Question

Assume that two firms issue bonds with the following char- acteristics. ABC Bonds are trading at premium with a coupon rate of 6%, while

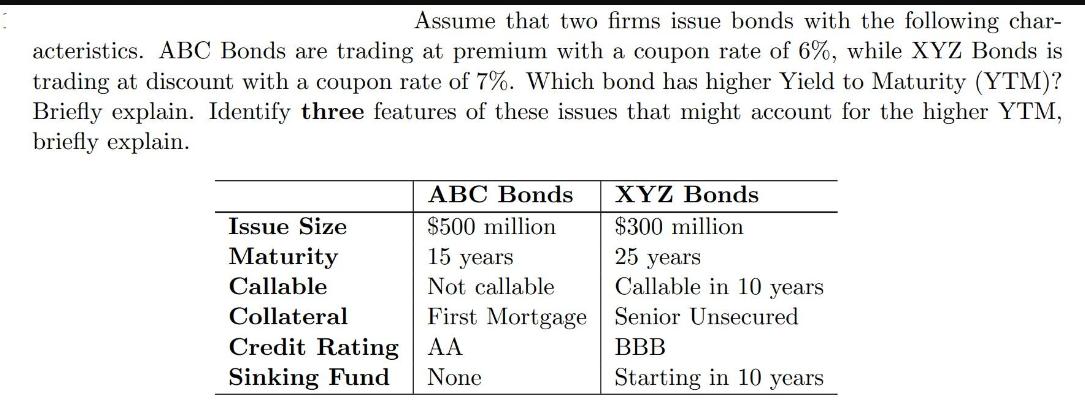

Assume that two firms issue bonds with the following char- acteristics. ABC Bonds are trading at premium with a coupon rate of 6%, while XYZ Bonds is trading at discount with a coupon rate of 7%. Which bond has higher Yield to Maturity (YTM)? Briefly explain. Identify three features of these issues that might account for the higher YTM, briefly explain. Issue Size Maturity Callable Collateral Credit Rating Sinking Fund ABC Bonds $500 million 15 years Not callable First Mortgage AA None XYZ Bonds $300 million 25 years Callable in 10 years Senior Unsecured BBB Starting in 10 years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Discounts vs premiums Bonds are usually issued at will and their prices can fluctuate in the seconda...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Cost Accounting A Managerial Emphasis

Authors: Charles T. Horngren, Srikant M. Datar, Madhav V. Rajan

15th edition

978-0133428858, 133428850, 133428702, 978-0133428704

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App