Answered step by step

Verified Expert Solution

Question

1 Approved Answer

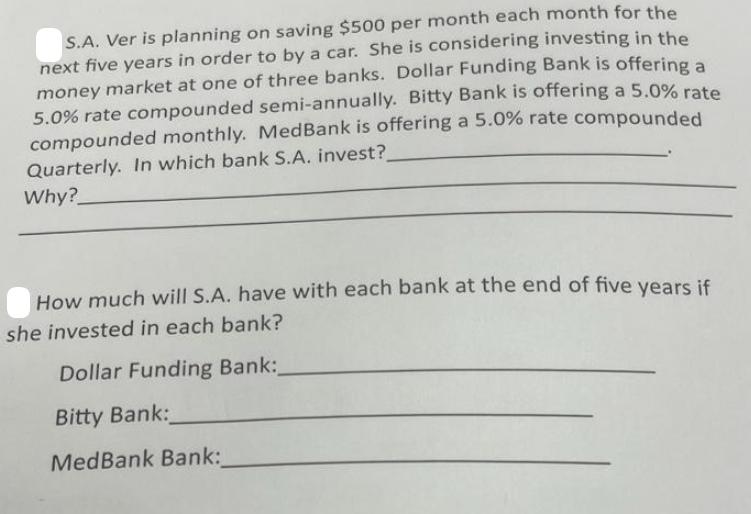

S.A. Ver is planning on saving $500 per month each month for the next five years in order to by a car. She is

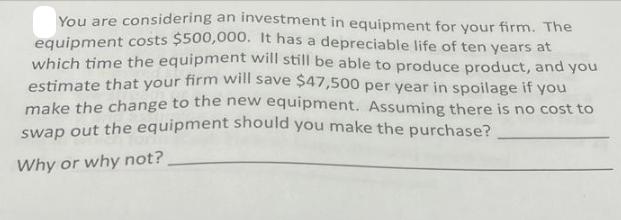

S.A. Ver is planning on saving $500 per month each month for the next five years in order to by a car. She is considering investing in the money market at one of three banks. Dollar Funding Bank is offering a 5.0% rate compounded semi-annually. Bitty Bank is offering a 5.0% rate compounded monthly. MedBank is offering a 5.0% rate compounded Quarterly. In which bank S.A. invest? Why? How much will S.A. have with each bank at the end of five years if she invested in each bank? Dollar Funding Bank: Bitty Bank: MedBank Bank: You are considering an investment in equipment for your firm. The equipment costs $500,000. It has a depreciable life of ten years at which time the equipment will still be able to produce product, and you estimate that your firm will save $47,500 per year in spoilage if you make the change to the new equipment. Assuming there is no cost to swap out the equipment should you make the purchase? Why or why not?

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

1 The formula is FVP1rnnt Here FV is the future value of the investment P is the monthly savings amo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started