Question

s) Paterson Inc. used $43,494,000 of its accounts receivable as collateral on a $32,600,000 loan. The interest rate on the loan was only 6%

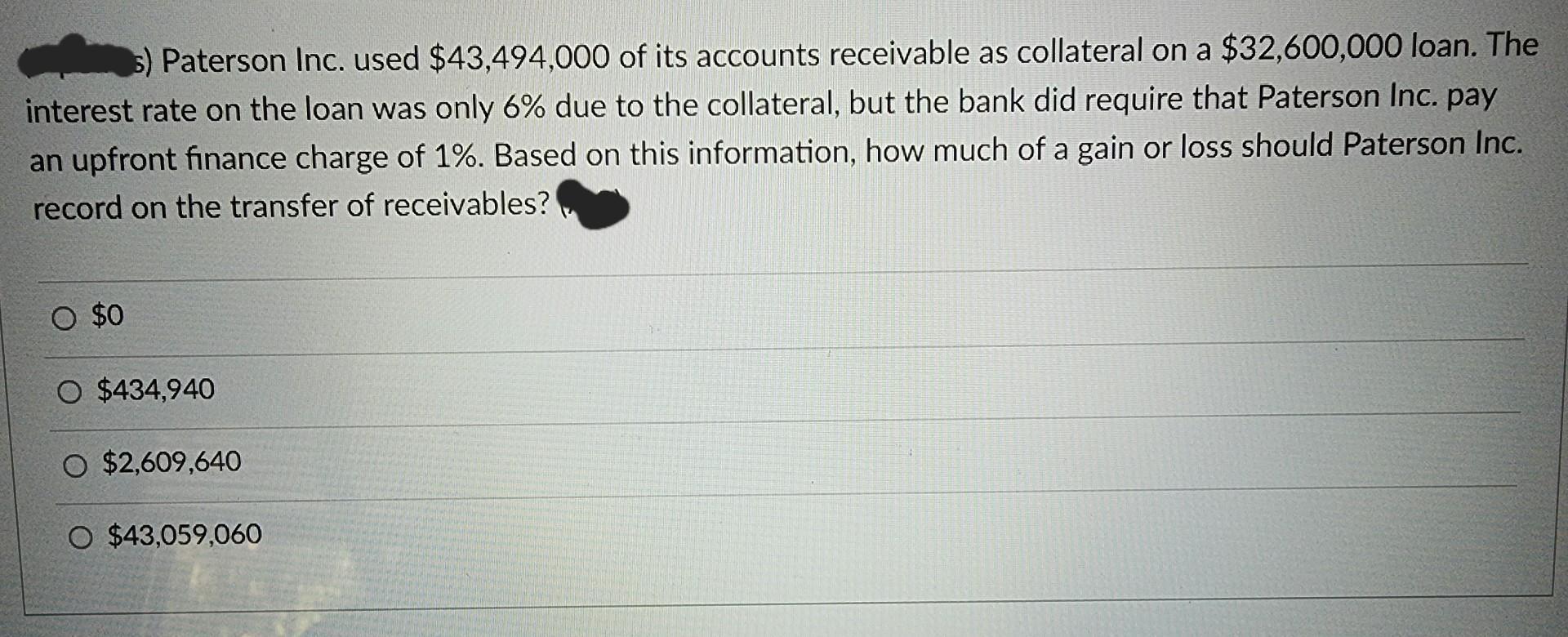

s) Paterson Inc. used $43,494,000 of its accounts receivable as collateral on a $32,600,000 loan. The interest rate on the loan was only 6% due to the collateral, but the bank did require that Paterson Inc. pay an upfront finance charge of 1%. Based on this information, how much of a gain or loss should Paterson Inc. record on the transfer of receivables? O $0 O $434,940 O $2,609,640 O $43,059,060

Step by Step Solution

3.44 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 Answer 0 Explanation Whenever Receivables are held as colla...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Introductory Financial Accounting for Business

Authors: Thomas Edmonds, Christopher Edmonds

1st edition

1260299449, 978-1260299441

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App