Question

RXL Electronics Company, located in Southern Ontario, manufactures precision measuring devices to monitor exhaust emission systems for the automotive and manufacturing sectors. Its products are

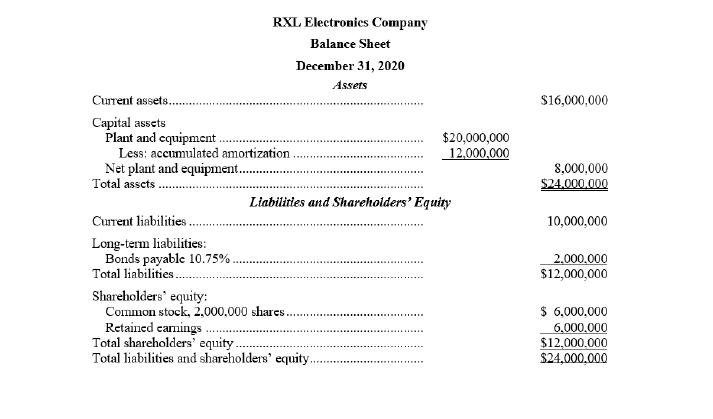

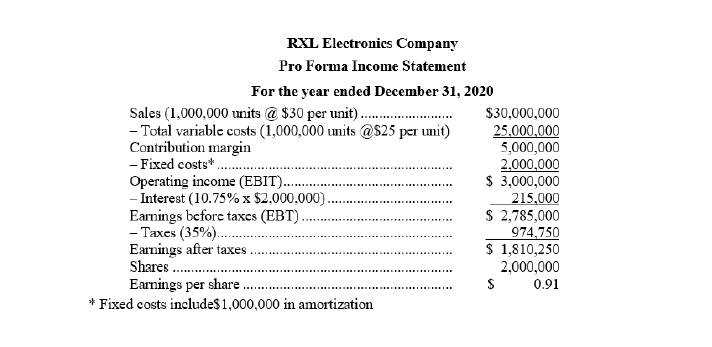

RXL Electronics Company, located in Southern Ontario, manufactures precision measuring devices to monitor exhaust emission systems for the automotive and manufacturing sectors. Its products are sold worldwide but are primarily in Canada. The firm hired Mike Ashton in January of 2021 as vice president in charge of manufacturing operations. Mike had a bachelors degree in industrial engineering from Ryerson University and an MBA from Western University. He has a significant amount of experience in the manufacturing sector, and the CEO of RXL made it clear that operations needed to improve as the company revenues have stagnated over the past three years. At age 38, he established a good reputation for innovation, and revitalizing the manufacturing process should help product innovation. Upon being hired, he began looking over the financial statements for 2020:

Mike has approached you for some insight into the company's financials. Required: 1. Complete the following calculations: Return on equity, return on assets, capital asset turnover, current ratio, and debt to total assets. 2. Do you think these calculations will help Mike drive the company forward? Explain why or why not. Your answer should be at least 500 words.

$16,000,000 RXL Electronics Company Balance Sheet December 31, 2020 Assets Current assets. Capital assets Plant and cquipment $20,000,000 Less: accumulated amortization 12,000,000 Net plant and equipment Total assets Liabilities and Shareholders' Equity Current liabilities Long-term liabilities: Bonds payable 10.75% Total liabilities. Shareholders' equity: Common stock, 2,000,000 shares. Retained carnings Total shareholders' equity Total liabilities and shareholders' equity. 8.000.000 $24.000.000 10,000,000 2.000.000 $12,000,000 $ 6.000.000 6,000,000 $12,000,000 $24,000,000 RXL Electronics Company Pro Forma Income Statement For the year ended December 31, 2020 Sales (1,000,000 units @ $30 per unit). $30,000,000 - Total variable costs (1,000,000 units @$25 per unit) 25,000,000 Contribution margin 5,000,000 - Fixed costs" 2.000.000 Operating income (EBIT)...... $ 3,000,000 - Interest (10.75% x $2.000.000) 215,000 Earnings before taxes (EBT). $ 2,785,000 - Taxes (35%).. 974.750 Earnings after taxes $ 1,810,250 Shares ........ 2,000,000 Earnings per share. $ 0.91 * Fixed costs include$ 1,000,000 in amortization ILLIEStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started