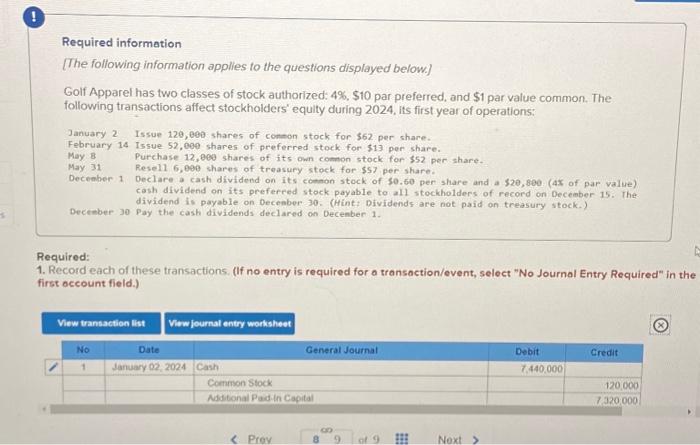

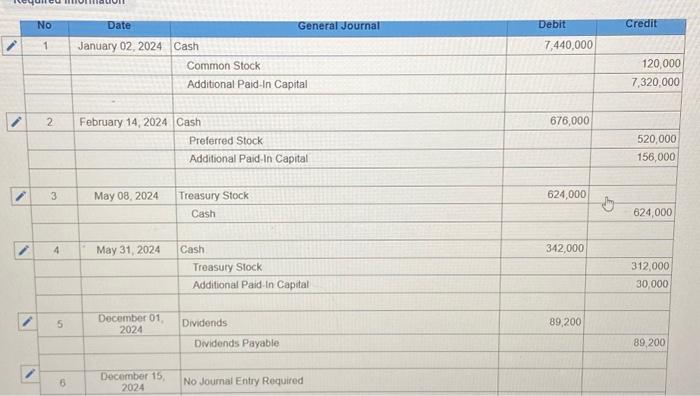

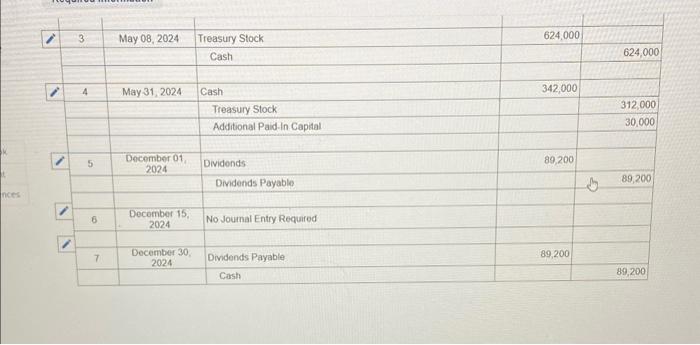

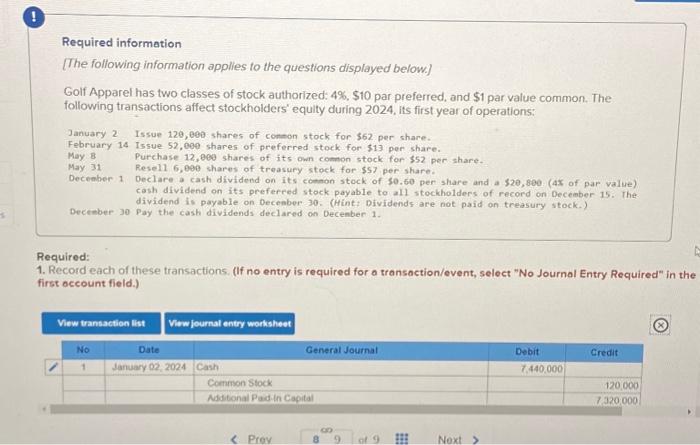

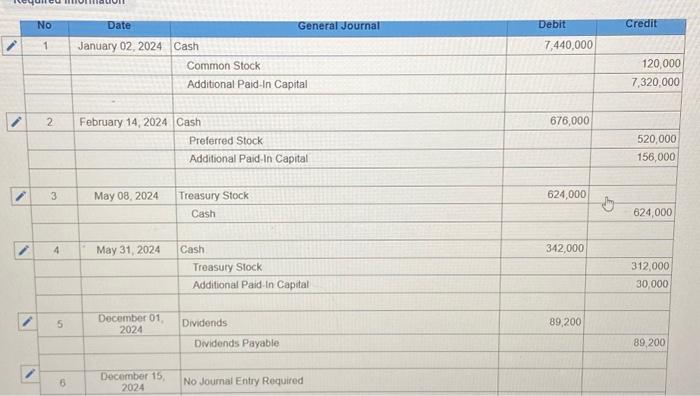

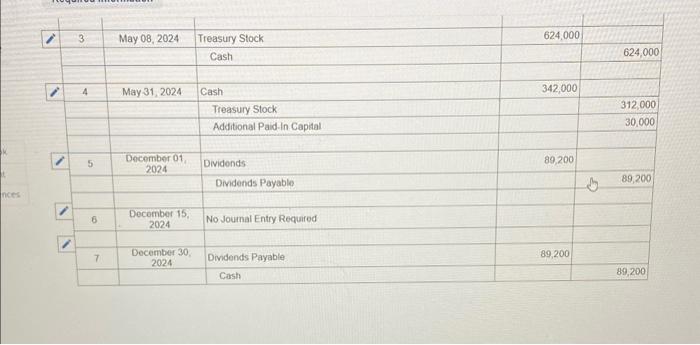

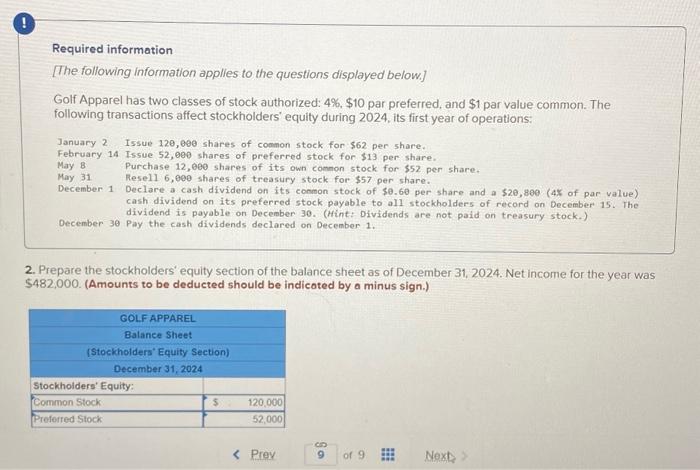

S Required information [The following information applies to the questions displayed below.] Golf Apparel has two classes of stock authorized: 4%, $10 par preferred, and $1 par value common. The following transactions affect stockholders' equity during 2024, its first year of operations: January 2 Issue 120,000 shares of common stock for $62 per share. Issue 52,000 shares of preferred stock for $13 per share. February 14 May 8 May 31 December 1 Purchase 12,000 shares of its own common stock for $52 per share. Resell 6,000 shares of treasury stock for $57 per share. Declare a cash dividend on its common stock of $0.60 per share and a $20,800 (4% of par value) cash dividend on its preferred stock payable to all stockholders of record on December 15. The dividend is payable on December 30. (Hint: Dividends are not paid on treasury stock.) December 30 Pay the cash dividends declared on December 1. L Required: 1. Record each of these transactions. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) No 1 View transaction list View journal entry worksheet Date January 02, 2024 Cash General Journal Common Stock Additional Paid-In Capital Debit 7,440,000 Credit 120,000 7,320,000

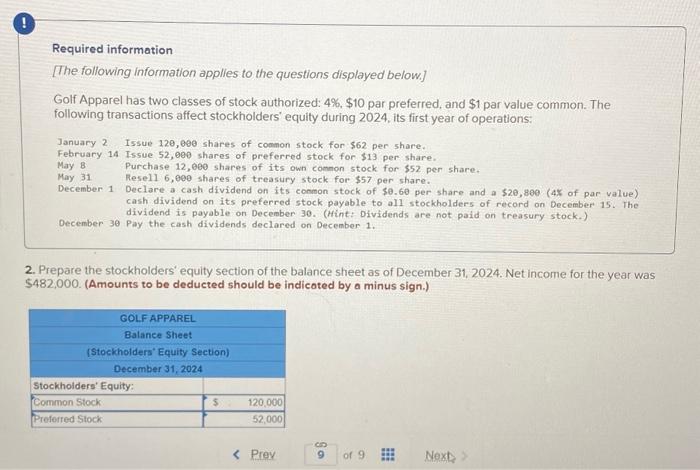

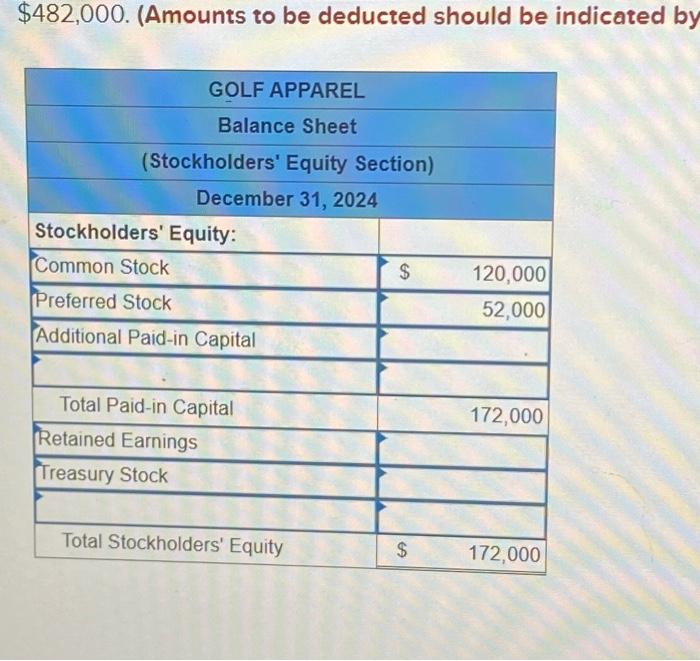

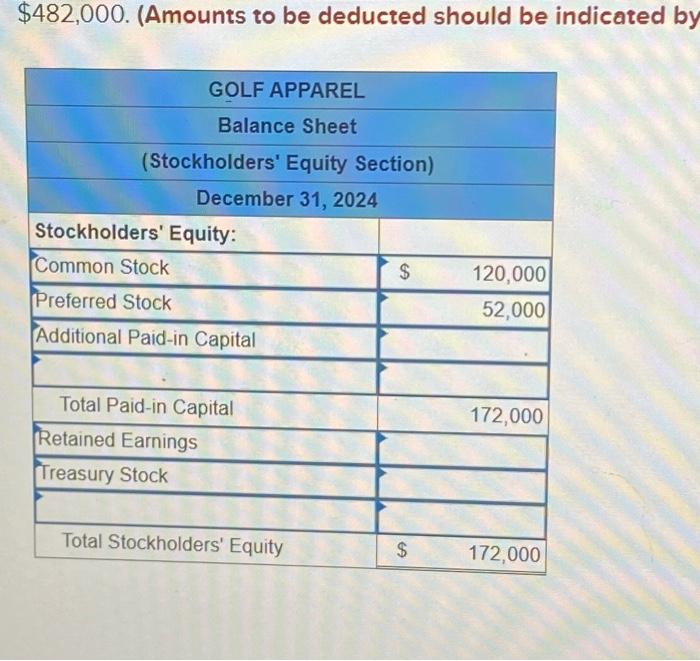

Required information [The following information applies to the questions displayed below.] Golf Apparel has two classes of stock authorized: 4%,$10 par preferred, and $1 par value common. The following transactions affect stockholders' equity during 2024, its first year of operations: January 2 Issue 120 , 200 shares of coneon stock for 562 per share - February 14 Issue 52 , 000 shares of preferred stock for $13 per share. May 8 Purchase 12,900 shares of its own common stock for $52 per share, May 31 Resel1 6,090 shares of treasury stock for $57 per share. December 1 Declare a cash dividend on its comen stock of 50.50 per share and a 520,800 (4x of par value) cash dividend on its preferred stock payable to all stockholders of record on December 15. The dividend is payable on Decenber 30. (Hint, Dividends are not paid on treasury stock.) Decenber 30 Pay the cash dividends declared on December 1. Required: 1. Record each of these transactions. (If no entry is required for a transoction/event, select "No Journal Entry Required" in th irst occount field.) $482,000. (Amounts to be deducted should be indicated by Required information [The following information applies to the questions displayed below.] Golf Apparel has two classes of stock authorized: 4%,$10 par preferred, and $1 par value common. The following transactions affect stockholders' equity during 2024, its first year of operations: January 2. Issue 120,090 shares of common stock for $62 per share. February 14 Issue 52,000 shares of preferred stock for $13 per share. May B Purchase 12,000 shares of its own comnon stock for $52 per share. May 31 Resel1 6,000 shares of treasury stock for $57 per share. December 1 Declare a cash dividend on its common stock of $0.60 per share and a $20,800 (48 of par value) cash dividend on its preferred stock payable to all stockholders of record on December 15 . The dividend is payable on December 30. (Hint: Dividends are not paid on treasury stock.) December 30 Pay the cash dividends declared on December 1. 2. Prepare the stockholders' equity section of the balance sheet as of December 31,2024 . Net income for the year was $482,000. (Amounts to be deducted should be indicoted by a minus sign.) Required information [The following information applies to the questions displayed below.] Golf Apparel has two classes of stock authorized: 4%,$10 par preferred, and $1 par value common. The following transactions affect stockholders' equity during 2024, its first year of operations: January 2 Issue 120 , 200 shares of coneon stock for 562 per share - February 14 Issue 52 , 000 shares of preferred stock for $13 per share. May 8 Purchase 12,900 shares of its own common stock for $52 per share, May 31 Resel1 6,090 shares of treasury stock for $57 per share. December 1 Declare a cash dividend on its comen stock of 50.50 per share and a 520,800 (4x of par value) cash dividend on its preferred stock payable to all stockholders of record on December 15. The dividend is payable on Decenber 30. (Hint, Dividends are not paid on treasury stock.) Decenber 30 Pay the cash dividends declared on December 1. Required: 1. Record each of these transactions. (If no entry is required for a transoction/event, select "No Journal Entry Required" in th irst occount field.) $482,000. (Amounts to be deducted should be indicated by Required information [The following information applies to the questions displayed below.] Golf Apparel has two classes of stock authorized: 4%,$10 par preferred, and $1 par value common. The following transactions affect stockholders' equity during 2024, its first year of operations: January 2. Issue 120,090 shares of common stock for $62 per share. February 14 Issue 52,000 shares of preferred stock for $13 per share. May B Purchase 12,000 shares of its own comnon stock for $52 per share. May 31 Resel1 6,000 shares of treasury stock for $57 per share. December 1 Declare a cash dividend on its common stock of $0.60 per share and a $20,800 (48 of par value) cash dividend on its preferred stock payable to all stockholders of record on December 15 . The dividend is payable on December 30. (Hint: Dividends are not paid on treasury stock.) December 30 Pay the cash dividends declared on December 1. 2. Prepare the stockholders' equity section of the balance sheet as of December 31,2024 . Net income for the year was $482,000. (Amounts to be deducted should be indicoted by a minus sign.)