Answered step by step

Verified Expert Solution

Question

1 Approved Answer

s) A new device is being purchase for a financial parameters have been estimated: Initial cost Annual savings (AS) Useful life (N) Salvage value (end

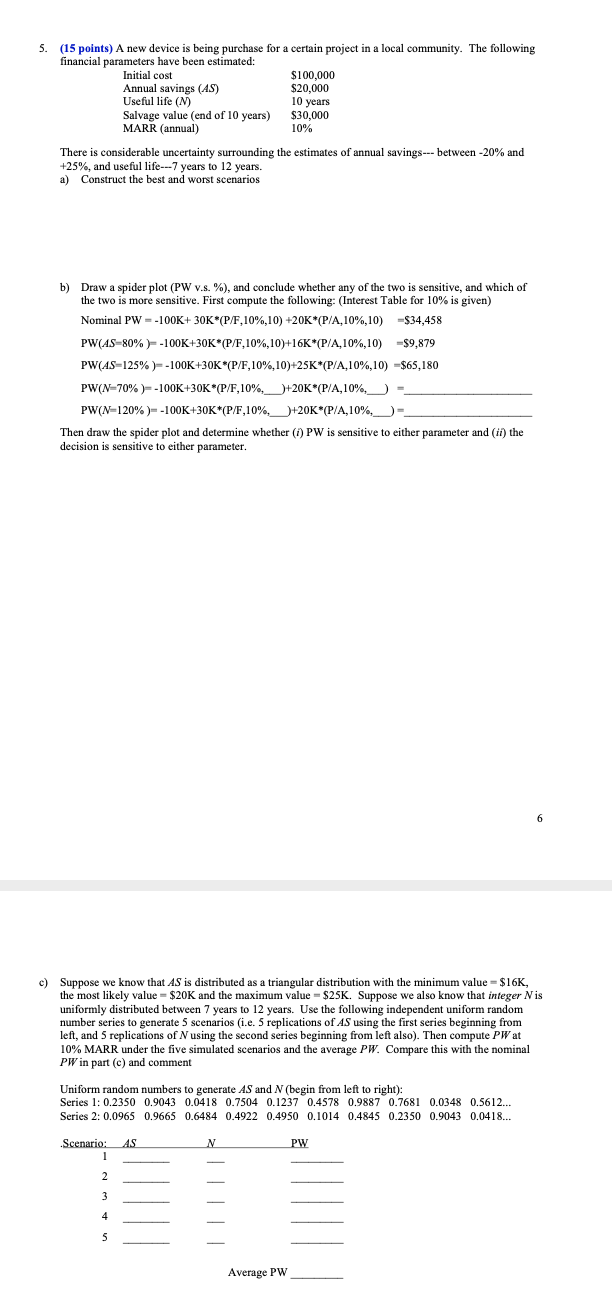

s) A new device is being purchase for a financial parameters have been estimated: Initial cost Annual savings (AS) Useful life (N) Salvage value (end of 10 years) MARR (annual) certain project in a local community. The following $100,000 $20,000 10 years $30,000 10% There is considerable uncertainty surrounding the estimates of annual savings--- between -20% and +25%, and useful life---7 years to 12 years. a) Construct the best and worst scenari

5. (15 points) A new device is being purchase for a certain project in a local community. The following financial parameters have been estimated: Initial cost $100,000 Annual savings (AS) $20,000 Useful life (N) 10 years Salvage value (end of 10 years) $30,000 MARR (annual) 10% There is considerable uncertainty surrounding the estimates of annual savings-between-20% and +25%, and useful life---7 years to 12 years. a) Construct the best and worst scenarios b) Draw a spider plot (PW v.s. %), and conclude whether any of the two is sensitive, and which of the two is more sensitive. First compute the following: (Interest Table for 10% is given) Nominal PW = -100K+ 30K*(P/F,10%, 10) +20K*(P/A, 10%, 10) =$34,458 PW(AS-80%) -100K+30K*(P/F,10%,10)+16K*(P/A,10%,10) -$9,879 PW(AS-125%)--100K+30K*(P/F,10%,10)+25K*(P/A,10%, 10) - $65,180 PW(N=70%)--100K+30K*(P/F,10% )+20K*(P/A,10% ) = PW(N=120%)--100K+30K*(P/F,10% +20K*(P/A, 10%,- Then draw the spider plot and determine whether (i) PW is sensitive to either parameter and (ii) the decision is sensitive to either parameter. c) Suppose we know that AS is distributed as a triangular distribution with the minimum value - $16K, the most likely value=$20K and the maximum value=$25K. Suppose we also know that integer Nis uniformly distributed between 7 years to 12 years. Use the following independent uniform random number series to generate 5 scenarios (i.e. 5 replications of AS using the first series beginning from left, and 5 replications of N using the second series beginning from left also). Then compute PW at 10% MARR under the five simulated scenarios and the average PW. Compare this with the nominal PW in part (c) and comment Uniform random numbers to generate AS and N (begin from left to right): Series 1: 0.2350 0.9043 0.0418 0.7504 0.1237 0.4578 0.9887 0.7681 0.0348 0.5612... Series 2: 0.0965 0.9665 0.6484 0.4922 0.4950 0.1014 0.4845 0.2350 0.9043 0.0418... Scenario: AS PW Average PW 5. (15 points) A new device is being purchase for a certain project in a local community. The following financial parameters have been estimated: Initial cost $100,000 Annual savings (AS) $20,000 Useful life (N) 10 years Salvage value (end of 10 years) $30,000 MARR (annual) 10% There is considerable uncertainty surrounding the estimates of annual savings-between-20% and +25%, and useful life---7 years to 12 years. a) Construct the best and worst scenarios b) Draw a spider plot (PW v.s. %), and conclude whether any of the two is sensitive, and which of the two is more sensitive. First compute the following: (Interest Table for 10% is given) Nominal PW = -100K+ 30K*(P/F,10%, 10) +20K*(P/A, 10%, 10) =$34,458 PW(AS-80%) -100K+30K*(P/F,10%,10)+16K*(P/A,10%,10) -$9,879 PW(AS-125%)--100K+30K*(P/F,10%,10)+25K*(P/A,10%, 10) - $65,180 PW(N=70%)--100K+30K*(P/F,10% )+20K*(P/A,10% ) = PW(N=120%)--100K+30K*(P/F,10% +20K*(P/A, 10%,- Then draw the spider plot and determine whether (i) PW is sensitive to either parameter and (ii) the decision is sensitive to either parameter. c) Suppose we know that AS is distributed as a triangular distribution with the minimum value - $16K, the most likely value=$20K and the maximum value=$25K. Suppose we also know that integer Nis uniformly distributed between 7 years to 12 years. Use the following independent uniform random number series to generate 5 scenarios (i.e. 5 replications of AS using the first series beginning from left, and 5 replications of N using the second series beginning from left also). Then compute PW at 10% MARR under the five simulated scenarios and the average PW. Compare this with the nominal PW in part (c) and comment Uniform random numbers to generate AS and N (begin from left to right): Series 1: 0.2350 0.9043 0.0418 0.7504 0.1237 0.4578 0.9887 0.7681 0.0348 0.5612... Series 2: 0.0965 0.9665 0.6484 0.4922 0.4950 0.1014 0.4845 0.2350 0.9043 0.0418... Scenario: AS PW Average PWStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started