Answered step by step

Verified Expert Solution

Question

1 Approved Answer

RYBR Inc. is planning to purchase LOB Ltd. This project would require an initial investment of $310 million. RYBR estimates that LOB would provide

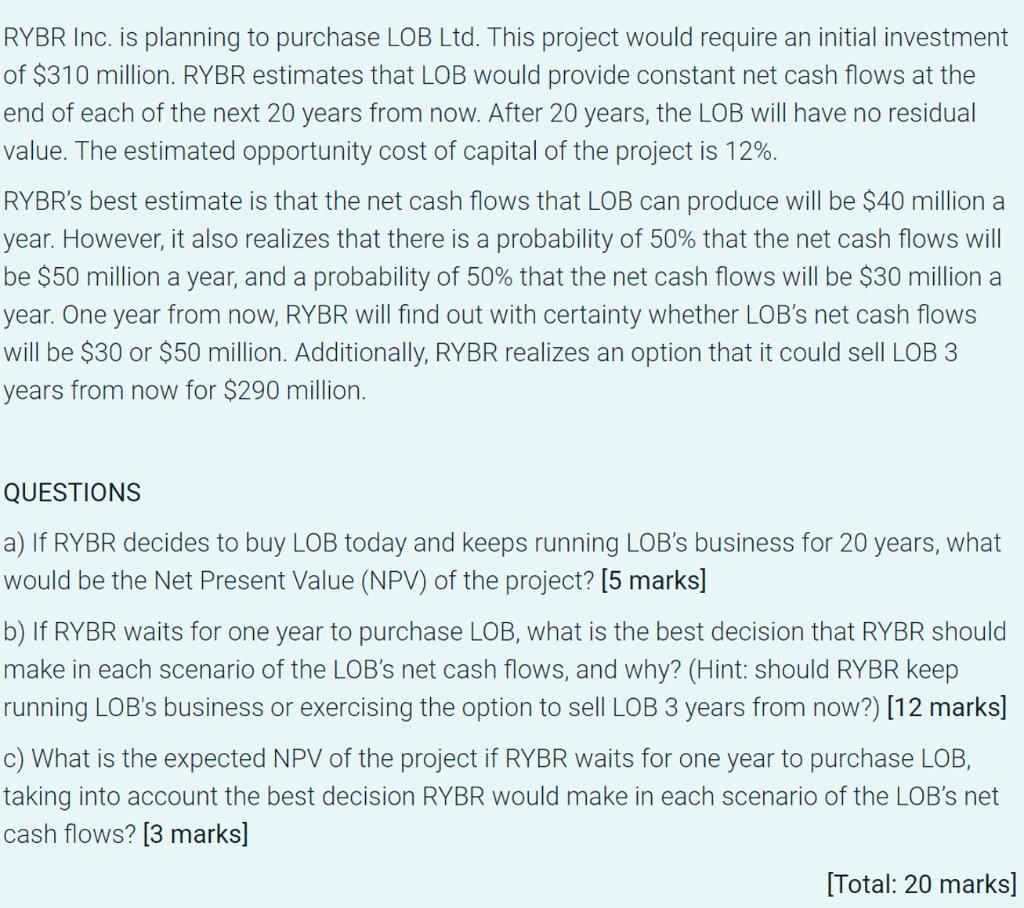

RYBR Inc. is planning to purchase LOB Ltd. This project would require an initial investment of $310 million. RYBR estimates that LOB would provide constant net cash flows at the end of each of the next 20 years from now. After 20 years, the LOB will have no residual value. The estimated opportunity cost of capital of the project is 12%. RYBR's best estimate is that the net cash flows that LOB can produce will be $40 million a year. However, it also realizes that there is a probability of 50% that the net cash flows will be $50 million a year, and a probability of 50% that the net cash flows will be $30 million a year. One year from now, RYBR will find out with certainty whether LOB's net cash flows will be $30 or $50 million. Additionally, RYBR realizes an option that it could sell LOB 3 years from now for $290 million. QUESTIONS a) If RYBR decides to buy LOB today and keeps running LOB's business for 20 years, what would be the Net Present Value (NPV) of the project? [5 marks] b) If RYBR waits for one year to purchase LOB, what is the best decision that RYBR should make in each scenario of the LOB's net cash flows, and why? (Hint: should RYBR keep running LOB's business or exercising the option to sell LOB 3 years from now?) [12 marks] c) What is the expected NPV of the project if RYBR waits for one year to purchase LOB, taking into account the best decision RYBR would make in each scenario of the LOB's net cash flows? [3 marks] [Total: 20 marks]

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started