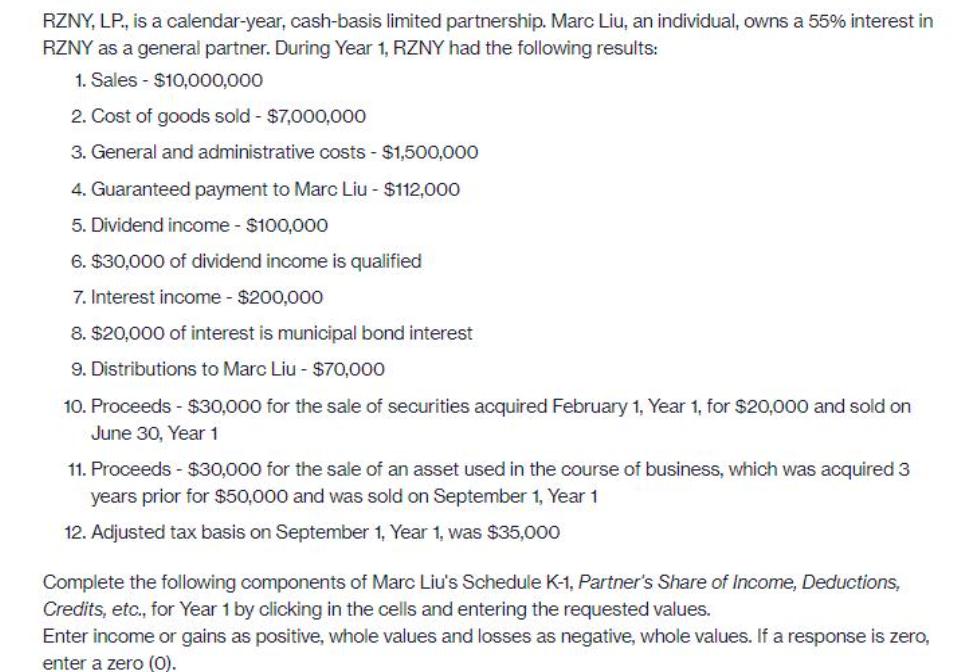

RZNY, LP., is a calendar-year, cash-basis limited partnership. Marc Liu, an individual, owns a 55% interest in RZNY as a general partner. During Year

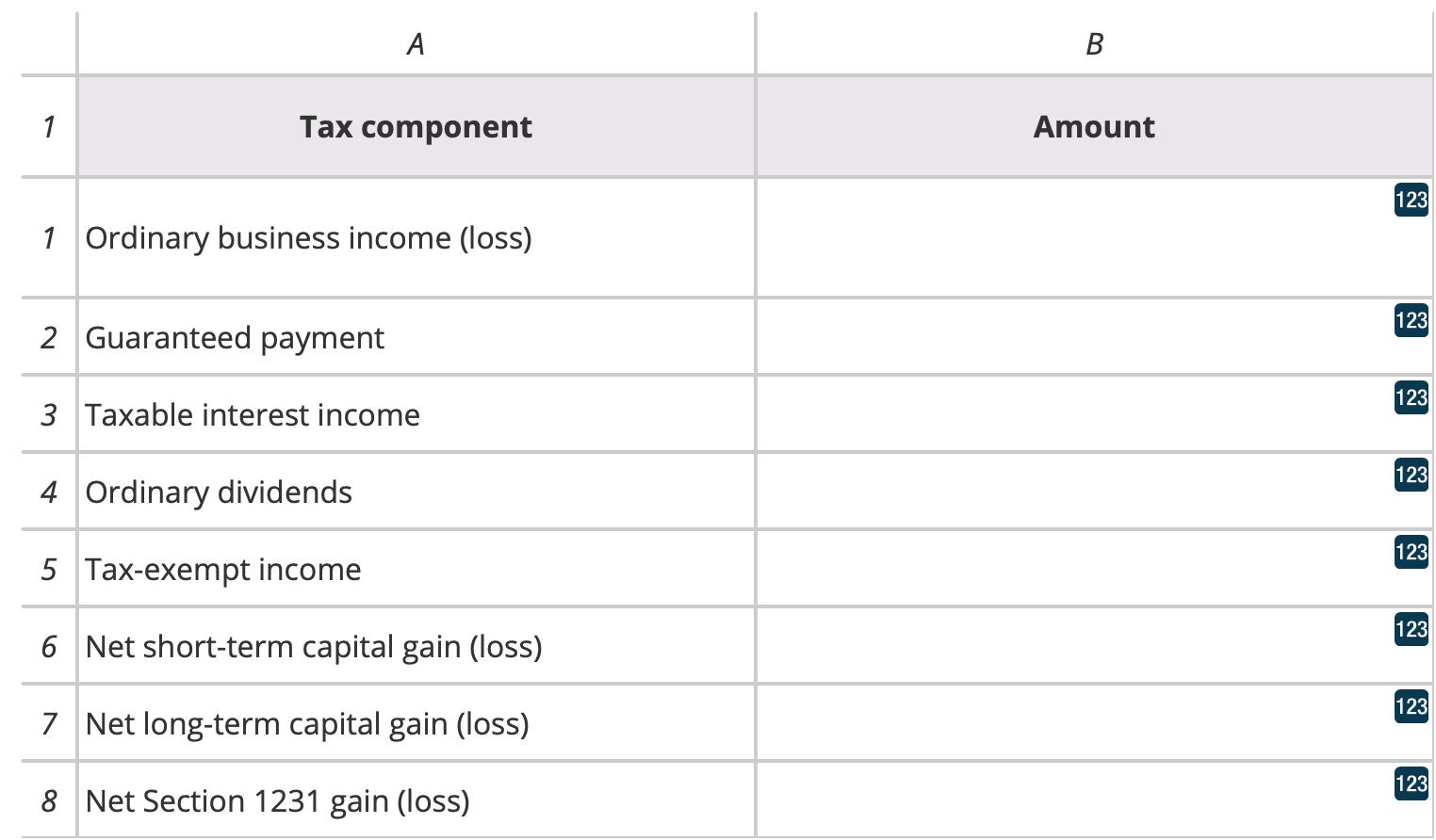

RZNY, LP., is a calendar-year, cash-basis limited partnership. Marc Liu, an individual, owns a 55% interest in RZNY as a general partner. During Year 1, RZNY had the following results: 1. Sales - $10,000,000 2. Cost of goods sold - $7,000,000 3. General and administrative costs - $1,500,000 4. Guaranteed payment to Marc Liu - $112,000 5. Dividend income - $100,000 6. $30,000 of dividend income is qualified 7. Interest income - $200,000 8. $20,000 of interest is municipal bond interest 9. Distributions to Marc Liu - $70,000 10. Proceeds - $30,000 for the sale of securities acquired February 1, Year 1, for $20,000 and sold on June 30, Year 1 11. Proceeds - $30,000 for the sale of an asset used in the course of business, which was acquired 3 years prior for $50,000 and was sold on September 1, Year 1 12. Adjusted tax basis on September 1, Year 1, was $35,000 Complete the following components of Marc Liu's Schedule K-1, Partner's Share of Income, Deductions, Credits, etc., for Year 1 by clicking in the cells and entering the requested values. Enter income or gains as positive, whole values and losses as negative, whole values. If a response is zero, enter a zero (0). A 1 Tax component Amount 123 1 Ordinary business income (loss) 123 2 Guaranteed payment 123 3 Taxable interest income 123 4 Ordinary dividends 123 5 Tax-exempt income 123 6 Net short-term capital gain (loss) 123 7 Net long-term capital gain (loss) 123 8 Net Section 1231 gain (loss)

Step by Step Solution

3.34 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

No Tax Component Amount 1 Ordinary Business income 1388000 1000000070000001500000112000 2 ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started