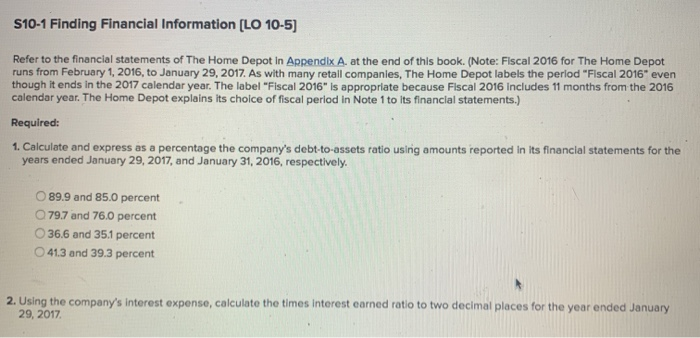

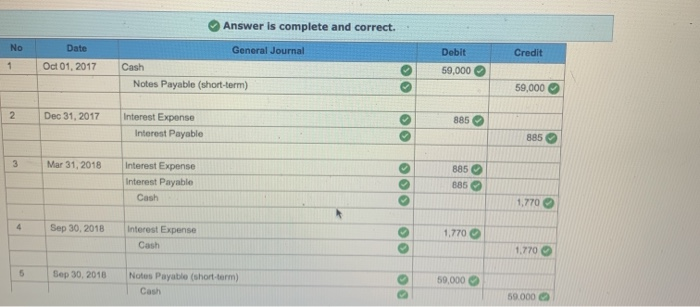

S10-1 Finding Financial Information (LO 10-5) Refer to the financial statements of The Home Depot in Appendix A. at the end of this book. (Note: Fiscal 2016 for The Home Depot runs from February 1, 2016, to January 29, 2017. As with many retail companies, The Home Depot labels the period "Fiscal 2016" even though it ends in the 2017 calendar year. The label "Fiscal 2016" is appropriate because Fiscal 2016 Includes 11 months from the 2016 calendar year. The Home Depot explains its choice of fiscal period in Note 1 to its financial statements.) Required: 1. Calculate and express as a percentage the company's debt-to-assets ratio using amounts reported in its financial statements for the years ended January 29, 2017, and January 31, 2016, respectively. 89.9 and 85.0 percent 79.7 and 76.0 percent 36.6 and 35.1 percent 41.3 and 39.3 percent 2. Using the company's interest expense, calculate the times interest earned ratio to two decimal places for the year ended January 29, 2017 Answer is complete and correct. Credit No 1 Date Oct 01, 2017 General Journal Cash Notes Payable (short-term) Debit 59,000 59,000 Dec 31, 2017 Interest Expense Interest Payable 885 Mar 31, 2018 Interest Expense Interest Payable Cash 1.770 Sep 30, 2018 1.770 interest Expense Cash 1.770 6 Sep 30, 2018 Notes Payable (short-term) Cash 59.000 59000 APPENDIX A Excerpts from the Fiscal 2016 Annual Report of The Home Depot, Inc. Management's Responsibility for Financial Statements The consolidated financial statements presented in this Annual Report have been prepared with integrity and objectivity and are the responsibility of the management of The Home Depot, Inc. These consolidated financial statements have been prepared in conformity with U.S. generally accepted accounting principles and properly reflect certain estimates and judg- ments based upon the best available information. The consolidated financial statements of the Company have been audited by KPMG LLP, an independent registered public accounting firm. Their accompanying report is based upon an audit conducted in accordance with the standards of the Public Company Accounting Oversight Board (United States). The Audit Committee of the Board of Directors, consisting solely of independent direc tors, meets five times a year with the independent registered public accounting firm, the inter- nal auditors and representatives of management to discuss auditing and financial reporting matters. In addition, a telephonic meeting is held prior to each quarterly earnings release. The Audit Committee retains the independent registered public accounting firm and regularly reviews the internal accounting controls, the activities of the independent registered public accounting firm and internal auditors and the financial condition of the Company. Both the Company's independent registered public accounting firm and the internal auditors have free access to the Audit Committee. Management's Report on Internal Control Over Financial Reporting Our management is responsible for establishing and maintaining adequate internal control over financial reporting, as such term is defined in Rule 13-15(D) promulgated under the Securities Exchange Act of 1934, as amended (the "Exchange Act"). Under the supervi. sion and with the participation of our management, including our Chief Executive Officer and Chief Financial Officer, we conducted an evaluation of the effectiveness of our internal control over financial reporting as of January 29, 2017 based on the framework in Internal Control Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO). Based on our evaluation, our managem that our internal control over financial reporting was effective as of January 29, 2017 in pro. viding reasonable assurance regarding the reliability of financial reporting and the prepara tidn of financial statements for external purposes in accordance with U.S. generally accepted accounting principles. The effectiveness of our internal control over financial reporting as of January 29, 2017 has been audited by KPMG LLP, an independent registered public account ing firm, as stated in their report. Is/ CRAIG A. MENEAR Craig A. Menear Chairman, Chief Executive Officer and President Is/ CAROL. B. TOM Carol B. Tom Chief Financial Officer and Executive Vice President - Corporate Services