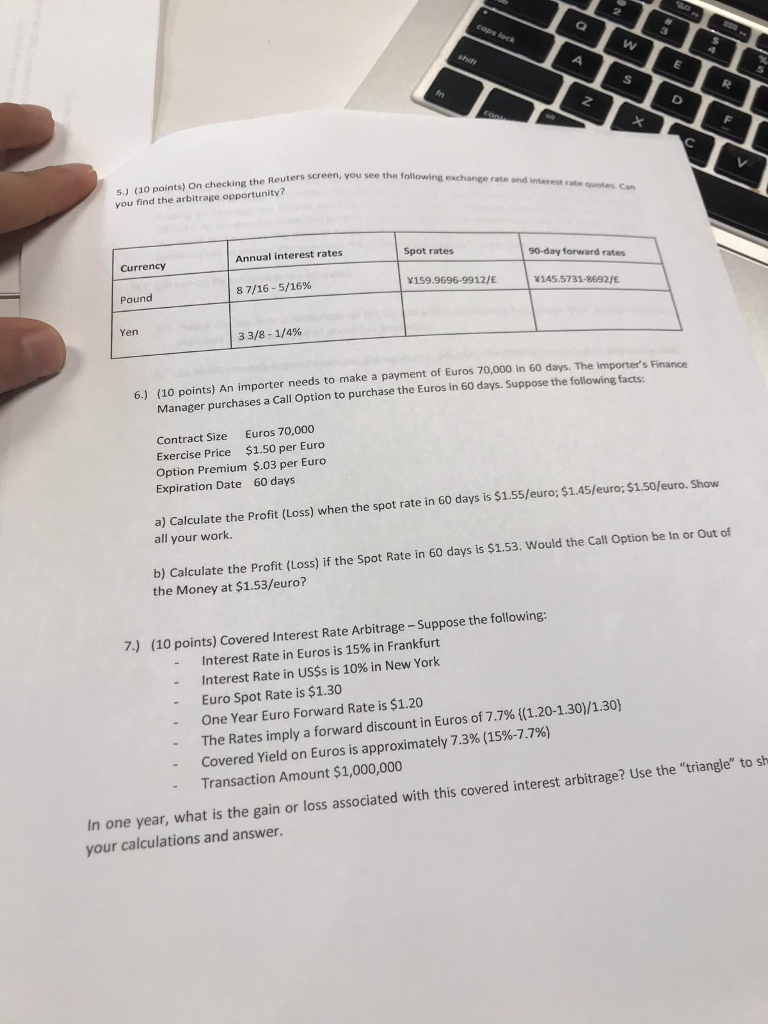

s.) (0 points) On checking you find the arbitrage opportunity? the Reuters screen, you see the following exchange rate and interess screen, you rate quotes Can Currency Annual interest rates Spot rates 90-day forward rates Pound 8 7/16-5/1696 159.9696-9912/E 145.5731-8692/ Yen 33/8-1/4% 6.) (10 points) An importer needs to make a payment of Euros 70,000 in 60 days Finance Manager purchases a Call Option to purchase the Euros in 60 days. Suppose the Contract Size Euros 70,000 Exercise Price $1.50 per Euro Option Premium $.03 per Euro Expiration Date 60 days a) Calculate the Profit (Loss) when the spot rate in 60 days is $1.55/euro; $1.45/euro; $1.50/euro. Show all your work. b) Calculate the Profit (Loss) if the Spot Rate in 60 days is $1.53. Would the Call Option be in or Out of the Money at $1.53/euro? 7.) (10 points) Covered Interest Rate Arbitrage -Suppose the following: -Interest Rate in Euros is 15% in Frankfurt " Interest Rate in US$s is 10% in New York - Euro Spot Rate is $1.30 -One Year Euro Forward Rate is $1.20 The Rates imply a forward discount in Euros of 7.7% {(1.20-1.30/1.30) Covered Yield on Euros is approximately 7.3% (15%-77%) Transaction Amount $1,000,000 In one year, what is the gain or loss associated with this covered interest arbitrage? Use the "triangle" to sh your calculations and answer. s.) (0 points) On checking you find the arbitrage opportunity? the Reuters screen, you see the following exchange rate and interess screen, you rate quotes Can Currency Annual interest rates Spot rates 90-day forward rates Pound 8 7/16-5/1696 159.9696-9912/E 145.5731-8692/ Yen 33/8-1/4% 6.) (10 points) An importer needs to make a payment of Euros 70,000 in 60 days Finance Manager purchases a Call Option to purchase the Euros in 60 days. Suppose the Contract Size Euros 70,000 Exercise Price $1.50 per Euro Option Premium $.03 per Euro Expiration Date 60 days a) Calculate the Profit (Loss) when the spot rate in 60 days is $1.55/euro; $1.45/euro; $1.50/euro. Show all your work. b) Calculate the Profit (Loss) if the Spot Rate in 60 days is $1.53. Would the Call Option be in or Out of the Money at $1.53/euro? 7.) (10 points) Covered Interest Rate Arbitrage -Suppose the following: -Interest Rate in Euros is 15% in Frankfurt " Interest Rate in US$s is 10% in New York - Euro Spot Rate is $1.30 -One Year Euro Forward Rate is $1.20 The Rates imply a forward discount in Euros of 7.7% {(1.20-1.30/1.30) Covered Yield on Euros is approximately 7.3% (15%-77%) Transaction Amount $1,000,000 In one year, what is the gain or loss associated with this covered interest arbitrage? Use the "triangle" to sh your calculations and