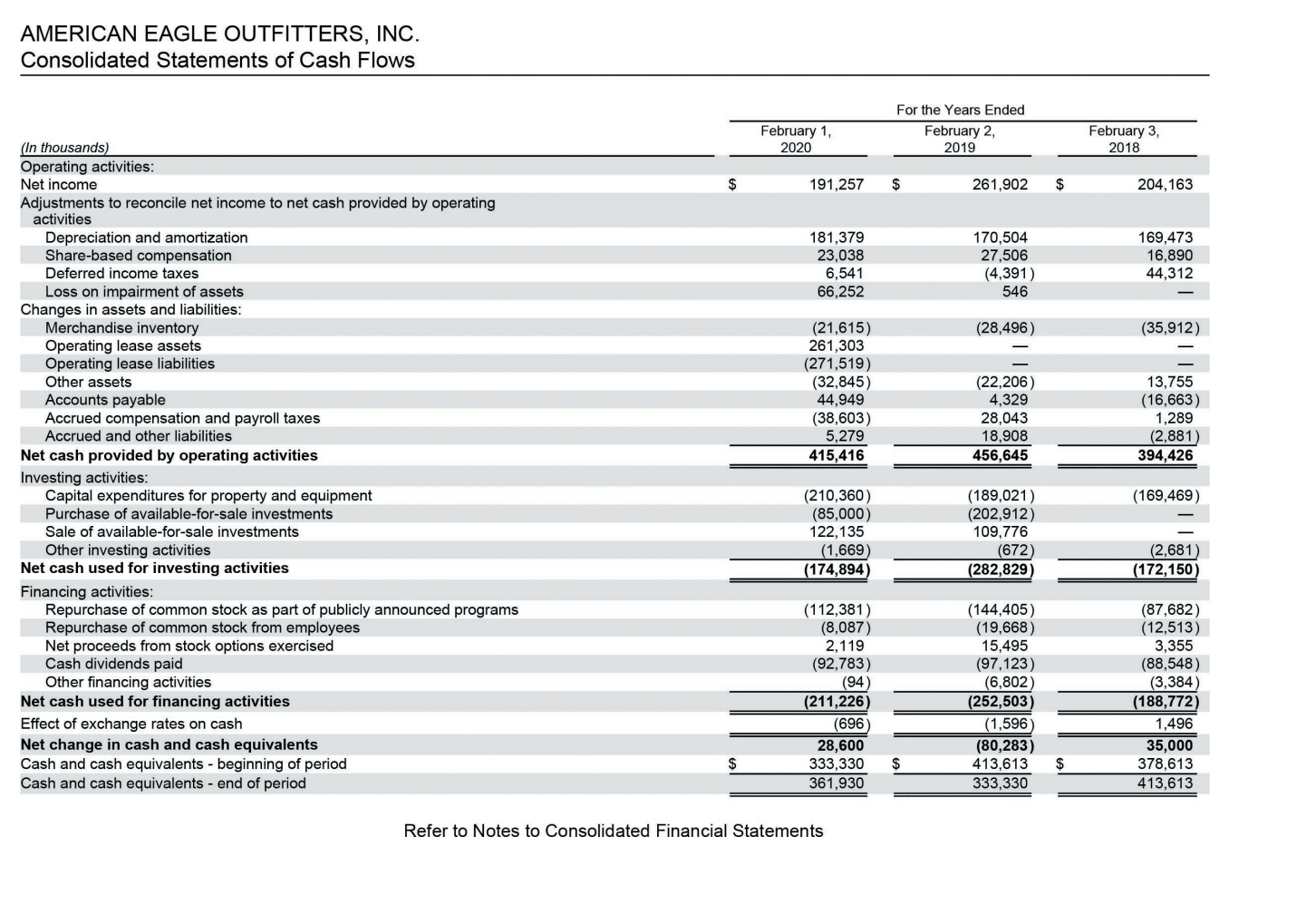

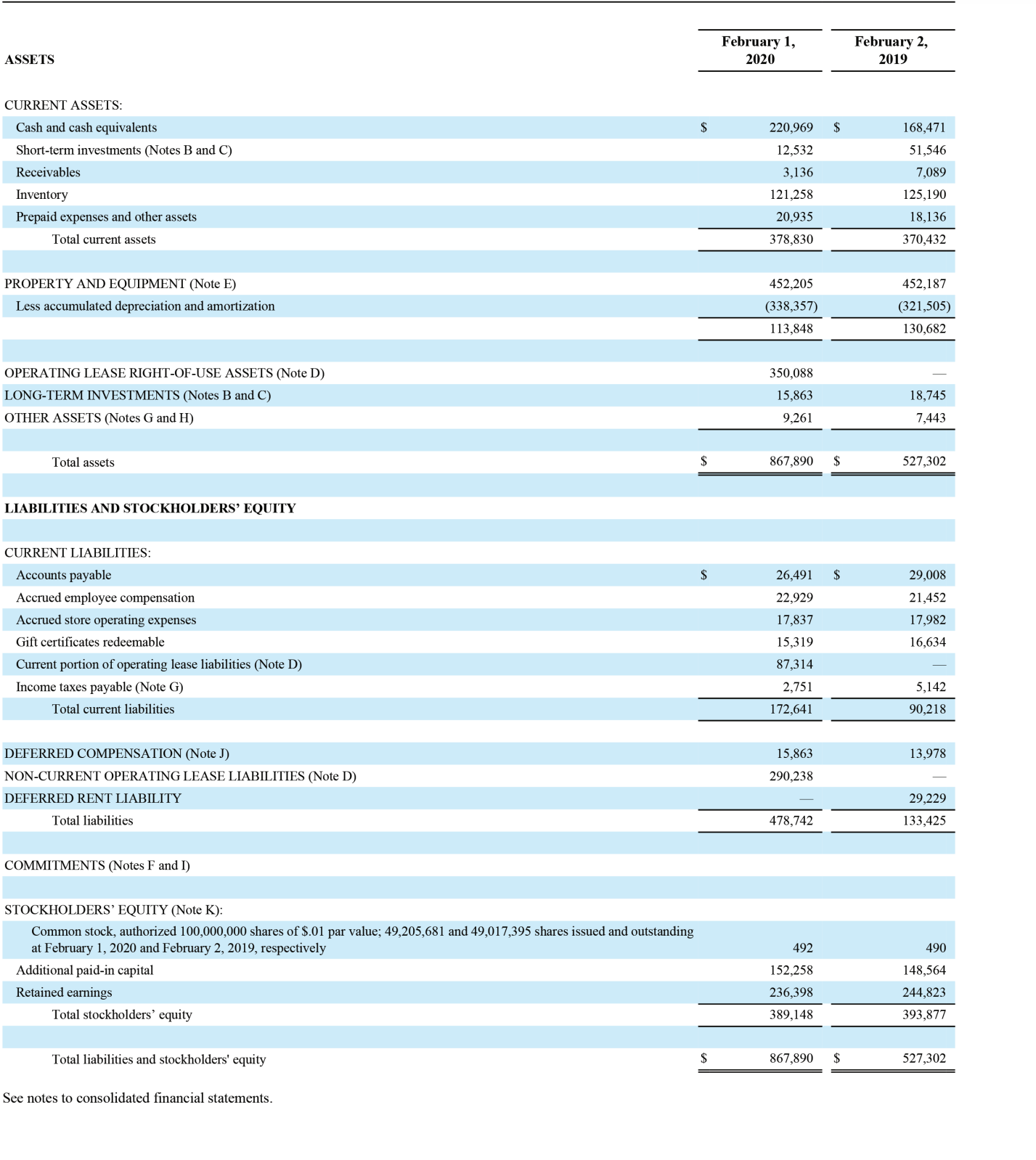

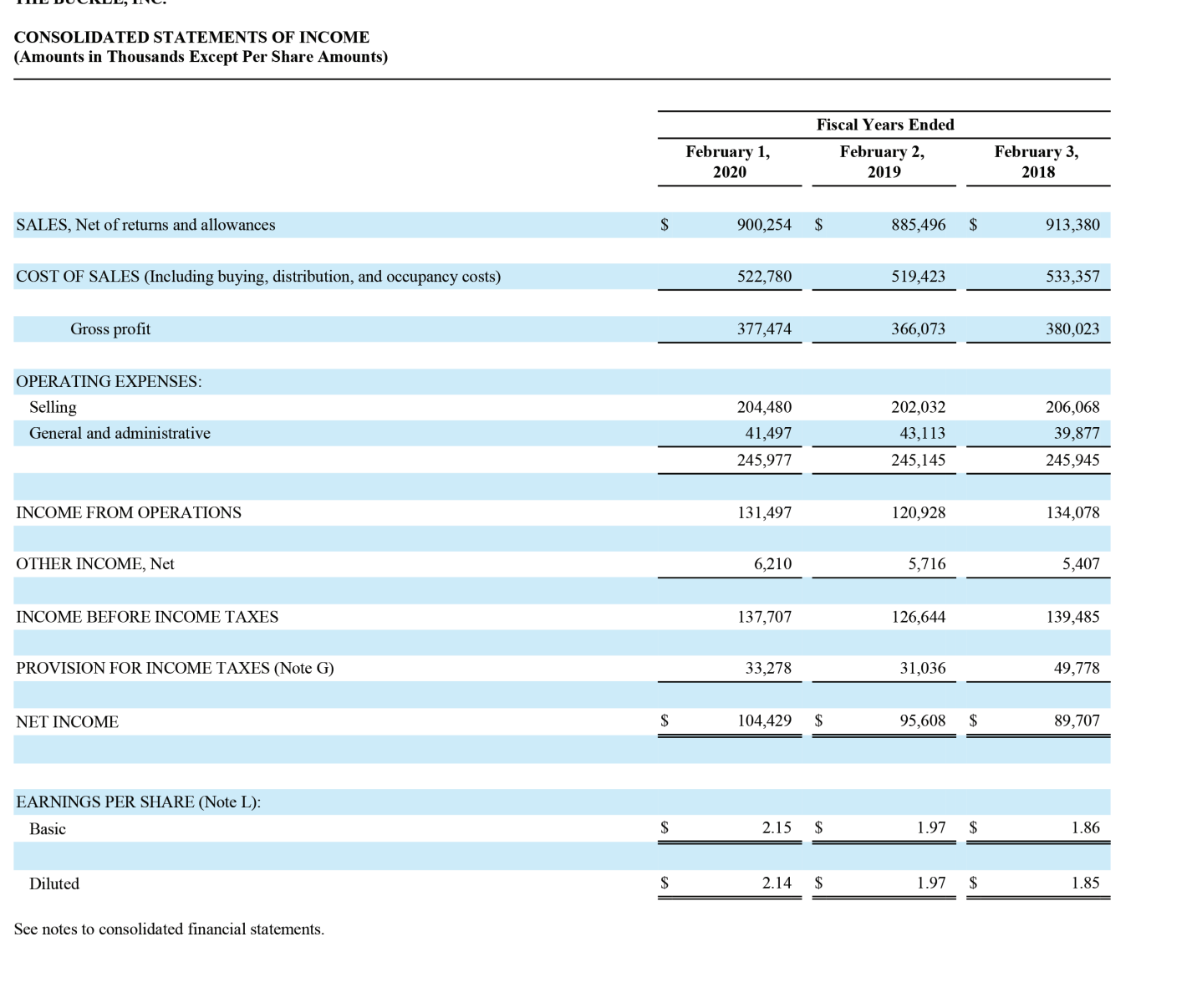

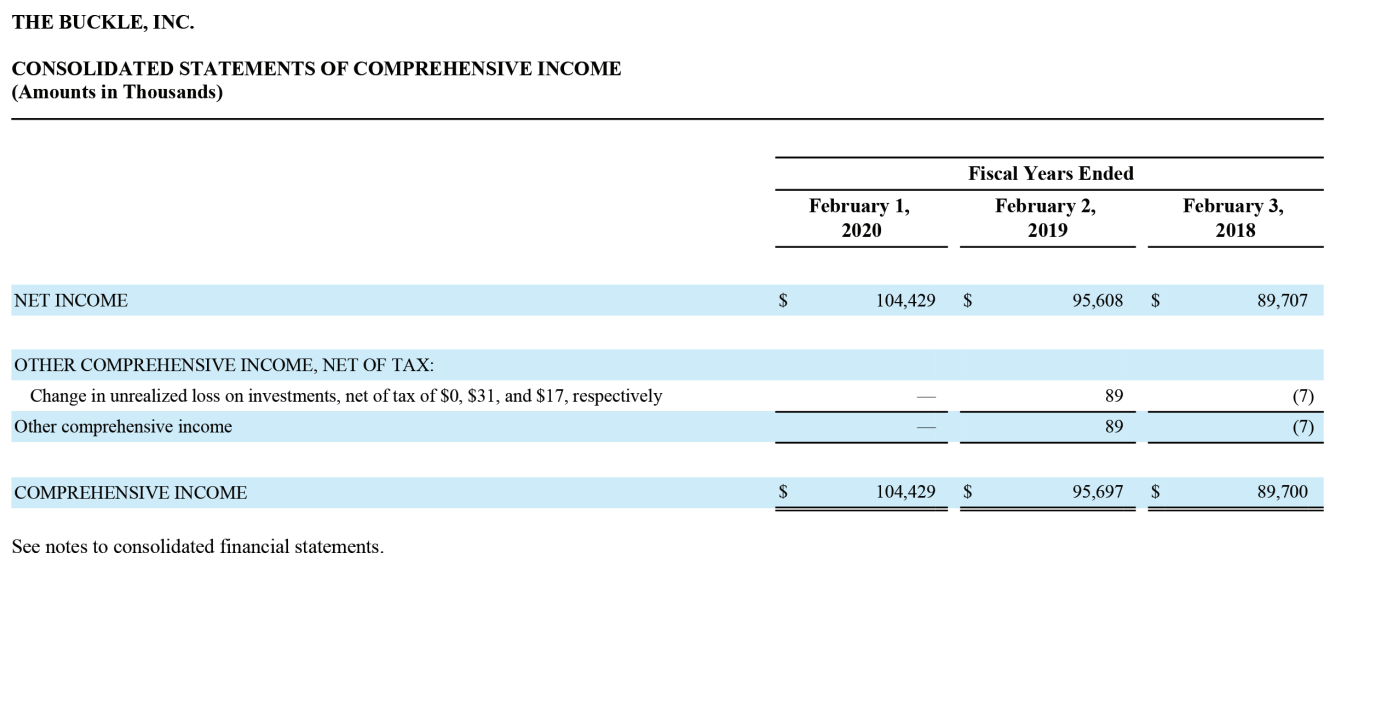

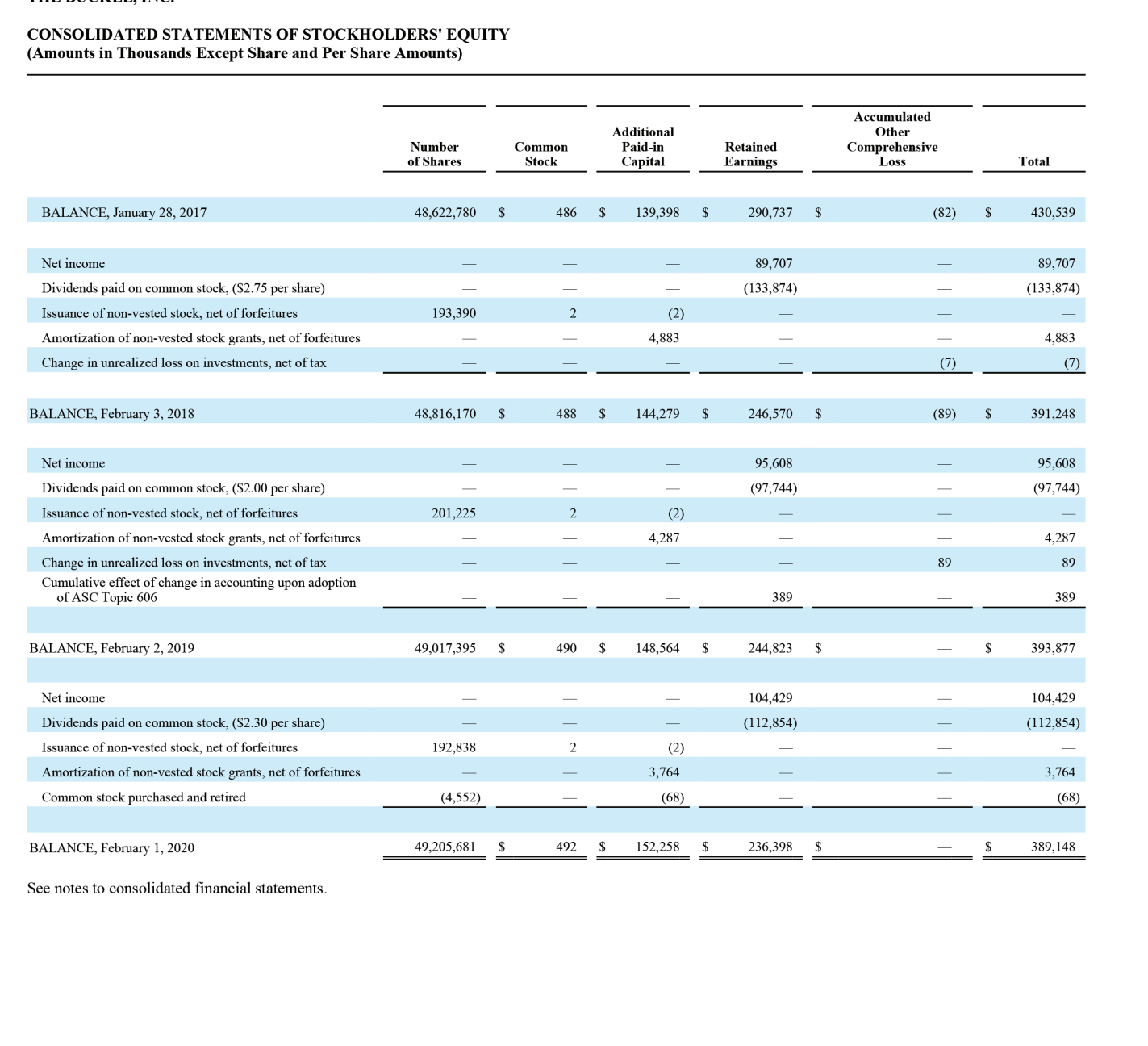

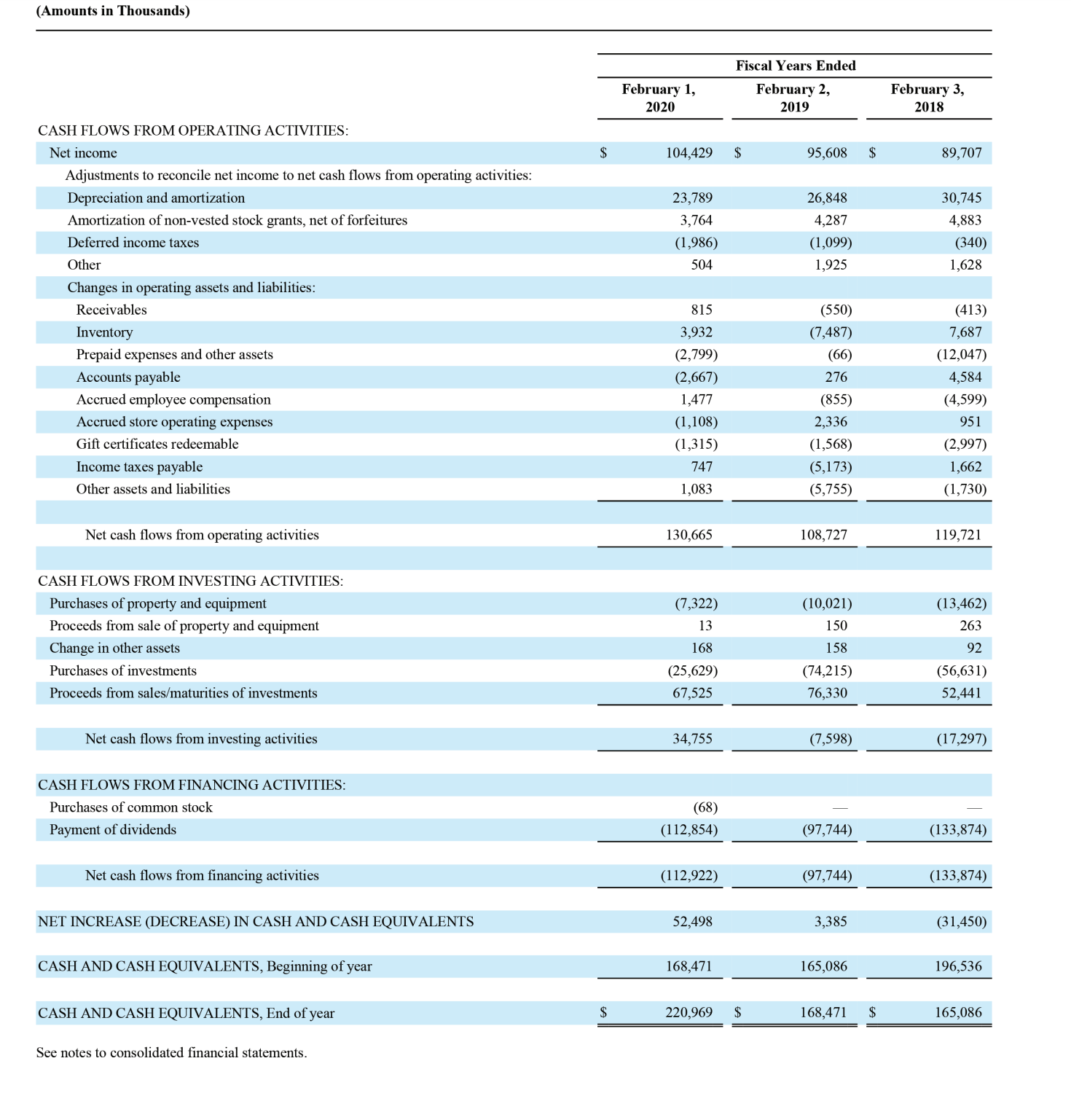

RWP12-4 (Static) Comparative Analysis Continuing Case: American Eagle Outfitters, Incorporated, vs. The Buckle, Incorporated Financial information for American Eagle is presented in Appendix A, and financial information for Buckle is presented in Appendix Required: 1-a. Calculate the following risk ratios for both companies for the most recent year. 1-b. Based on these calculations, which company appears to be more risky? 2-a. Calculate the following profitability ratios for both companies for the most recent year. 2-b. Based on these calculations, which company appears to be more profitable? Complete this question by entering your answers in the tabs below. Calculate the following risk ratios for both companies for the most recent year. (Use 365 days a year. Round your intermediate calculations and final answers to 1 decimal place.) RWP12-4 (Static) Comparative Analysis Continuing Case: American Eagle Outfitters, Incorporated, vs. The Buckle, Incorporated Financial information for American Eagle is presented in Appendix A, and financial information for Buckle is presented in Appendix B. Required: 1-a. Calculate the following risk ratios for both companies for the most recent year. 1-b. Based on these calculations, which company appears to be more risky? 2-a. Calculate the following profitability ratios for both companies for the most recent year. 2-b. Based on these calculations, which company appears to be more profitable? Complete this question by entering your answers in the tabs below. Based on these calculations, which company appears to be more risky? Based on these calculations, which company appears to be more risky? RWP12-4 (Static) Comparative Analysis Continuing Case: American Eagle Outfitters, Incorporated, vs. The Buckle, Incorporated Financial information for American Eagle is presented in Appendix A, and financial information for Buckle is presented in Appendix B Required: 1-a. Calculate the following risk ratios for both companies for the most recent year. 1-b. Based on these calculations, which company appears to be more risky? 2-a. Calculate the following profitability ratios for both companies for the most recent year. 2-b. Based on these calculations, which company appears to be more profitable? Complete this question by entering your answers in the tabs below. Calculate the following profitability ratios for both companies for the most recent year. (Round your intermediate calculations and final answers to 1 decimal place.) RWP12-4 (Static) Comparative Analysis Continuing Case: American Eagle Outfitters, Incorporated, vs. The Buckle, Incorporated Financial information for American Eagle is presented in AppendixA, and financial information for Buckle is presented in ppendixB.. Required: 1-a. Calculate the following risk ratios for both companies for the most recent year. 1-b. Based on these calculations, which company appears to be more risky? 2-a. Calculate the following profitability ratios for both companies for the most recent year. 2-b. Based on these calculations, which company appears to be more profitable? Complete this question by entering your answers in the tabs below. Based on these calculations, which company appears to be more profitable? Based on these calculations, which company appears to be more profitable? AMERICAN EAGLE OUTFITTERS, INC. Consolidated Balance Sheets Refer to Notes to Consolidated Financial Statements Refer to Notes to Consolidated Financial Statements Refer to Notes to Consolidated Financial Statements AMERICAN EAGLE OUTFITTERS, INC. Consolidated Statements of Stockholders' Equity (1) 600,000 authorized, 249,566 issued and 166,993 outstanding, $0.01 par value common stock at February 1,2020;600,000 authorized, 249,566 issued and 172,436 outstanding, $0.01 par value common stock at February 2,2019;600,000 authorized, 249,566 issued and 177,316 outstanding, $0.01 par value common stock at February 3,2018;600,000 authorized, 249,566 issued and 181,886 outstanding, $0.01 par value common stock at January 28,2017 . The Company has 5,000 authorized, with none issued or outstanding, $0.01 par value preferred stock for all periods presented. (2) 82,573 shares, 77,130 shares and 72,250 shares at February 1, 2020, February 2, 2019 and February 3, 2018 respectively. During Fiscal 2019, Fiscal 2018, and Fiscal 2017, 1,324 shares, 3,363 shares, and 2,301 shares, respectively, were reissued from treasury stock for the issuance of share-based payments. AMERICAN EAGLE OUTFITTERS, INC. Consolidated Statements of Cash Flows Refer to Notes to Consolidated Financial Statements ASSETS CURRENT ASSETS: LIABILITIES AND STOCKHOLDERS' EQUITY CURRENT LIABILITIES: COMMITMENTS (Notes F and I) STOCKHOLDERS' EQUITY (Note K): Common stock, authorized 100,000,000 shares of $.01 par value; 49,205,681 and 49,017,395 shares issued and outstanding at February 1, 2020 and February 2,2019, respectively Additional paid-in capital Retained earnings Total stockholders' equity Total liabilities and stockholders' equity See notes to consolidated financial statements. CONSOLIDATED STATEMENTS OF INCOME (Amounts in Thousands Except Per Share Amounts) See notes to consolidated financial statements. THE BUCKLE, INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (Amounts in Thousands) See notes to consolidated financial statements. CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY (Amounts in Thousands Except Share and Per Share Amounts) (Amounts in Thousands) See notes to consolidated financial statements

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started