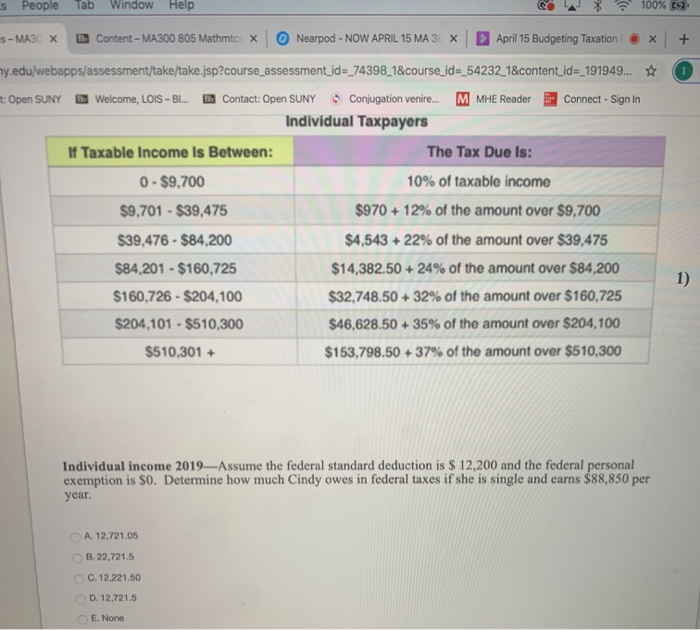

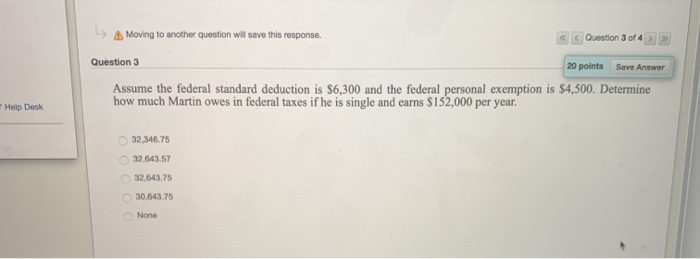

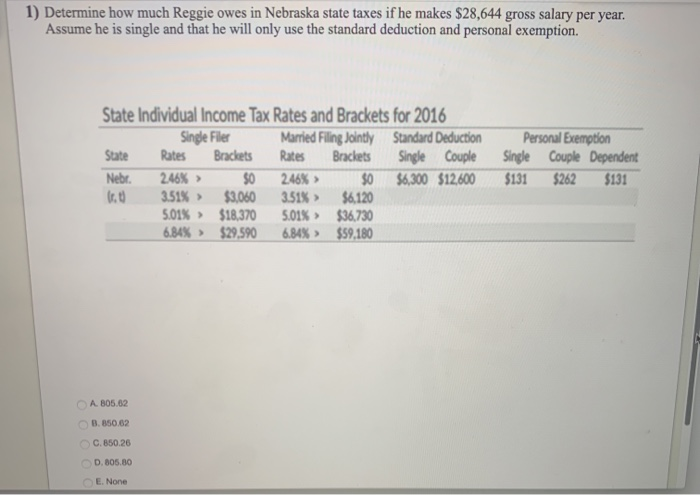

s People Tab Window Help * 100% 247 S-MA30 X Content - MA300 805 Mathmic: X Nearpod - NOW APRIL 15 MA 30 X April 15 Budgeting Taxation : x + O my.edu/webapps/assessment/take/take.jsp?course_assessment_id=_74398_1&course_id=_54232_1&content_id=_191949... t: Open SUNY Welcome, LOIS - B... Contact: Open SUNY Conjugation venire... M MHE Reader Connect - Sign In Individual Taxpayers If Taxable Income Is Between: The Tax Due is: 0 - $9,700 10% of taxable income $9,701 - $39,475 $970 + 12% of the amount over $9,700 $39,476 - $84,200 $4,543 + 22% of the amount over $39,475 $84,201 - $160,725 $14,382.50 +24% of the amount over $84,200 $160,726 - $204,100 $32,748.50 + 32% of the amount over $160,725 $204,101 - $510,300 $46,628.50 + 35% of the amount over $204,100 $510,301 + $153,798.50 +37% of the amount over $510,300 Individual income 2019. Assume the federal standard deduction is $ 12,200 and the federal personal exemption is $0. Determine how much Cindy owes in federal taxes if she is single and earns $88,850 per year. CA. 12,721.05 B.22,721.5 C. 12,221.50 D. 12,721.5 E. None > Moving to another question will save this response. Question 3 of 4 > >> Question 3 20 points Save Answer Assume the federal standard deduction is $6,300 and the federal personal exemption is $4,500. Determine how much Martin owes in federal taxes if he is single and earns $152,000 per year, Help Desk 32,346.75 32.643.57 32,643.75 30,643.75 None 1) Determine how much Reggie owes in Nebraska state taxes if he makes $28,644 gross salary per year. Assume he is single and that he will only use the standard deduction and personal exemption. State Individual Income Tax Rates and Brackets for 2016 Single Fler Married Filing Jointly Standard Deduction Suite Rates Brackets Rates Brackets Single Couple Nebr. 246%) 80 246% > 80 56,300 $12,600 c. 3.51%) $3.0603.51% > $6.120 5.01% $18,370 5 .01% > $36,730 6.84%) $29,590 6 .84%) $59.180 Personal Exemption Single Couple Dependent $131 $262 $131 A 806.62 3.85062 C. 850.26 0.805.80 None s People Tab Window Help * 100% 247 S-MA30 X Content - MA300 805 Mathmic: X Nearpod - NOW APRIL 15 MA 30 X April 15 Budgeting Taxation : x + O my.edu/webapps/assessment/take/take.jsp?course_assessment_id=_74398_1&course_id=_54232_1&content_id=_191949... t: Open SUNY Welcome, LOIS - B... Contact: Open SUNY Conjugation venire... M MHE Reader Connect - Sign In Individual Taxpayers If Taxable Income Is Between: The Tax Due is: 0 - $9,700 10% of taxable income $9,701 - $39,475 $970 + 12% of the amount over $9,700 $39,476 - $84,200 $4,543 + 22% of the amount over $39,475 $84,201 - $160,725 $14,382.50 +24% of the amount over $84,200 $160,726 - $204,100 $32,748.50 + 32% of the amount over $160,725 $204,101 - $510,300 $46,628.50 + 35% of the amount over $204,100 $510,301 + $153,798.50 +37% of the amount over $510,300 Individual income 2019. Assume the federal standard deduction is $ 12,200 and the federal personal exemption is $0. Determine how much Cindy owes in federal taxes if she is single and earns $88,850 per year. CA. 12,721.05 B.22,721.5 C. 12,221.50 D. 12,721.5 E. None > Moving to another question will save this response. Question 3 of 4 > >> Question 3 20 points Save Answer Assume the federal standard deduction is $6,300 and the federal personal exemption is $4,500. Determine how much Martin owes in federal taxes if he is single and earns $152,000 per year, Help Desk 32,346.75 32.643.57 32,643.75 30,643.75 None 1) Determine how much Reggie owes in Nebraska state taxes if he makes $28,644 gross salary per year. Assume he is single and that he will only use the standard deduction and personal exemption. State Individual Income Tax Rates and Brackets for 2016 Single Fler Married Filing Jointly Standard Deduction Suite Rates Brackets Rates Brackets Single Couple Nebr. 246%) 80 246% > 80 56,300 $12,600 c. 3.51%) $3.0603.51% > $6.120 5.01% $18,370 5 .01% > $36,730 6.84%) $29,590 6 .84%) $59.180 Personal Exemption Single Couple Dependent $131 $262 $131 A 806.62 3.85062 C. 850.26 0.805.80 None