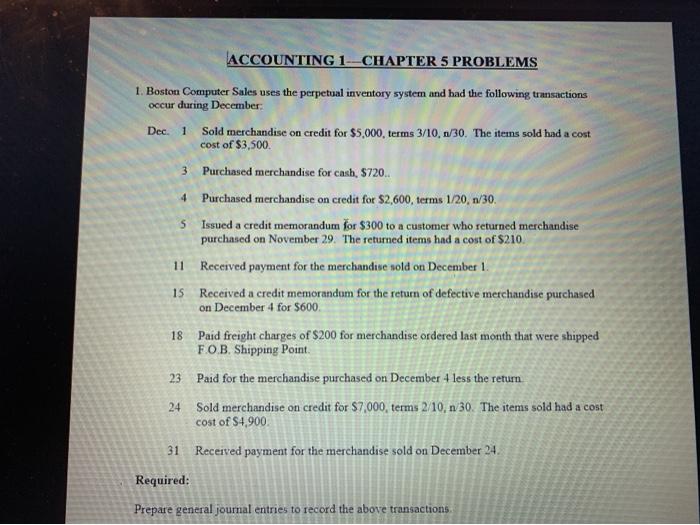

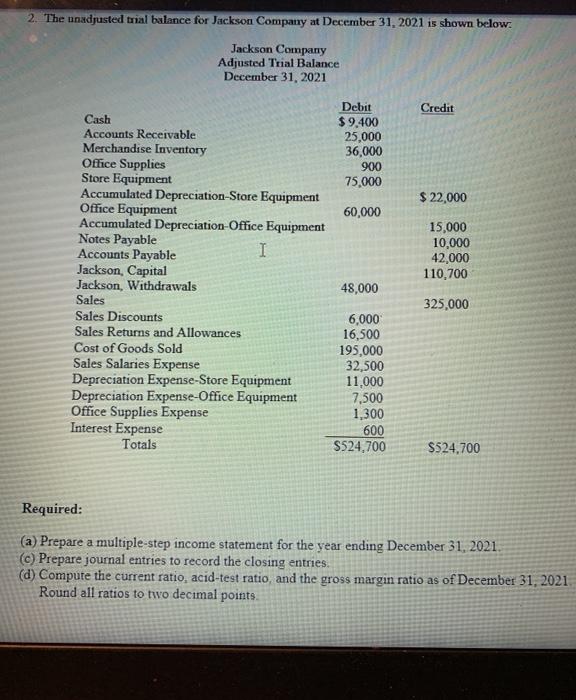

S ACCOUNTING 1--CHAPTER 5 PROBLEMS 1. Boston Computer Sales uses the perpetual inventory system and had the following transactions occur during December Dec. 1 Sold merchandise on credit for $5,000, terms 3/10,6/30. The items sold had a cost cost of $3,500 3 Purchased merchandise for cash, $720.. 4 Purchased merchandise on credit for $2,600, terms 1/20, n/30 Issued a credit memorandum for $300 to a customer who returned merchandise purchased on November 29. The returned items had a cost of $210. 11 Received payment for the merchandise sold on December 1 15 Received a credit memorandum for the return of defective merchandise purchased on December 4 for $600 Paid freight charges of $200 for merchandise ordered last month that were shipped FO.B. Shipping Point 23 Paid for the merchandise purchased on December 4 less the return 24 Sold merchandise on credit for $7,000, terms 2/10, n 30. The items sold had a cost cost of $4,900 18 31 Received payment for the merchandise sold on December 24 Required: Prepare general journal entries to record the above transactions 2. The unadjusted trial balance for Jackson Company at December 31, 2021 is shown below: Jackson Company Adjusted Trial Balance December 31, 2021 Credit Debit $9.400 25,000 36,000 900 75,000 $ 22,000 60,000 15,000 10,000 42,000 110,700 Cash Accounts Receivable Merchandise Inventory Office Supplies Store Equipment Accumulated Depreciation Store Equipment Office Equipment Accumulated Depreciation Office Equipment Notes Payable Accounts Payable I Jackson Capital Jackson, Withdrawals Sales Sales Discounts Sales Returns and Allowances Cost of Goods Sold Sales Salaries Expense Depreciation Expense-Store Equipment Depreciation Expense-Office Equipment Office Supplies Expense Interest Expense Totals 48,000 325,000 6,000 16,500 195,000 32,500 11,000 7,500 1,300 600 S524,700 $524,700 Required: (a) Prepare a multiple-step income statement for the year ending December 31, 2021 (c) Prepare journal entries to record the closing entries (d) Compute the current ratio, acid-test ratio, and the gross margin ratio as of December 31, 2021 Round all ratios to two decimal points