Answered step by step

Verified Expert Solution

Question

1 Approved Answer

S8 - part 3 - line 7 OR 9 The amount of CPP contributions Anna is able to claim as a tax credit (the amount

S8 - part 3 - line 7 OR 9

The amount of CPP contributions Anna is able to claim as a tax credit

(the amount she has already paid OR the amount she is correctly required to pay - whichever is less)

Question

S8 - Part 3 - line 8 OR 10

This is the amount of "enhanced CPP contributions" Anna may have paid. This will be counted as a deduction.

Question

T1 - step 4 - line 66

This is Anna's taxable income

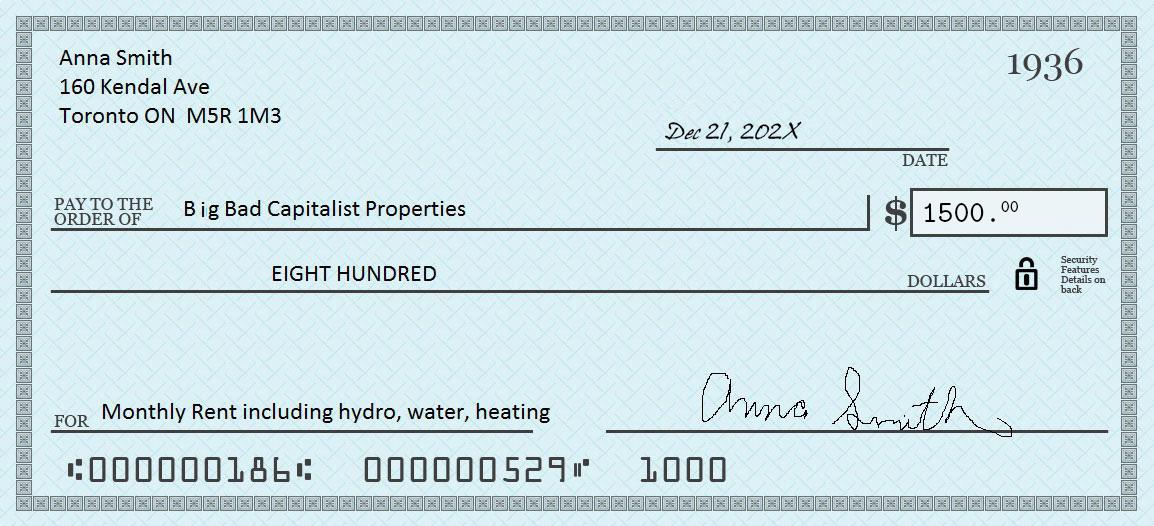

Anna Smith 160 Kendal Ave Toronto ON M5R 1M3 PAY TO THE ORDER OF Big Bad Capitalist Properties EIGHT HUNDRED FOR Monthly Rent including hydro, water, heating 000000186 000000529 Dec 21, 202X DATE 1936 1500.00 Security Features Details on DOLLARS back Anna Smith 1000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started