Answered step by step

Verified Expert Solution

Question

1 Approved Answer

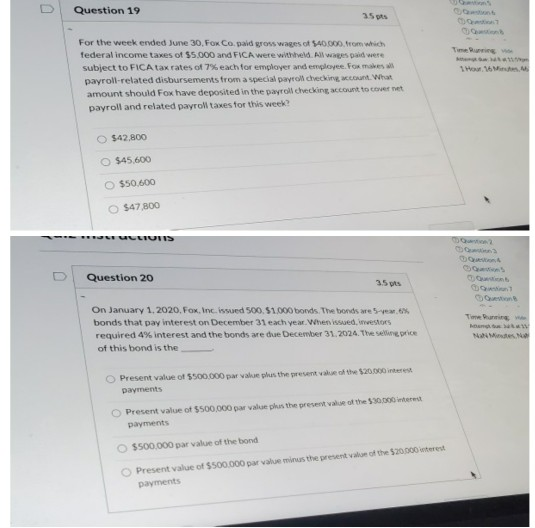

's Question 19 35 pts 1 Hour 16 MM For the week ended June 30, Fox Copaid grosswages of $40.000 from which federal income taxes

's Question 19 35 pts 1 Hour 16 MM For the week ended June 30, Fox Copaid grosswages of $40.000 from which federal income taxes of $5.000 and FICA were withheld All Waxes paid were subject to FICA tax rates of 7% each for employer and employee. Fox makes payroll-related disbursements from a special payroll checking account. Wha amount should Fox have deposited in the payroll checking account to come payroll and related payroll taxes for this week? $42.800 $45.600 $50.600 $47800 CLINIS Question 20 On January 1, 2020. Fox, Inc. issued 500 51.000 bonds. The bonds are 5 ve6% bonds that pay interest on December 31 each year. When issued, westors required 4% interest and the bonds are due December 31, 2024. The seve price of this bond is the toure. NeN Present value of $500.000 par le plus the prevent value of the $20.000 payments Present value of $500,000 par value phas the preservale of the $30.000 mm payments $500.000 par value of the bond Present value of $500.000 par value minus the presentation of the $20.000 terest payments

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started