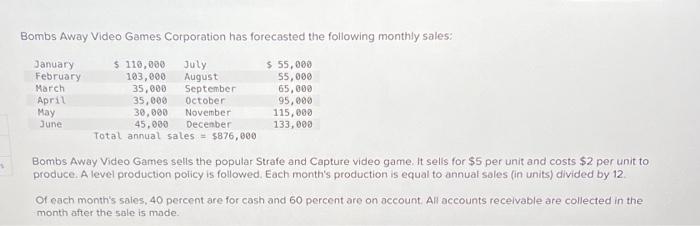

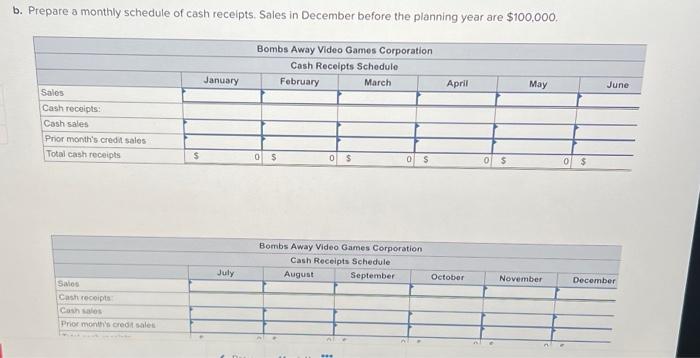

S Bombs Away Video Games Corporation has forecasted the following monthly sales: $ 110,000 July 103,000 August 35,000 September 35,000 October 30,000 November 45,000 December Total annual sales = $876,000 January February March April May June $ 55,000 55,000 65,000 95,000 115,000 133,000 Bombs Away Video Games sells the popular Strafe and Capture video game. It sells for $5 per unit and costs $2 per unit to produce. A level production policy is followed. Each month's production is equal to annual sales (in units) divided by 12. Of each month's sales, 40 percent are for cash and 60 percent are on account. All accounts receivable are collected in the month after the sale is made.

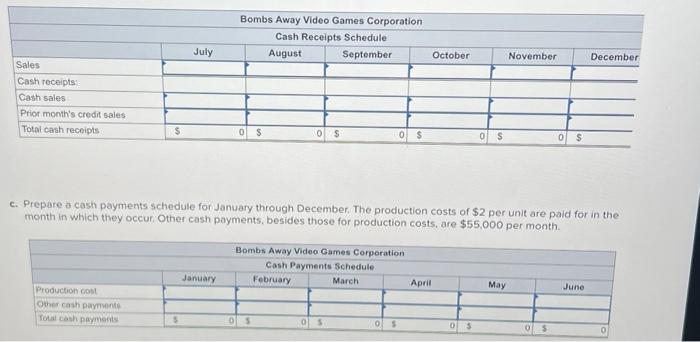

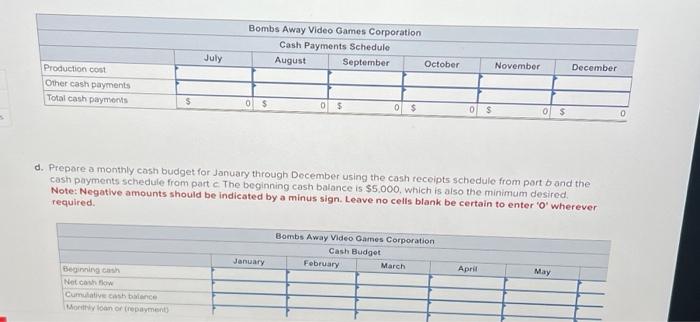

Prepare a monthly schedule of cash receipts. Sales in December before the planning year are $100,000. Prepare a monthly cash budget for January through December using the cash receipts schedule from part b and the cash payments schedule from part c. The beginning cash balance is $5,000, which is also the minimum desired. Note: Negative amounts should be indicated by a minus sign, teave no cells blank be certain to enter 'O' wherever required. Bombs Away Video Games Corporation has forecasted the following monthly sales: Bombs Away Video Games sells the popular Strafe and Capture video game. It sells for $5 per unit and costs $2 per unit to produce. A level production policy is followed. Each month's production is equal to annual soles (in units) divided by 12. Of each month's sales, 40 percent are for cash and 60 percent are on account. All accounts recelvable are collected in the month after the sale is made. Cumulative cash balance Monthly loan or (repayment) Ending cash balance Cumulative loan balance \begin{tabular}{|c|c|c|c|c|c|c|} \hline \multicolumn{7}{|c|}{ Bombs Away Video Games Corporation } \\ \hline \multicolumn{7}{|c|}{ Cash Budget } \\ \hline & July & August & September & October & November & Dec \\ \hline \multicolumn{7}{|l|}{\begin{tabular}{l} Beginning cash \\ Netcash fow \end{tabular}} \\ \hline \multicolumn{7}{|l|}{\begin{tabular}{l} Netcash fow \\ Cumulative cesh balance \end{tabular}} \\ \hline \multicolumn{7}{|l|}{\begin{tabular}{l} Cumviative cesh balance \\ Montvily loan of (reparyment \end{tabular}} \\ \hline \multicolumn{7}{|l|}{\begin{tabular}{l} Montivy loan of (repayment) \\ Enditg cash balance \end{tabular}} \\ \hline \multicolumn{7}{|l|}{\begin{tabular}{l} Ending cash balance \\ Cumuiature ion bolance \end{tabular}} \\ \hline Cumuiature ioan bolance & & & & & & \\ \hline \end{tabular} Cumulative cash balance Monthly loan or (repayment) Ending cash balance Cumulative loan balance \begin{tabular}{|c|c|c|c|c|c|c|} \hline \multicolumn{7}{|c|}{ Bombs Away Video Games Corporation } \\ \hline \multicolumn{7}{|c|}{ Cash Budget } \\ \hline & July & August & September & October & November & Dec \\ \hline \multicolumn{7}{|l|}{\begin{tabular}{l} Beginning cash \\ Netcash fow \end{tabular}} \\ \hline \multicolumn{7}{|l|}{\begin{tabular}{l} Netcash fow \\ Cumulative cesh balance \end{tabular}} \\ \hline \multicolumn{7}{|l|}{\begin{tabular}{l} Cumviative cesh balance \\ Montvily loan of (reparyment \end{tabular}} \\ \hline \multicolumn{7}{|l|}{\begin{tabular}{l} Montivy loan of (repayment) \\ Enditg cash balance \end{tabular}} \\ \hline \multicolumn{7}{|l|}{\begin{tabular}{l} Ending cash balance \\ Cumuiature ion bolance \end{tabular}} \\ \hline Cumuiature ioan bolance & & & & & & \\ \hline \end{tabular} Prepare a cash payments schedule for January through December. The production costs of $2 per unit are paid for in the month in which they occur, Other cosh payments, besides those for production costs, are $55,000 per month