Question: S corporations are often used as the entity type for many small businesses. However, there are certain requirements that must be met to be an

S corporations are often used as the entity type for many small businesses. However, there are certain requirements that must be met to be an S corporation. This discussion explores one of these requirements.

Action Items

- CCS is an S corporation. Read the ethics problem in Chapter 22 in the textbook.

- Research the impact of using the RIA checkpoint.

- Answer the three questions in the ethics box. Provide support, with proper citations, for your response.

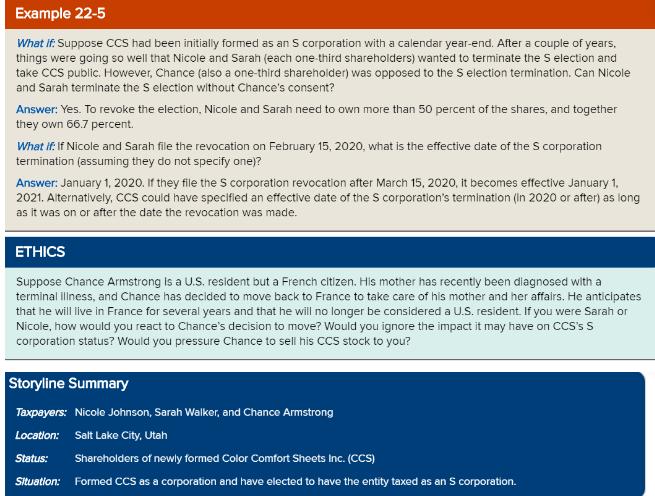

Example 22-5 What If: Suppose CCS had been initially formed as an S corporation with a calendar year-end. After a couple of years, things were going so well that Nicole and Sarah (each one-third shareholders) wanted to terminate the S election and take CCS public. However, Chance (also a one-third shareholder) was opposed to the S election termination. Can Nicole and Sarah terminate the S election without Chance's consent? Answer: Yes. To revoke the election, Nicole and Sarah need to own more than 50 percent of the shares, and together they own 66.7 percent. What if: If Nicole and Sarah file the revocation on February 15, 2020, what is the effective date of the S corporation termination (assuming they do not specify one)? Answer: January 1, 2020. If they file the 5 corporation revocation after March 15, 2020, it becomes effective January 1, 2021. Alternatively, CCS could have specified an effective date of the S corporation's termination (In 2020 or after) as long as it was on or after the date the revocation was made. ETHICS Suppose Chance Armstrong is a U.S. resident but a French citizen. His mother has recently been diagnosed with a terminal illness, and Chance has decided to move back to France to take care of his mother and her affairs. He anticipates that he will live in France for several years and that he will no longer be considered a U.S. resident. If you were Sarah or Nicole, how would you react to Chance's decision to move? Would you ignore the impact it may have on CCS's S corporation status? Would you pressure Chance to sell his CCS stock to you? Storyline Summary Taxpayers: Nicole Johnson, Sarah Walker, and Chance Armstrong Location: Salt Lake City, Utah Status: Situation: Shareholders of newly formed Color Comfort Sheets Inc. (CCS) Formed CCS as a corporation and have elected to have the entity taxed as an S corporation.

Step by Step Solution

There are 3 Steps involved in it

I can provide you with a general understanding of the scenario and offer assistance in addressing the ethical questions presented In the scenario Nico... View full answer

Get step-by-step solutions from verified subject matter experts