Answered step by step

Verified Expert Solution

Question

1 Approved Answer

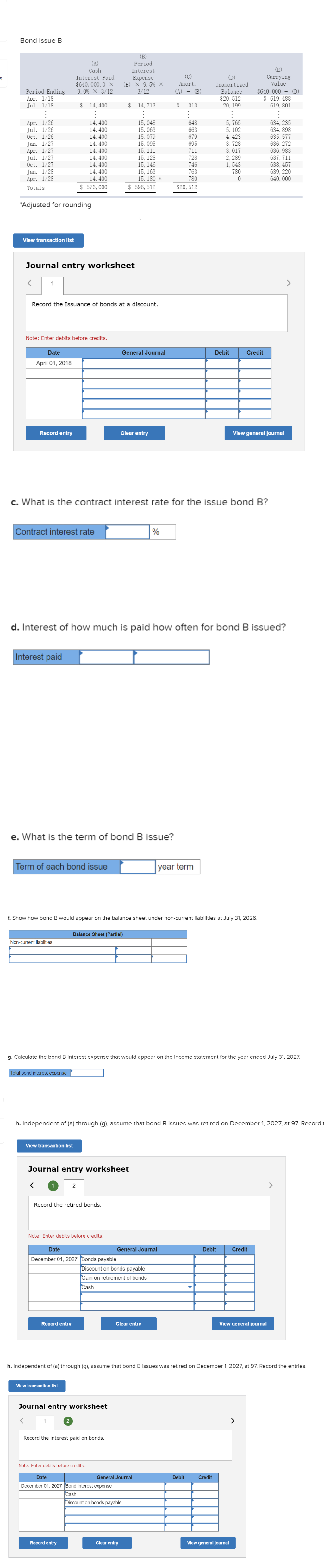

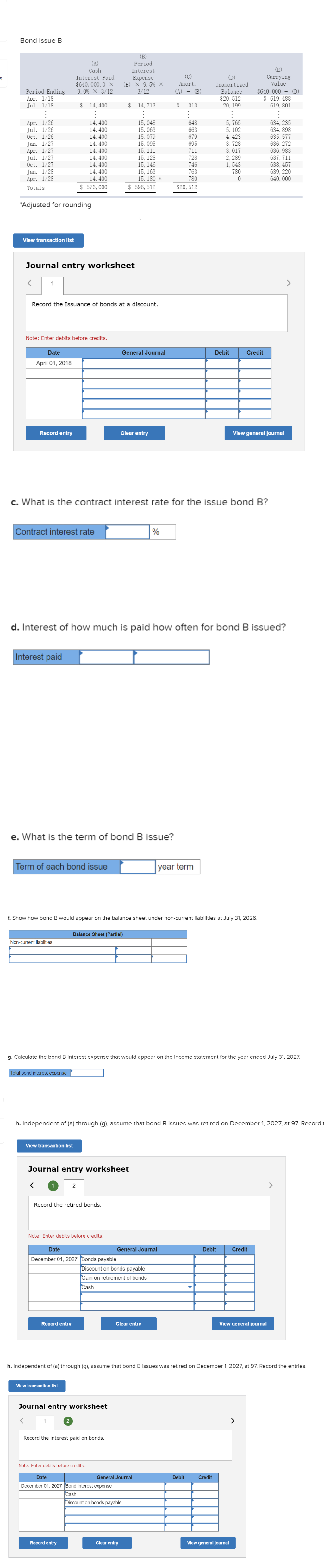

Record the issuance of bonds at a discount. s Bond Issue B (A) Cash (B) Period Interest Interest Paid Expense Period Ending $640,000.0 x 9.0%

Record the issuance of bonds at a discount.

s Bond Issue B (A) Cash (B) Period Interest Interest Paid Expense Period Ending $640,000.0 x 9.0% 3/12 (E) X9.5% x (C) Amort. 3/12 (A) - (B) Apr. 1/18 (D) Unamortized Balance $20, 512 (E) Carrying Value $640,000 - (D) $ 619, 488 Jul. 1/18 $ 14,400 $ 14, 713 $ 313 20, 199 619, 801 : Apr. 1/26 14,400 15, 048 648 5, 765 634, 235 Jul. 1/26 14,400 15,063 663 5, 102 634, 898 Oct. 1/26 14, 400 15,079 679 4,423 635, 577 Jan. 1/27 14,400 15,095 695 3,728 636, 272 Apr. 1/27 14,400 15, 111 711 3, 017 636, 983 Jul. 1/27 14,400 15, 128 728 2,289 637, 711 Oct. 1/27 14,400 15, 146 746 1,543 638, 457 Jan. 1/28 14,400 15, 163 763 780 639, 220 Apr. 1/28 14,400 15, 180* 780 0 640,000 Totals $ 576,000 $ 596, 512 $20,512 *Adjusted for rounding View transaction list Journal entry worksheet 1 Record the Issuance of bonds at a discount. Note: Enter debits before credits. Date April 01, 2018 General Journal Debit Credit View general journal Record entry Clear entry c. What is the contract interest rate for the issue bond B? Contract interest rate % d. Interest of how much is paid how often for bond B issued? Interest paid e. What is the term of bond B issue? Term of each bond issue year term f. Show how bond B would appear on the balance sheet under non-current liabilities at July 31, 2026. Non-current liablities Balance Sheet (Partial) > g. Calculate the bond B interest expense that would appear on the income statement for the year ended July 31, 2027. Total bond interest expense h. Independent of (a) through (g), assume that bond B issues was retired on December 1, 2027, at 97. Record t View transaction list Journal entry worksheet 2 Record the retired bonds. Note: Enter debits before credits. Date General Journal Debit Credit December 01, 2027 Bonds payable Discount on bonds payable Gain on retirement of bonds Cash Record entry Clear entry View general journal > h. Independent of (a) through (g), assume that bond B issues was retired on December 1, 2027, at 97. Record the entries. View transaction list Journal entry worksheet < 1 2 Record the interest paid on bonds. Note: Enter debits before credits. Date December 01, 2027 Bond interest expense General Journal Debit Credit Cash Discount on bonds payable Record entry Clear entry View general journal >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started