Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ryanair's finances have been greatly affected by the COVID-19 pandemic and this question requires you to consider the impact on key 2021 Balance Sheet

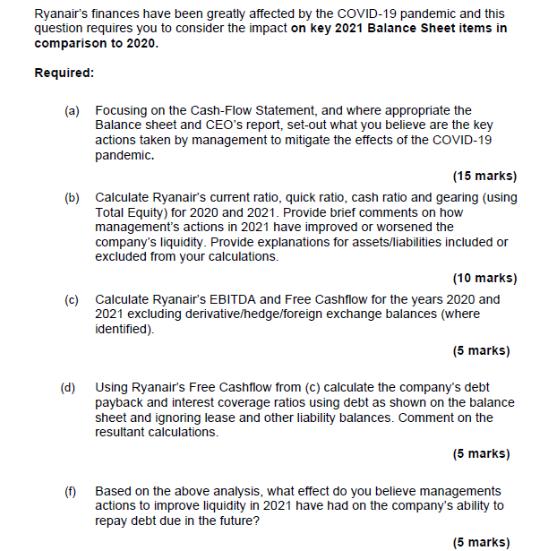

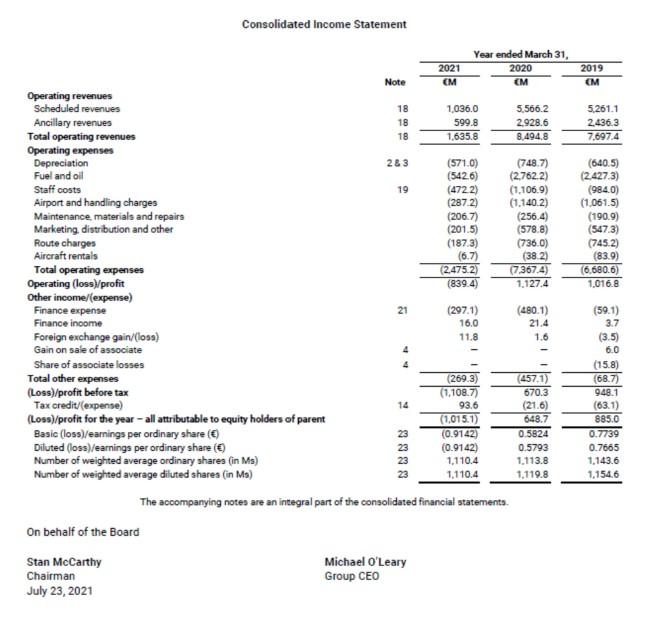

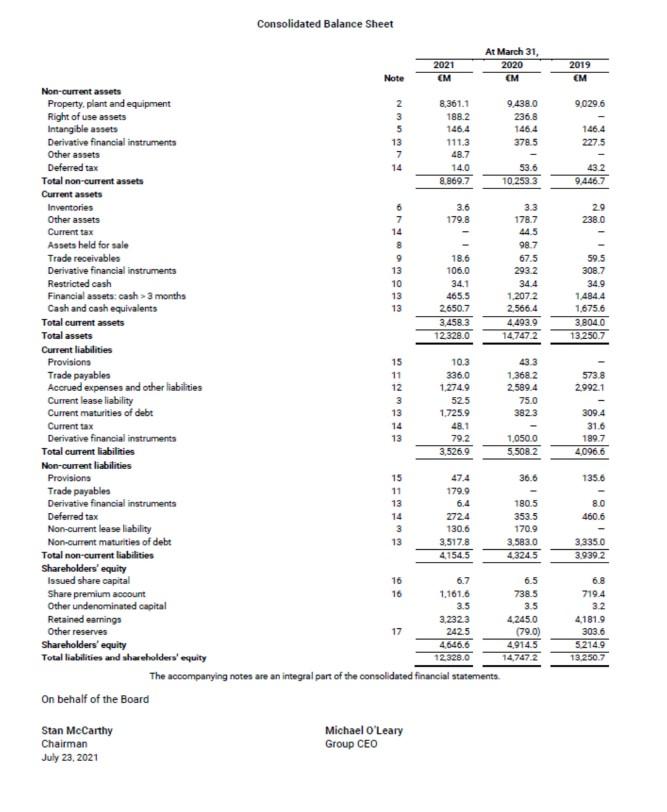

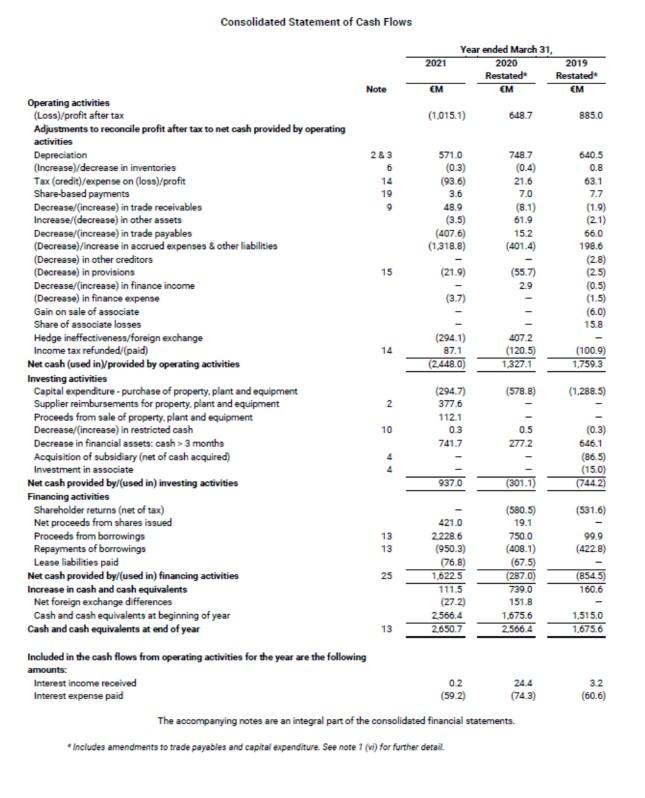

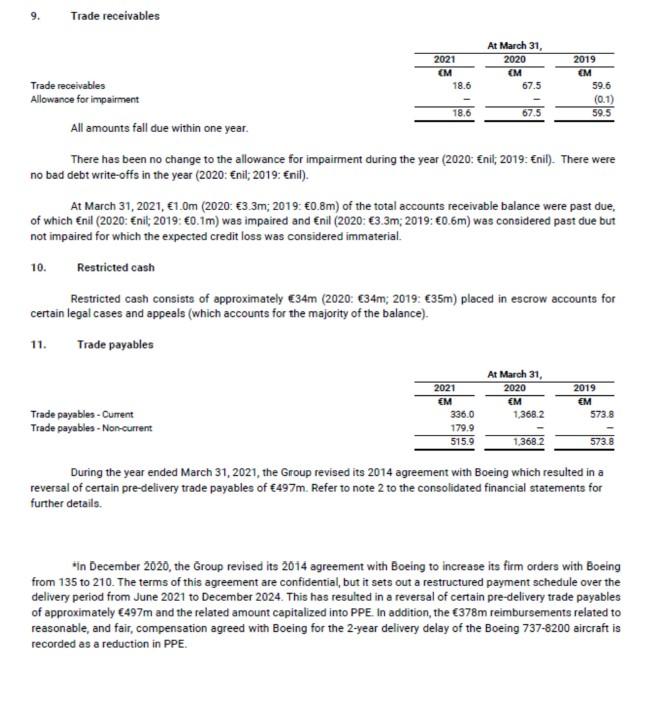

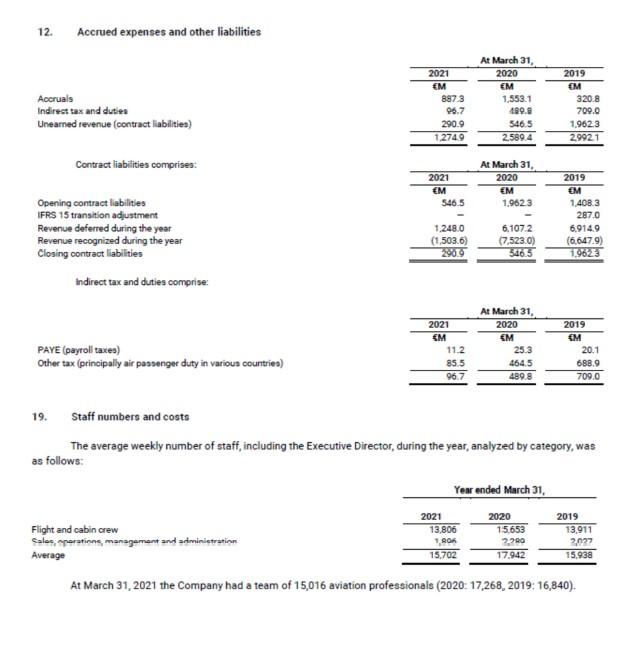

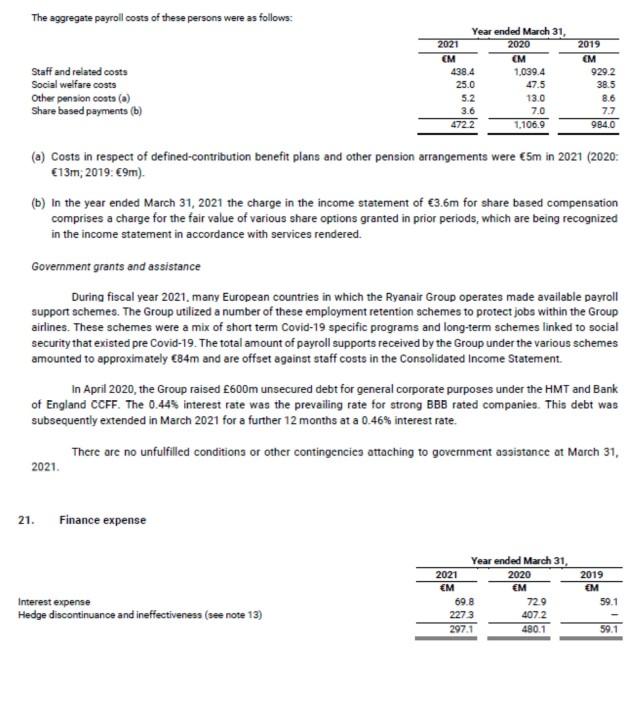

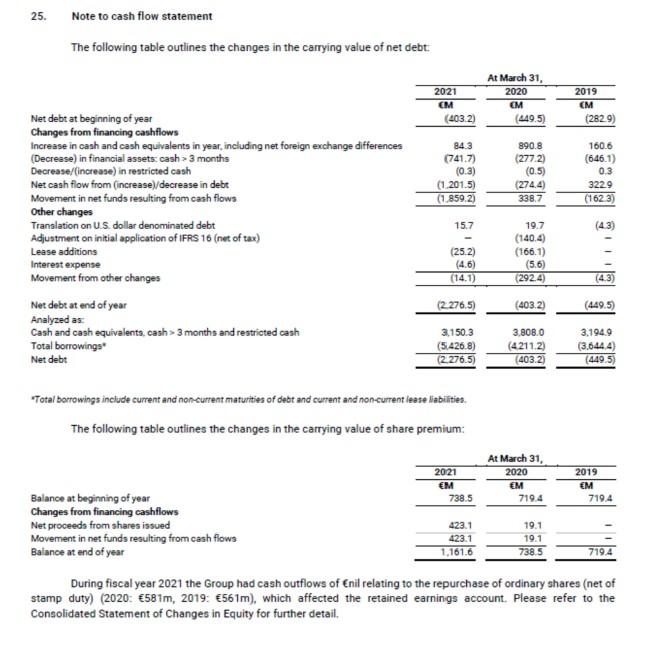

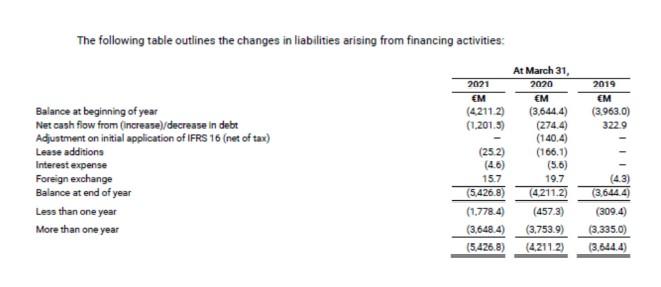

Ryanair's finances have been greatly affected by the COVID-19 pandemic and this question requires you to consider the impact on key 2021 Balance Sheet items in comparison to 2020. Required: (a) Focusing on the Cash-Flow Statement, and where appropriate the Balance sheet and CEO's report, set-out what you believe are the key actions taken by management to mitigate the effects of the COVID-19 pandemic. (15 marks) (b) Calculate Ryanair's current ratio, quick ratio, cash ratio and gearing (using Total Equity) for 2020 and 2021. Provide brief comments on how management's actions in 2021 have improved or worsened the company's liquidity. Provide explanations for assets/liabilities included or excluded from your calculations. (10 marks) (c) Calculate Ryanair's EBITDA and Free Cashflow for the years 2020 and 2021 excluding derivative/hedge/foreign exchange balances (where identified). (5 marks) (d) Using Ryanair's Free Cashflow from (c) calculate the company's debt payback and interest coverage ratios using debt as shown on the balance sheet and ignoring lease and other liability balances. Comment on the resultant calculations. (5 marks) (f) Based on the above analysis, what effect do you believe managements actions to improve liquidity in 2021 have had on the company's ability to repay debt due in the future? (5 marks) Operating revenues Scheduled revenues Ancillary revenues Total operating revenues Operating expenses Depreciation Fuel and oil Staff costs Airport and handling charges Maintenance, materials and repairs Marketing, distribution and other Route charges Aircraft rentals Total operating expenses Operating (loss)/profit Other income/(expense) Finance expense Finance income Foreign exchange gain/(loss) Gain on sale of associate Share of associate losses Total other expenses (Loss)/profit before tax Consolidated Income Statement Tax credit/(expense) (Loss)/profit for the year - all attributable to equity holders of parent Basic (loss)/earnings per ordinary share () Diluted (loss) /earnings per ordinary share () Number of weighted average ordinary shares (in Ms) Number of weighted average diluted shares (in Ms) On behalf of the Board Stan McCarthy Chairman July 23, 2021 Note 18 18 18 2&3 19 21 14 23 23 23 23 2021 CM Michael O'Leary Group CEO Year ended March 31, 2020 EM 1,036.0 599.8 1,635.8 (571.0) (542.6) (472.2) (287.2) (206.7) (201.5) (187.3) (6.7) (2.475.2) (839.4) (297.1) 16.0 11.8 (269.3) (1,108.7) 93.6 (1,015.1) (0.9142) (0.9142) 1,110.4 1,110.4 The accompanying notes are an integral part of the consolidated financial statements. 5,566.2 2,928.6 8,494.8 (748.7) (2,762.2) (1,106.9) (1.140.2) (256.4) (578.8) (736.0) (38.2) (7.367.4) 1,127.4 (480.1) 21.4 1.6 (457.1) 670.3 (21.6) 648.7 0.5824 0.5793 1,113.8 1,119.8 2019 (M 5,261.1 2,436.3 7,697.4 (640.5) (2,427.3) (984.0) (1.061.5) (190.9) (547.3) (745.2) (83.9) (6.680.6) 1,016.8 (59.1) 3.7 (3.5) 6.0 (15.8) (68.7) 948.1 (63.1) 885.0 0.7739 0.7665 1,143.6 1,154.6 Non-current assets Property, plant and equipment Right of use assets Intangible assets Derivative financial instruments Other assets Deferred tax Total non-current assets Current assets Inventories Other assets Current tax Assets held for sale Trade receivables Derivative financial instruments Restricted cash Financial assets: cash >3 months Cash and cash equivalents Total current assets Total assets Current liabilities Provisions Trade payables Accrued expenses and other liabilities Current lease liability Current maturities of debt Current tax Derivative financial instruments Total current liabilities Non-current liabilities Provisions Trade payables Derivative financial instruments Deferred tax Non-current lease liability Non-current maturities of debt Total non-current liabilities Shareholders' equity Issued share capital Share premium account Other undenominated capital Retained earnings Other reserves Shareholders' equity Total liabilities and shareholders' equity Consolidated Balance Sheet On behalf of the Board Stan McCarthy Chairman July 23, 2021 Note 23537 13 14 GEHELEOMM 6 7 14 8 9 13 10 13 13 RINGSHE 15 11 12 3 13 14 13 15 11 13 14 3 13 16 16 17 2021 EM Michael O'Leary Group CEO 8,361.1 188.2 146.4 111.3 48.7 14.0 8.869.7 3.6 179.8 18.6 106.0 34.1 465.5 2.650.7 3,458.3 12.328.0 10.3 336.0 1,274.9 52.5 1,725.9 48.1 79.2 3,526.9 47.4 179.9 6.4 272.4 130.6 3,517.8 4,154.5 6.7 1,161.6 3.5 3,232.3 242.5 4,646.6 12,328.0 The accompanying notes are an integral part of the consolidated financial statements. At March 31, 2020 (M 9,438.0 236.8 146.4 378.5 53.6 10.253.3 3.3 178.7 44.5 98.7 67.5 293.2 34.4 1,207.2 2,566.4 4,493.9 14,747.2 43.3 1,368.2 2,589.4 75.0 382.3 1,050.0 5,508.2 36.6 180.5 353.5 170.9 3,583.0 4.324.5 6.5 738.5 3.5 4,245.0 (79.0) 4,914.5 14,747.2 2019 EM 9,029.6 146.4 227.5 43.2 9,446.7 29 238.0 59.5 308.7 34.9 1.484.4 1,675.6 3,804.0 13,250.7 573.8 2,992.1 309.4 31.6 189.7 4,096.6 135.6 8.0 460.6 3,335.0 3.939.2 6.8 719.4 3.2 4,181.9 303.6 5.214.9 13,250.7 Operating activities (Loss)/profit after tax Adjustments to reconcile profit after tax to net cash provided by operating activities Depreciation (Increase)/decrease in inventories Tax (credit)/expense on (loss)/profit Share-based payments Decrease/(increase) in trade receivables Increase/(decrease) in other assets Decrease/(increase) in trade payables (Decrease)/increase in accrued expenses & other liabilities (Decrease) in other creditors (Decrease) in provisions Decrease/(increase) in finance income (Decrease) in finance expense Gain on sale of associate Share of associate losses Consolidated Statement of Cash Flows Hedge ineffectiveness/foreign exchange Income tax refunded/(paid) Net cash (used in)/provided by operating activities Investing activities Capital expenditure-purchase of property, plant and equipment Supplier reimbursements for property, plant and equipment Proceeds from sale of property, plant and equipment Decrease/(increase) in restricted cash Decrease in financial assets: cash >3 months Acquisition of subsidiary (net of cash acquired) Investment in associate Net cash provided by/(used in) investing activities Financing activities Shareholder returns (net of tax) Net proceeds from shares issued Proceeds from borrowings Repayments of borrowings Lease liabilities paid Net cash provided by/(used in) financing activities Increase in cash and cash equivalents Net foreign exchange differences Cash and cash equivalents at beginning of year Cash and cash equivalents at end of year Note Included in the cash flows from operating activities for the year are the following amounts: Interest income received Interest expense paid 2&3 6 14 19 9 15 14 2 10 13 13 25 13 2021 EM Year ended March 31, 2020 Restated EM (1.015.1) 571.0 (0.3) (93.6) 3.6 48.9 (3.5) (407.6) (1,318.8) (21.9) (3.7) (294.1) 87.1 (2.448.0) (294.7) 377.6 112.1 0.3 741.7 937.0 421.0 2.228.6 (950.3) (76.8) 1,622.5 111.5 (27.2) 2,566.4 2.650.7 *Includes amendments to trade payables and capital expenditure. See note 1 (vi) for further detail 648.7 748.7 (0.4) 21.6 7.0 (8.1) 61.9 15.2 (401.4) (55.7) 2.9 407.2 (120.5) 1,327.1 (578.8) 0.5 277.2 (301.1) (580.5) 19.1 750.0 (408.1) (67.5) (287.0) 739.0 151.8 1,675.6 2.566.4 0.2 (59.2) The accompanying notes are an integral part of the consolidated financial statements. 24.4 (74.3) 2019 Restated EM 885.0 640.5 0.8 63.1 7.7 (1.9) (2.1) 66.0 198.6 (2.8) (2.5) (0.5) (1.5) (6.0) 15.8 (100.9) 1,759.3 (1,288.5) (0.3) 646.1 (86.5) (15.0) (744.2) (531.6) 99.9 (422.8) (854.5) 160.6 1,515.0 1,675.6 3.2 (60.6) Trade receivables Trade receivables Allowance for impairment 10. 2021 CM 18.6 18.6 Trade payables-Current Trade payables - Non-current At March 31, 2020 (M 67.5 All amounts fall due within one year. There has been no change to the allowance for impairment during the year (2020: Enil, 2019: nil). There were no bad debt write-offs in the year (2020: Enil; 2019: Enil). 2021 EM 67.5 At March 31, 2021, 1.0m (2020: 3.3m; 2019: 0.8m) of the total accounts receivable balance were past due, of which nil (2020: Enil; 2019: 0.1m) was impaired and Enil (2020: 3.3m; 2019: 0.6m) was considered past due but not impaired for which the expected credit loss was considered immaterial. Restricted cash 336.0 179.9 515.9 Restricted cash consists of approximately 34m (2020: 34m; 2019: 35m) placed in escrow accounts for certain legal cases and appeals (which accounts for the majority of the balance). 11. Trade payables 2019 EM At March 31, 2020 (M 59.6 (0.1) 59.5 1,368.2 1,368.2 2019 EM 573.8 573.8 During the year ended March 31, 2021, the Group revised its 2014 agreement with Boeing which resulted in a reversal of certain pre-delivery trade payables of 497m. Refer to note 2 to the consolidated financial statements for further details. *in December 2020, the Group revised its 2014 agreement with Boeing to increase its firm orders with Boeing from 135 to 210. The terms of this agreement are confidential, but it sets out a restructured payment schedule over the delivery period from June 2021 to December 2024. This has resulted in a reversal of certain pre-delivery trade payables of approximately 497m and the related amount capitalized into PPE. In addition, the 378m reimbursements related to reasonable, and fair, compensation agreed with Boeing for the 2-year delivery delay of the Boeing 737-8200 aircraft is recorded as a reduction in PPE. 12. Accrued expenses and other liabilities Accruals Indirect tax and duties Unearned revenue (contract liabilities) Contract liabilities comprises: Opening contract liabilities IFRS 15 transition adjustment Revenue deferred during the year Revenue recognized during the year Closing contract liabilities 19. Indirect tax and duties comprise: PAYE (payroll taxes) Other tax (principally air passenger duty in various countries) 2021 EM Flight and cabin crew Sales, Sparations, management and administration Average 887.3 96.7 290.9 1,274.9 2021 EM 546.5 1,248.0 (1,503.6) 290.9 2021 M 2021 11.2 85.5 96.7 At March 31, 2020 EM 1,553.1 499.9 546.5 2.589.4 13,806 1,906 15,702 At March 31, 2020 EM 1,962.3 6,107.2 (7,523.0) 546.5 At March 31, 2020 M 25.3 464.5 489.8 Year ended March 31, 2020 2019 EM 15.653 2,290 17,942 320.8 709.0 Staff numbers and costs The average weekly number of staff, including the Executive Director, during the year, analyzed by category, was as follows: 1,962.3 2,992.1 2019 EM 1.408.3 287.0 6,914.9 (6.647.9) 1.9623 2019 (M 20.1 688.9 709.0 2019 13,911 2,027 15,938 At March 31, 2021 the Company had a team of 15,016 aviation professionals (2020: 17,268, 2019: 16,840). The aggregate payroll costs of these persons were as follows: Staff and related costs Social welfare costs Other pension costs (a) Share based payments (b) 2021 CM 2021. 21. Year ended March 31, 2020 CM 438.4 25.0 5.2 3.6 472.2 (a) Costs in respect of defined-contribution benefit plans and other pension arrangements were 5m in 2021 (2020: 13m; 2019: 9m). Finance expense (b) In the year ended March 31, 2021 the charge in the income statement of 3.6m for share based compensation comprises a charge for the fair value of various share options granted in prior periods, which are being recognized in the income statement in accordance with services rendered. Interest expense Hedge discontinuance and ineffectiveness (see note 13) Government grants and assistance During fiscal year 2021, many European countries in which the Ryanair Group operates made available payroll support schemes. The Group utilized a number of these employment retention schemes to protect jobs within the Group airlines. These schemes were a mix of short term Covid-19 specific programs and long-term schemes linked to social security that existed pre Covid-19. The total amount of payroll supports received by the Group under the various schemes amounted to approximately 84m and are offset against staff costs in the Consolidated Income Statement. 1,039.4 47.5 13.0 7.0 1,106.9 In April 2020, the Group raised 600m unsecured debt for general corporate purposes under the HMT and Bank of England CCFF. The 0.44% interest rate was the prevailing rate for strong BBB rated companies. This debt was subsequently extended in March 2021 for a further 12 months at a 0.46% interest rate. There are no unfulfilled conditions or other contingencies attaching to government assistance at March 31, 2021 EM 2019 (M 929.2 38.5 8.6 7.7 984.0 Year ended March 31, 2020 EM 69.8 227.3 297.1 72.9 407.2 480.1 2019 EM 59.1 59.1 25. Note to cash flow statement The following table outlines the changes in the carrying value of net debt Net debt at beginning of year Changes from financing cashflows Increase in cash and cash equivalents in year, including net foreign exchange differences (Decrease) in financial assets: cash> 3 months Decrease/(increase) in restricted cash Net cash flow from (increase)/decrease in debt Movement in net funds resulting from cash flows Other changes Translation on U.S. dollar denominated debt Adjustment on initial application of IFRS 16 (net of tax) Lease additions Interest expense Movement from other changes Net debt at end of year Analyzed as: Cash and cash equivalents, cash > 3 months and restricted cash Total borrowings* Net debt 2021 Balance at beginning of year Changes from financing cashflows Net proceeds from shares issued Movement in net funds resulting from cash flows Balance at end of year CM (403.2) 84.3 (741.7) (0.3) (1.201.5) (1,859.2) 15.7 (25.2) (4.6) (14.1) (2.276.5) 3,150.3 (5.426.8) (2.276.5) "Total borrowings include current and non-current maturities of debt and current and non-current lease liabilities. The following table outlines the changes in the carrying value of share premium: 2021 M 738.5 423.1 423.1 1,161.6 At March 31, 2020 EM (449.5) 890.8 (277.2) (0.5) (274.4) 338.7 19.7 (140.4) (166.1) (5.6) (292.4) (403.2) 3,808.0 (4.211.2) (403.2) At March 31, 2020 EM 719.4 19.1 19.1 738.5 2019 CM (282.9) 160.6 (646.1) 0.3 322.9 (162.3) (4.3) (4.3) (449.5) 3,194.9 (3.644.4) (449.5) 2019 EM 719.4 719.4 During fiscal year 2021 the Group had cash outflows of Enil relating to the repurchase of ordinary shares (net of stamp duty) (2020: 581m, 2019: 561m), which affected the retained earnings account. Please refer to the Consolidated Statement of Changes in Equity for further detail. The following table outlines the changes in liabilities arising from financing activities: Balance at beginning of year Net cash flow from (increase)/decrease in debt Adjustment on initial application of IFRS 16 (net of tax) Lease additions Interest expense Foreign exchange Balance at end of year Less than one year More than one year 2021 EM (4.211.2) (1,201.5) (25.2) (4.6) 15.7 At March 31, 2020 EM (3,644.4) (274.4) (140.4) (166.1) (5.6) 19.7 (5.426.8) (4,211.2) 2019 EM (3.963.0) 322.9 (4.3) (3.644.4) (1,778.4) (457.3) (309.4) (3,648.4) (3,753.9) (3,335.0) (5.426.8) (4.211.2) (3,644.4)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Key actions taken by Ryanair management to mitigate COVID19 effects Grounded most of fleet from March 2020 to reduce costs retiring some older aircr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started