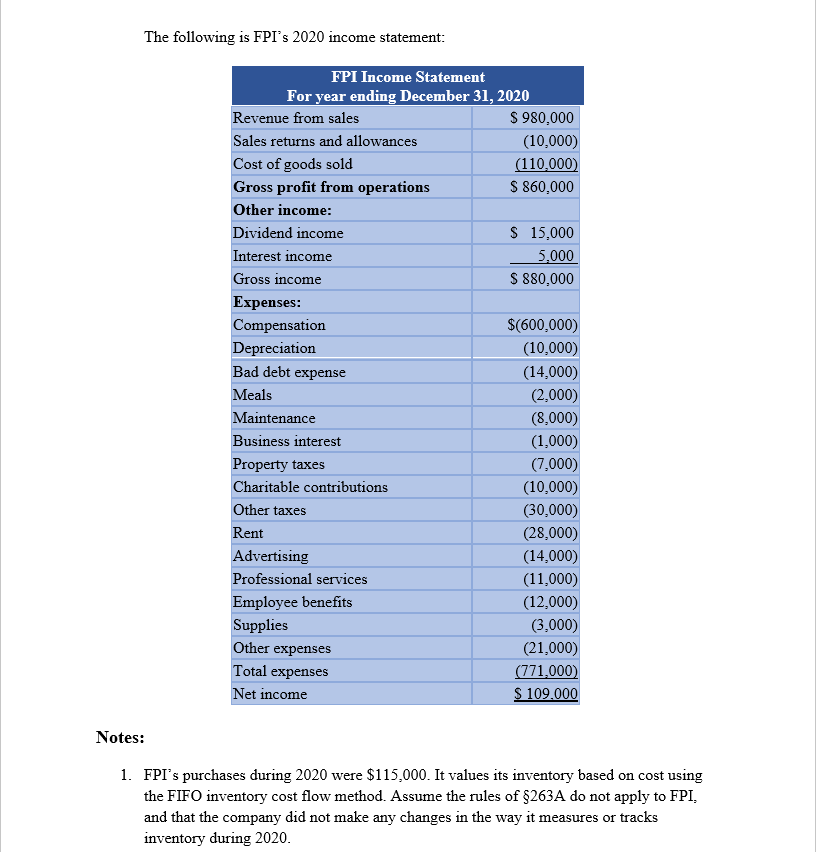

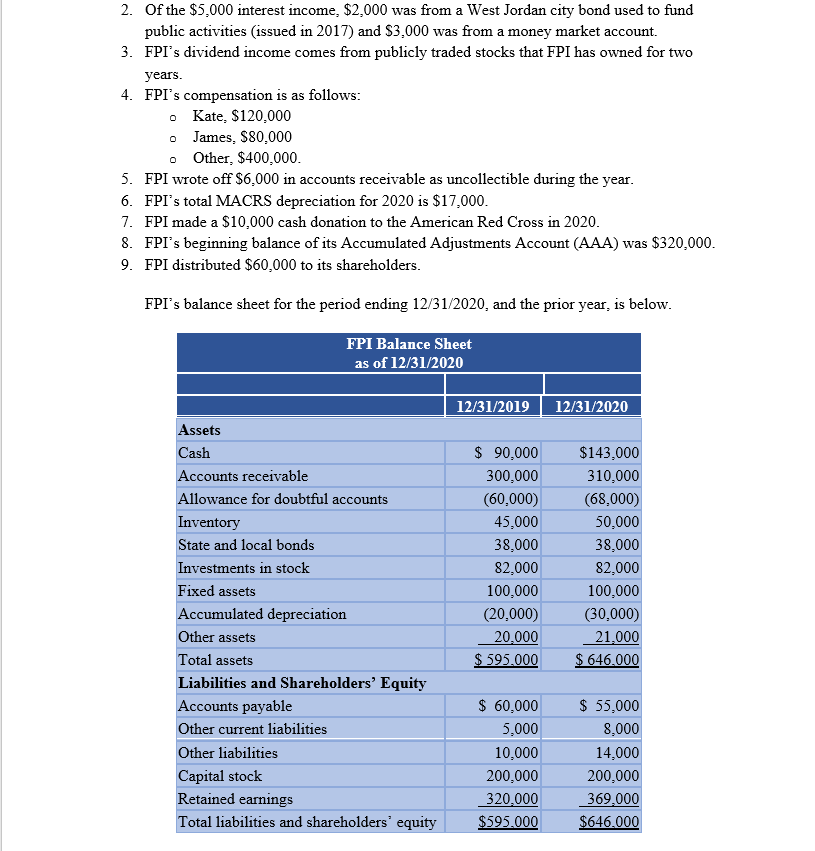

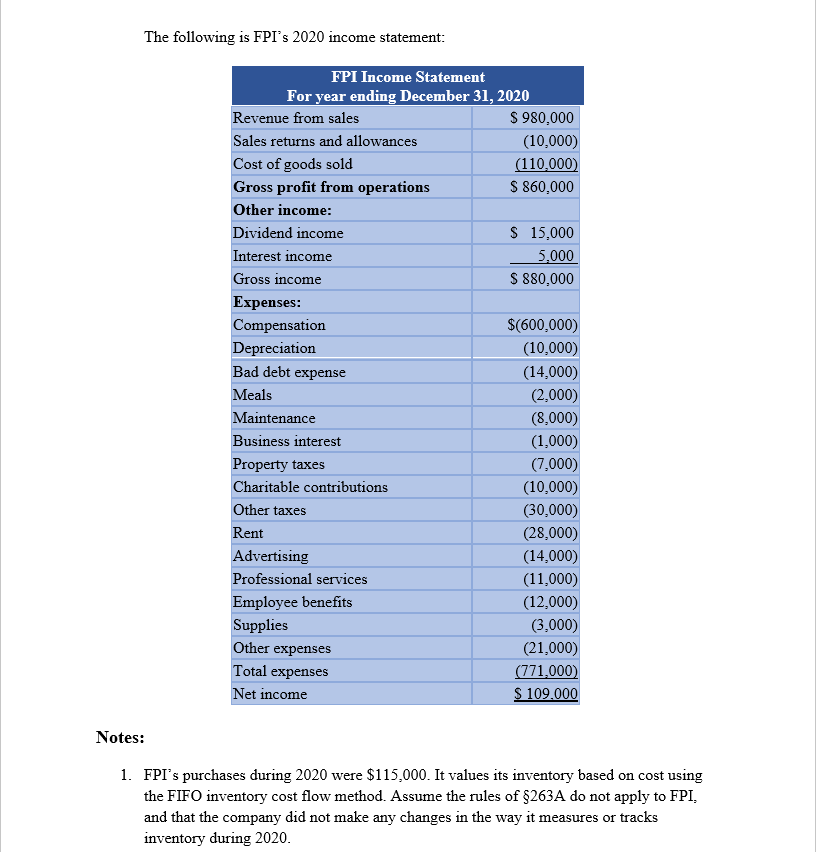

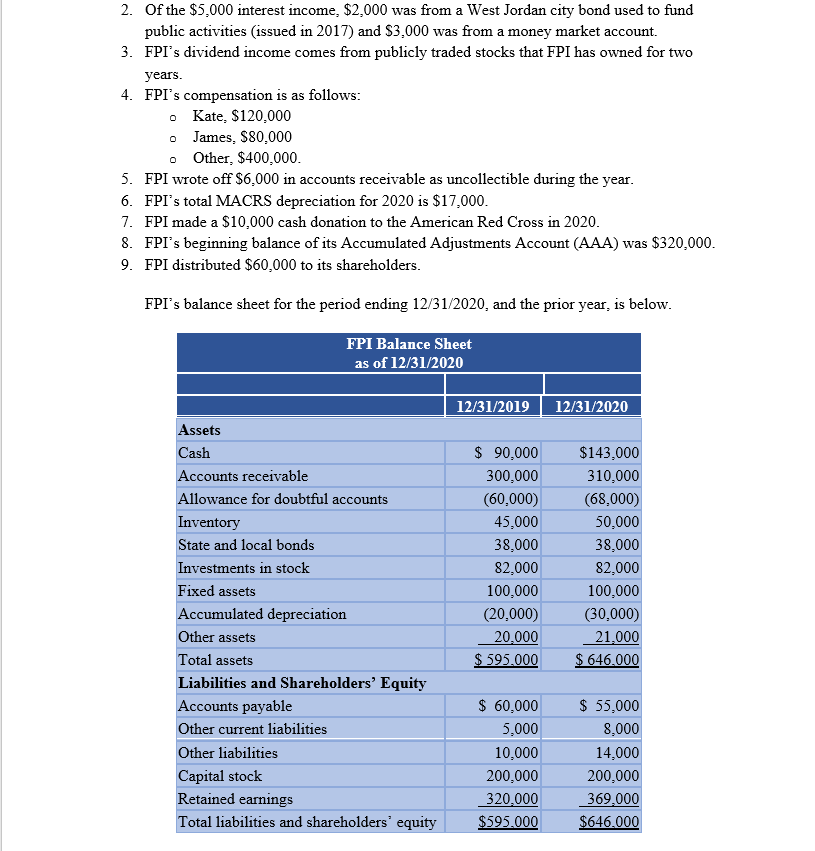

S Corporation Tax Return Problem Required: Using the information provided below, complete First Place Inc.'s (FPI) 2020 Form 1120S. Also complete Kate Kleiber's Schedule K-1 and the forms 1125-A and 1125-E. Form 4562 for depreciation is not required. Include the amount of tax depreciation given in the problem on the appropriate line on the first page of Form 1120S. If any information is missing, use reasonable assumptions to fill in the gaps. The forms, schedules, and instructions can be found at the IRS website (www.irs.gov). The instructions can be helpful in completing the forms. Facts: First Place Inc. (FPI) was formed as a corporation on January 5, 2017, by its two owners Kate Kleiber and James Chandler. FPI immediately elected to be taxed as an S corporation for federal income tax purposes. FPI sells mountain climbing gear to retailers throughout the Rocky Mountain region. Kate owns 70 percent of the FPI common stock (the only class of stock outstanding) and James owns 30 percent, and both devote 100% of their working time to FPI. . . FPI is located at 4200 West 400 North, Salt Lake City, Utah 84116. FPI's Employer Identification Number is 87-5467544. FPI's business activity is wholesale sales. Its business activity code is 423910. Both shareholders work as employees of the corporation. Kate is the president of FPI (Social Security number 312-89-4567). Kate's address is 1842 East 8400 South Sandy, Utah 84094. James is the vice president of FPI (Social Security number 321-98-7645). James's address is 2002 East 8145 South Sandy, Utah 84094. FPI uses the accrual method of accounting and has a calendar year-end. . The following is FPI's 2020 income statement: FPI Income Statement For year ending December 31, 2020 Revenue from sales S 980,000 Sales returns and allowances (10,000) Cost of goods sold (110,000) Gross profit from operations $ 860,000 Other income: Dividend income $ 15,000 Interest income 5.000 Gross income $ 880,000 Expenses: Compensation $(600,000) Depreciation (10,000) Bad debt expense (14,000) Meals (2.000) Maintenance (8,000) Business interest (1,000) Property taxes (7,000) Charitable contributions (10,000) Other taxes (30,000) Rent (28,000) Advertising (14,000) Professional services (11,000) Employee benefits (12,000) Supplies (3,000) Other expenses (21,000) Total expenses (771,000) Net income $ 109,000 Notes: 1. FPI's purchases during 2020 were $115,000. It values its inventory based on cost using the FIFO inventory cost flow method. Assume the rules of $263A do not apply to FPI. and that the company did not make any changes in the way it measures or tracks inventory during 2020. 2. Of the $5,000 interest income, $2,000 was from a West Jordan city bond used to fund public activities (issued in 2017) and $3,000 was from a money market account. 3. FPI's dividend income comes from publicly traded stocks that FPI has owned for two years. 4. FPI's compensation is as follows: o Kate, $120,000 o James, $80,000 o Other, $400,000. 5. FPI wrote off $6,000 in accounts receivable as uncollectible during the year. 6. FPI's total MACRS depreciation for 2020 is $17,000. 7. FPI made a $10,000 cash donation to the American Red Cross in 2020. 8. FPI's beginning balance of its Accumulated Adjustments Account (AAA) was $320,000. 9. FPI distributed $60,000 to its shareholders. FPI's balance sheet for the period ending 12/31/2020, and the prior year, is below. FPI Balance Sheet as of 12/31/2020 12/31/2019 12/31/2020 Assets Cash Accounts receivable Allowance for doubtful accounts Inventory State and local bonds Investments in stock Fixed assets Accumulated depreciation Other assets Total assets Liabilities and Shareholders' Equity Accounts payable Other current liabilities Other liabilities Capital stock Retained earnings Total liabilities and shareholders' equity $ 90,000 300,000 (60,000) 45,000 38,000 82,000 100,000 (20,000) 20.000 $ 595.000 $143,000 310,000 (68,000) 50,000 38,000 82,000 100,000 (30,000) 21,000 $646.000 $ 60,000 5,000 10,000 200,000 320,000 $595.000 $ 55,000 8,000 14,000 200,000 369.000 $646.000 S Corporation Tax Return Problem Required: Using the information provided below, complete First Place Inc.'s (FPI) 2020 Form 1120S. Also complete Kate Kleiber's Schedule K-1 and the forms 1125-A and 1125-E. Form 4562 for depreciation is not required. Include the amount of tax depreciation given in the problem on the appropriate line on the first page of Form 1120S. If any information is missing, use reasonable assumptions to fill in the gaps. The forms, schedules, and instructions can be found at the IRS website (www.irs.gov). The instructions can be helpful in completing the forms. Facts: First Place Inc. (FPI) was formed as a corporation on January 5, 2017, by its two owners Kate Kleiber and James Chandler. FPI immediately elected to be taxed as an S corporation for federal income tax purposes. FPI sells mountain climbing gear to retailers throughout the Rocky Mountain region. Kate owns 70 percent of the FPI common stock (the only class of stock outstanding) and James owns 30 percent, and both devote 100% of their working time to FPI. . . FPI is located at 4200 West 400 North, Salt Lake City, Utah 84116. FPI's Employer Identification Number is 87-5467544. FPI's business activity is wholesale sales. Its business activity code is 423910. Both shareholders work as employees of the corporation. Kate is the president of FPI (Social Security number 312-89-4567). Kate's address is 1842 East 8400 South Sandy, Utah 84094. James is the vice president of FPI (Social Security number 321-98-7645). James's address is 2002 East 8145 South Sandy, Utah 84094. FPI uses the accrual method of accounting and has a calendar year-end. . The following is FPI's 2020 income statement: FPI Income Statement For year ending December 31, 2020 Revenue from sales S 980,000 Sales returns and allowances (10,000) Cost of goods sold (110,000) Gross profit from operations $ 860,000 Other income: Dividend income $ 15,000 Interest income 5.000 Gross income $ 880,000 Expenses: Compensation $(600,000) Depreciation (10,000) Bad debt expense (14,000) Meals (2.000) Maintenance (8,000) Business interest (1,000) Property taxes (7,000) Charitable contributions (10,000) Other taxes (30,000) Rent (28,000) Advertising (14,000) Professional services (11,000) Employee benefits (12,000) Supplies (3,000) Other expenses (21,000) Total expenses (771,000) Net income $ 109,000 Notes: 1. FPI's purchases during 2020 were $115,000. It values its inventory based on cost using the FIFO inventory cost flow method. Assume the rules of $263A do not apply to FPI. and that the company did not make any changes in the way it measures or tracks inventory during 2020. 2. Of the $5,000 interest income, $2,000 was from a West Jordan city bond used to fund public activities (issued in 2017) and $3,000 was from a money market account. 3. FPI's dividend income comes from publicly traded stocks that FPI has owned for two years. 4. FPI's compensation is as follows: o Kate, $120,000 o James, $80,000 o Other, $400,000. 5. FPI wrote off $6,000 in accounts receivable as uncollectible during the year. 6. FPI's total MACRS depreciation for 2020 is $17,000. 7. FPI made a $10,000 cash donation to the American Red Cross in 2020. 8. FPI's beginning balance of its Accumulated Adjustments Account (AAA) was $320,000. 9. FPI distributed $60,000 to its shareholders. FPI's balance sheet for the period ending 12/31/2020, and the prior year, is below. FPI Balance Sheet as of 12/31/2020 12/31/2019 12/31/2020 Assets Cash Accounts receivable Allowance for doubtful accounts Inventory State and local bonds Investments in stock Fixed assets Accumulated depreciation Other assets Total assets Liabilities and Shareholders' Equity Accounts payable Other current liabilities Other liabilities Capital stock Retained earnings Total liabilities and shareholders' equity $ 90,000 300,000 (60,000) 45,000 38,000 82,000 100,000 (20,000) 20.000 $ 595.000 $143,000 310,000 (68,000) 50,000 38,000 82,000 100,000 (30,000) 21,000 $646.000 $ 60,000 5,000 10,000 200,000 320,000 $595.000 $ 55,000 8,000 14,000 200,000 369.000 $646.000