Answered step by step

Verified Expert Solution

Question

1 Approved Answer

S & X Co. is a retail store owned solely by Joe Saunder. During the month of November, the equity accounts were affected by the

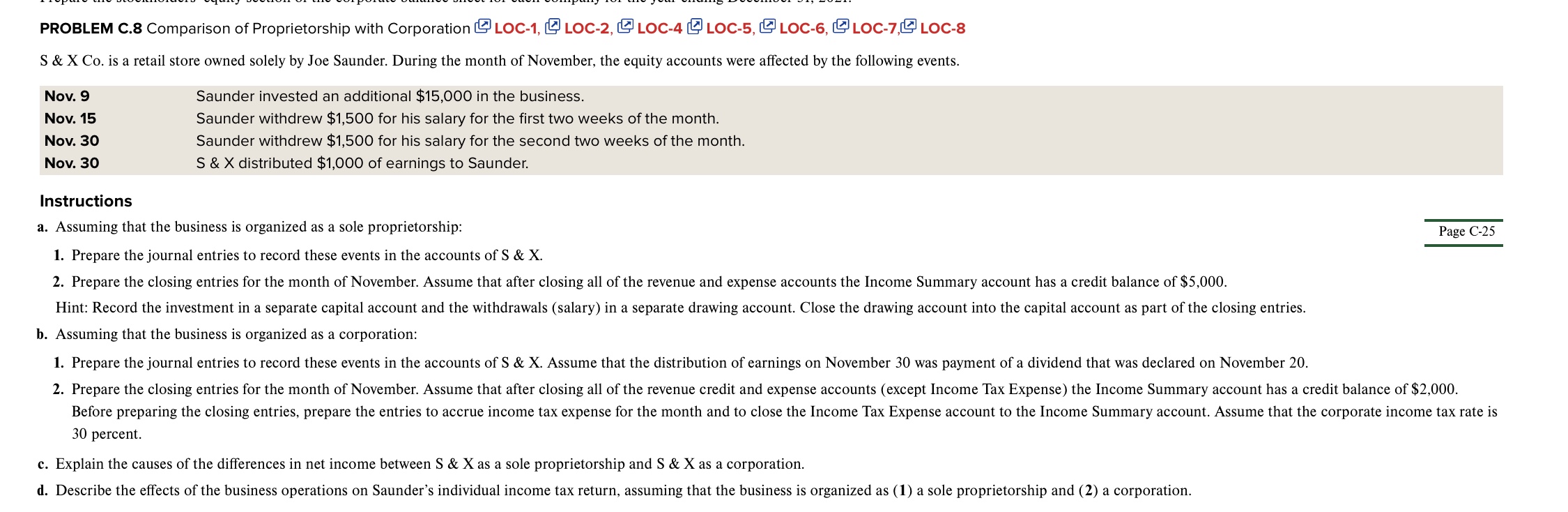

S \& X Co. is a retail store owned solely by Joe Saunder. During the month of November, the equity accounts were affected by the following events. Nov. 9 Nov. 15 Nov. 30 Nov. 30 Saunder invested an additional $15,000 in the business. Saunder withdrew $1,500 for his salary for the first two weeks of the month. Saunder withdrew $1,500 for his salary for the second two weeks of the month. S&X distributed $1,000 of earnings to Saunder. Instructions a. Assuming that the business is organized as a sole proprietorship: Page C-25 1. Prepare the journal entries to record these events in the accounts of S&X. 2. Prepare the closing entries for the month of November. Assume that after closing all of the revenue and expense accounts the Income Summary account has a credit balance of $5,000. Hint: Record the investment in a separate capital account and the withdrawals (salary) in a separate drawing account. Close the drawing account into the capital account as part of the closing entries. b. Assuming that the business is organized as a corporation: 1. Prepare the journal entries to record these events in the accounts of S \& X. Assume that the distribution of earnings on November 30 was payment of a dividend that was declared on November 20. 30 percent. c. Explain the causes of the differences in net income between S&X as a sole proprietorship and S&X as a corporation. d. Describe the effects of the business operations on Saunder's individual income tax return, assuming that the business is organized as (1) a sole proprietorship and (2) a corporation

S \& X Co. is a retail store owned solely by Joe Saunder. During the month of November, the equity accounts were affected by the following events. Nov. 9 Nov. 15 Nov. 30 Nov. 30 Saunder invested an additional $15,000 in the business. Saunder withdrew $1,500 for his salary for the first two weeks of the month. Saunder withdrew $1,500 for his salary for the second two weeks of the month. S&X distributed $1,000 of earnings to Saunder. Instructions a. Assuming that the business is organized as a sole proprietorship: Page C-25 1. Prepare the journal entries to record these events in the accounts of S&X. 2. Prepare the closing entries for the month of November. Assume that after closing all of the revenue and expense accounts the Income Summary account has a credit balance of $5,000. Hint: Record the investment in a separate capital account and the withdrawals (salary) in a separate drawing account. Close the drawing account into the capital account as part of the closing entries. b. Assuming that the business is organized as a corporation: 1. Prepare the journal entries to record these events in the accounts of S \& X. Assume that the distribution of earnings on November 30 was payment of a dividend that was declared on November 20. 30 percent. c. Explain the causes of the differences in net income between S&X as a sole proprietorship and S&X as a corporation. d. Describe the effects of the business operations on Saunder's individual income tax return, assuming that the business is organized as (1) a sole proprietorship and (2) a corporation Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started