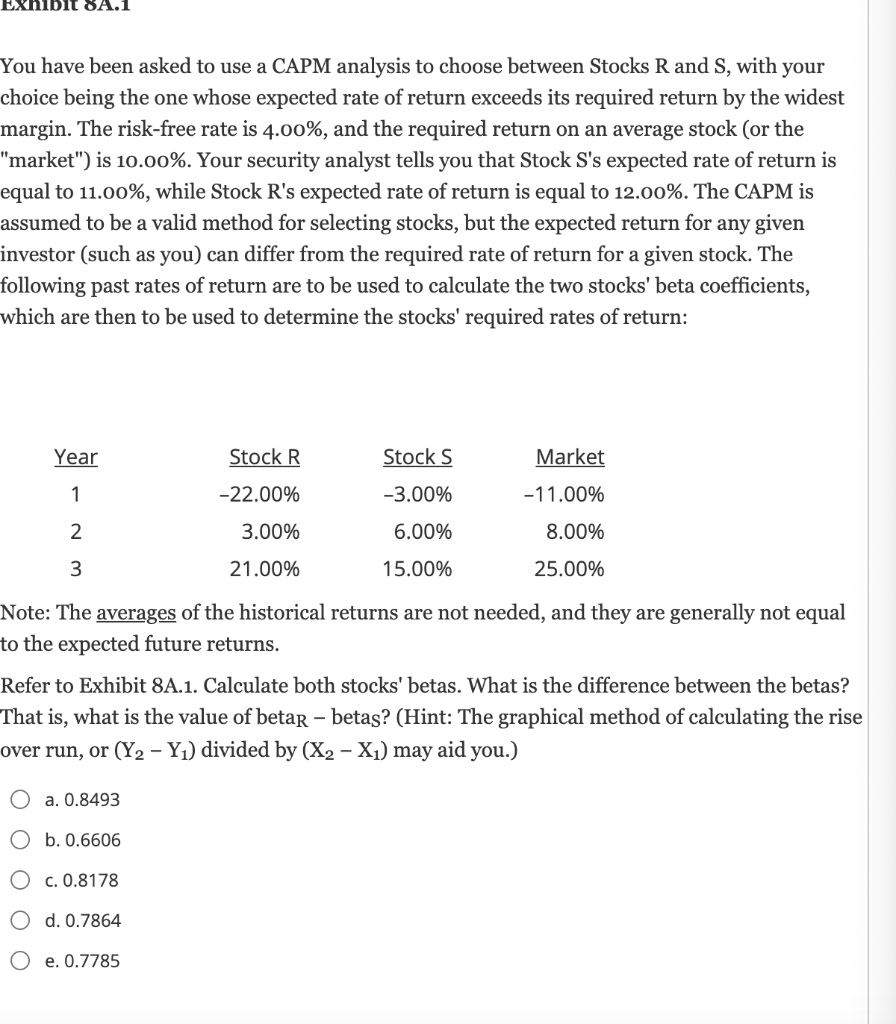

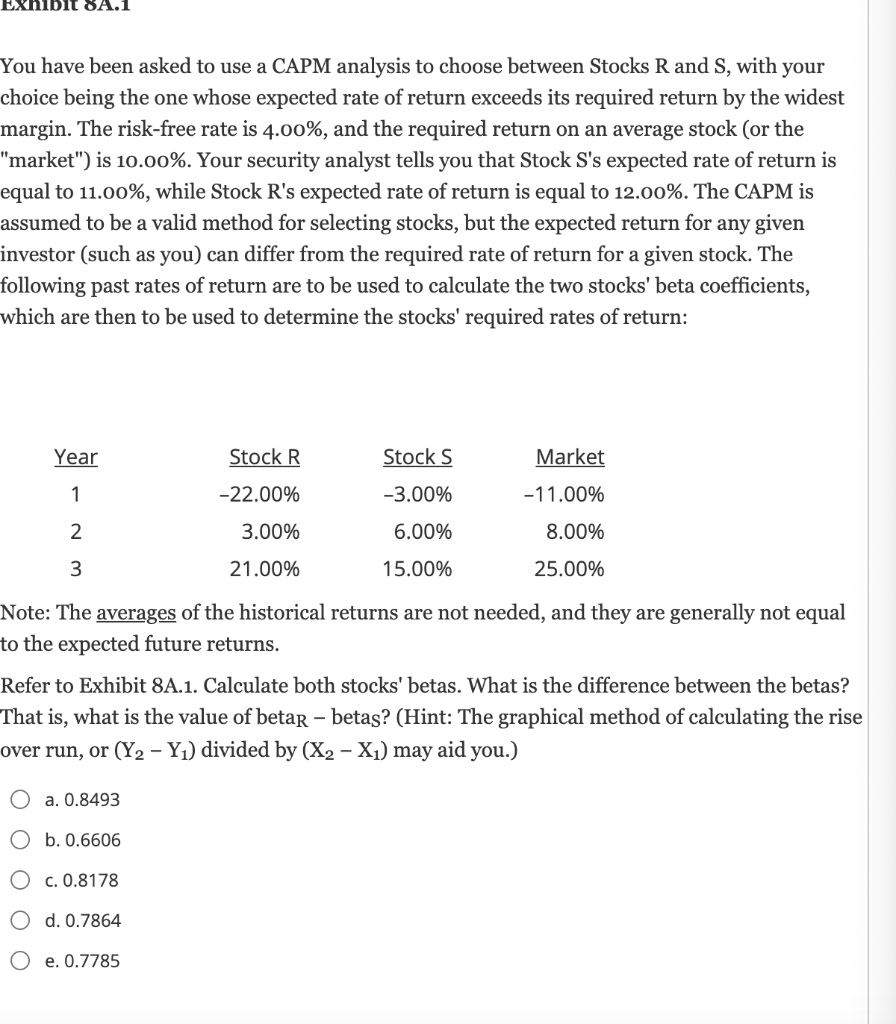

SA.1 You have been asked to use a CAPM analysis to choose between Stocks R and S, with your choice being the one whose expected rate of return exceeds its required return by the widest margin. The risk-free rate is 4.00%, and the required return on an average stock (or the "market") is 10.00%. Your security analyst tells you that Stock S's expected rate of return is equal to 11.00%, while Stock R's expected rate of return is equal to 12.00%. The CAPM is assumed to be a valid method for selecting stocks, but the expected return for any given investor (such as you) can differ from the required rate of return for a given stock. The following past rates of return are to be used to calculate the two stocks' beta coefficients, which are then to be used to determine the stocks' required rates of return: Year Stock R Stocks Market 1 -22.00% -3.00% -11.00% 2 3.00% 6.00% 8.00% 3 21.00% 15.00% 25.00% Note: The averages of the historical returns are not needed, and they are generally not equal to the expected future returns. Refer to Exhibit 8A.1. Calculate both stocks' betas. What is the difference between the betas? That is, what is the value of betar betas? (Hint: The graphical method of calculating the rise over run, or (Y2 - Y1) divided by (X2 - X) may aid you.) a. 0.8493 O b. 0.6606 O c. 0.8178 d. 0.7864 e. 0.7785 SA.1 You have been asked to use a CAPM analysis to choose between Stocks R and S, with your choice being the one whose expected rate of return exceeds its required return by the widest margin. The risk-free rate is 4.00%, and the required return on an average stock (or the "market") is 10.00%. Your security analyst tells you that Stock S's expected rate of return is equal to 11.00%, while Stock R's expected rate of return is equal to 12.00%. The CAPM is assumed to be a valid method for selecting stocks, but the expected return for any given investor (such as you) can differ from the required rate of return for a given stock. The following past rates of return are to be used to calculate the two stocks' beta coefficients, which are then to be used to determine the stocks' required rates of return: Year Stock R Stocks Market 1 -22.00% -3.00% -11.00% 2 3.00% 6.00% 8.00% 3 21.00% 15.00% 25.00% Note: The averages of the historical returns are not needed, and they are generally not equal to the expected future returns. Refer to Exhibit 8A.1. Calculate both stocks' betas. What is the difference between the betas? That is, what is the value of betar betas? (Hint: The graphical method of calculating the rise over run, or (Y2 - Y1) divided by (X2 - X) may aid you.) a. 0.8493 O b. 0.6606 O c. 0.8178 d. 0.7864 e. 0.7785