Answered step by step

Verified Expert Solution

Question

1 Approved Answer

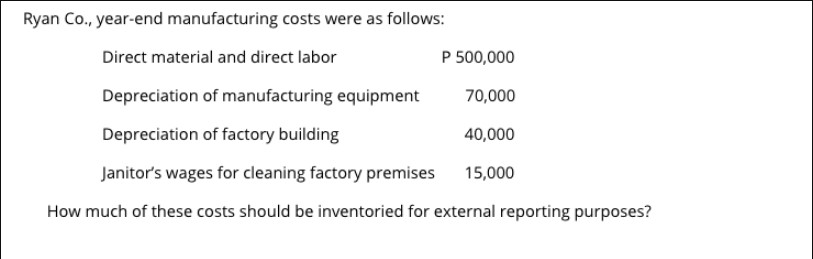

Ryan Co., year-end manufacturing costs were as follows: Direct material and direct labor P 500,000 Depreciation of manufacturing equipment 70,000 Depreciation of factory building

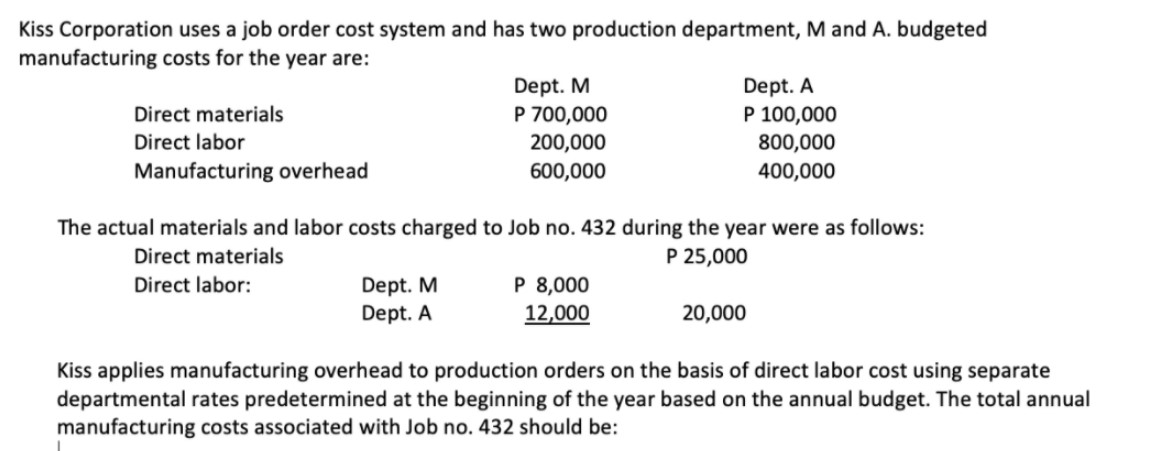

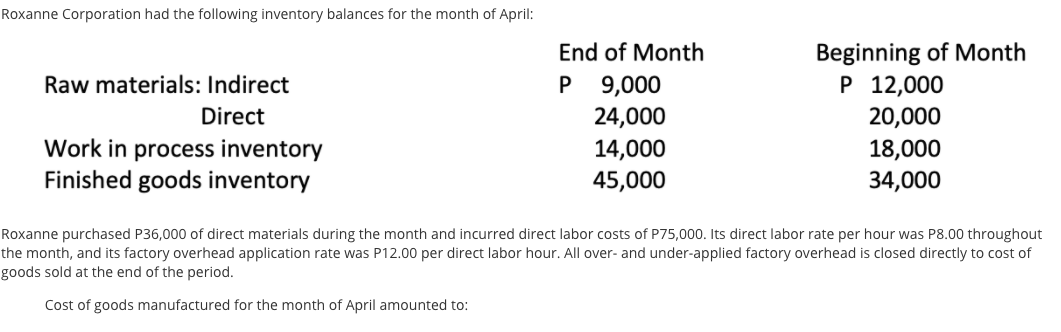

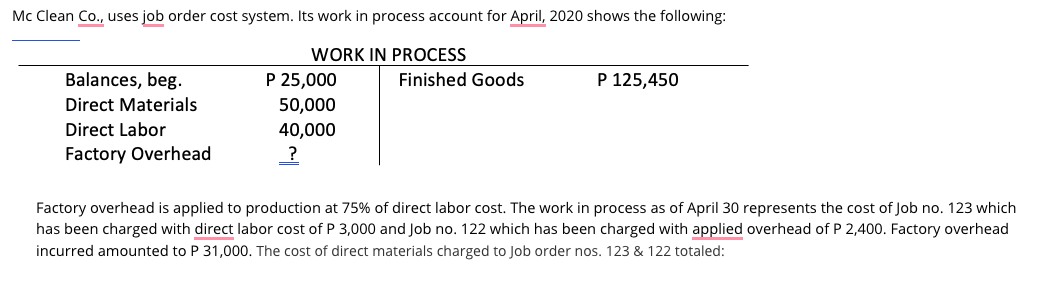

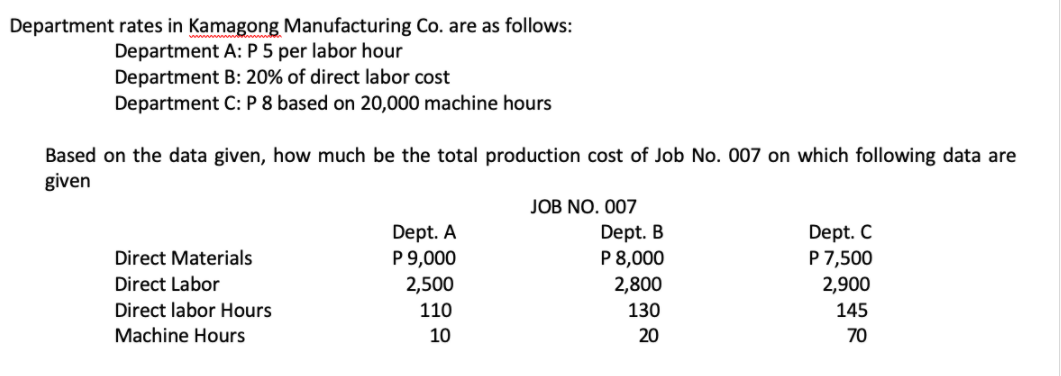

Ryan Co., year-end manufacturing costs were as follows: Direct material and direct labor P 500,000 Depreciation of manufacturing equipment 70,000 Depreciation of factory building 40,000 15,000 Janitor's wages for cleaning factory premises How much of these costs should be inventoried for external reporting purposes? Kiss Corporation uses a job order cost system and has two production department, M and A. budgeted manufacturing costs for the year are: Direct materials Direct labor Manufacturing overhead Dept. M P 700,000 200,000 600,000 Dept. A P 100,000 800,000 400,000 The actual materials and labor costs charged to Job no. 432 during the year were as follows: Direct materials Direct labor: Dept. M Dept. A P 8,000 12,000 P 25,000 20,000 Kiss applies manufacturing overhead to production orders on the basis of direct labor cost using separate departmental rates predetermined at the beginning of the year based on the annual budget. The total annual manufacturing costs associated with Job no. 432 should be: Roxanne Corporation had the following inventory balances for the month of April: Raw materials: Indirect Direct Work in process inventory Finished goods inventory End of Month P 9,000 Beginning of Month P 12,000 24,000 20,000 14,000 18,000 45,000 34,000 Roxanne purchased P36,000 of direct materials during the month and incurred direct labor costs of P75,000. Its direct labor rate per hour was P8.00 throughout the month, and its factory overhead application rate was P12.00 per direct labor hour. All over- and under-applied factory overhead is closed directly to cost of goods sold at the end of the period. Cost of goods manufactured for the month of April amounted to: Mc Clean Co., uses job order cost system. Its work in process account for April, 2020 shows the following: WORK IN PROCESS Balances, beg. Direct Materials Direct Labor Factory Overhead P 25,000 50,000 40,000 ? Finished Goods P 125,450 Factory overhead is applied to production at 75% of direct labor cost. The work in process as of April 30 represents the cost of Job no. 123 which has been charged with direct labor cost of P 3,000 and Job no. 122 which has been charged with applied overhead of P 2,400. Factory overhead incurred amounted to P 31,000. The cost of direct materials charged to job order nos. 123 & 122 totaled: Department rates in Kamagong Manufacturing Co. are as follows: Department A: P 5 per labor hour Department B: 20% of direct labor cost Department C: P 8 based on 20,000 machine hours Based on the data given, how much be the total production cost of Job No. 007 on which following data are given Direct Materials Direct Labor Direct labor Hours Machine Hours JOB NO. 007 Dept. A P 9,000 2,500 Dept. B P 8,000 2,800 Dept. C P 7,500 2,900 110 10 130 20 145 70

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started