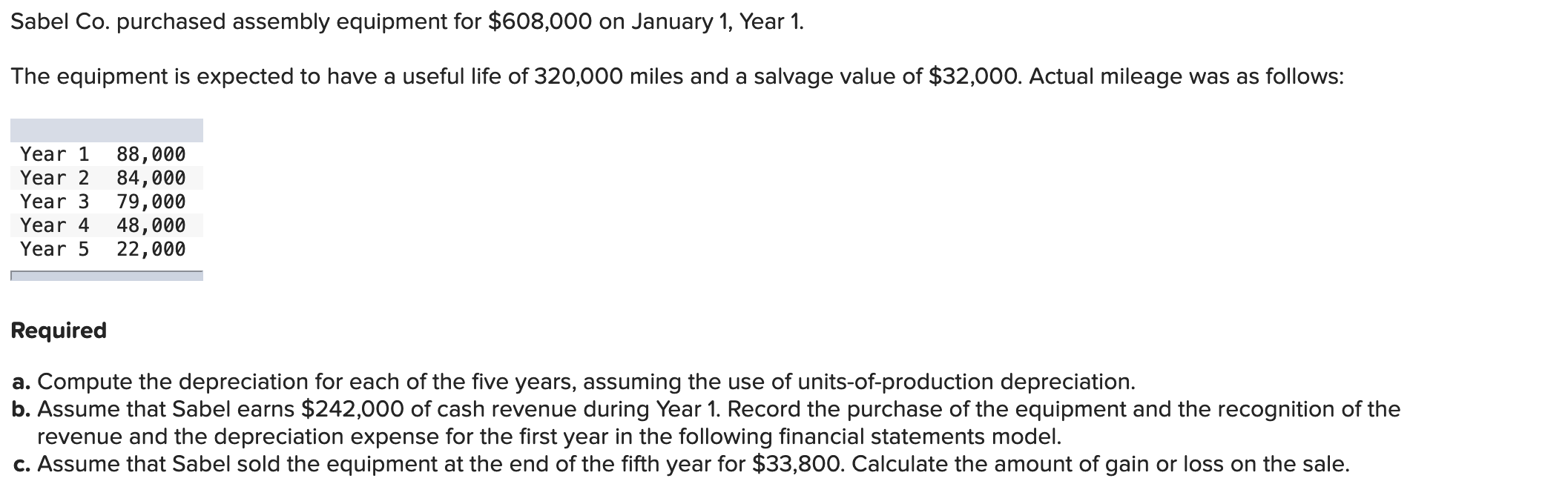

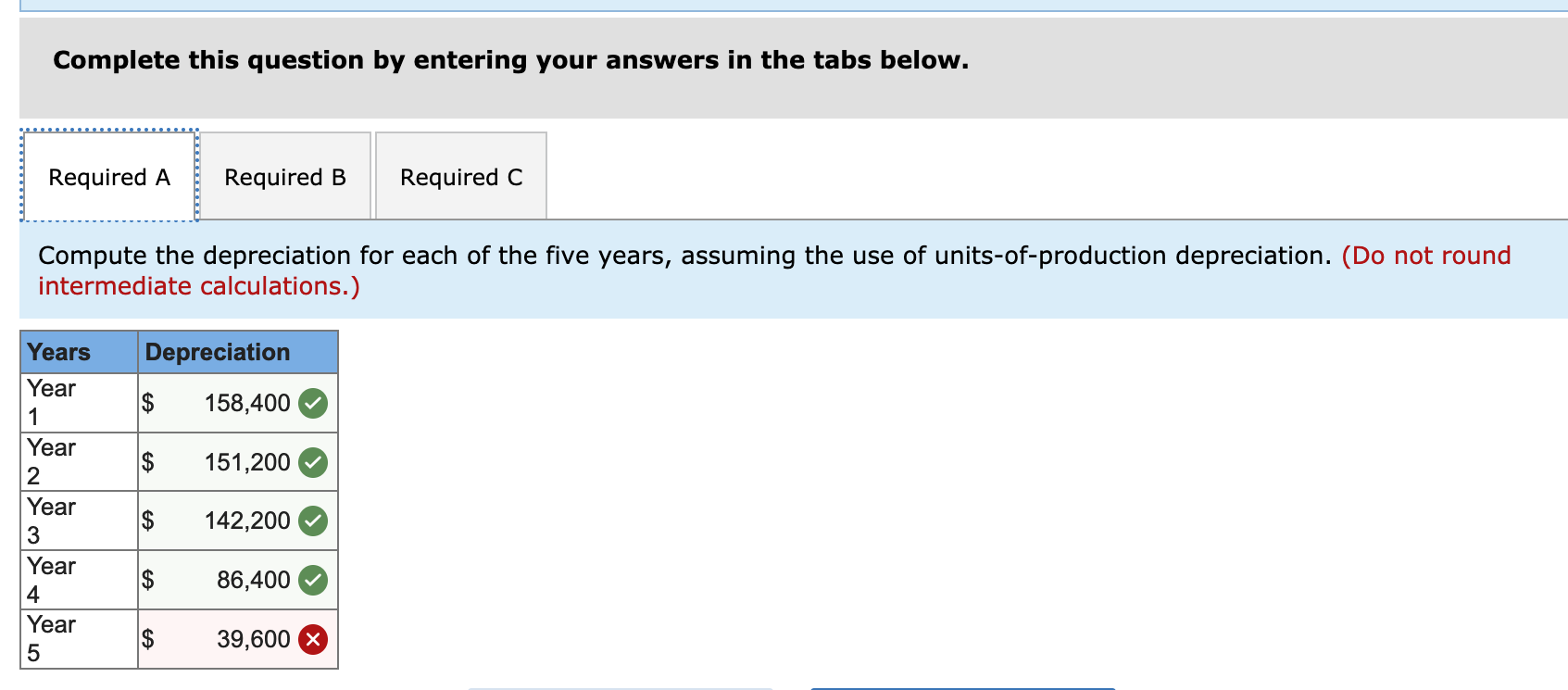

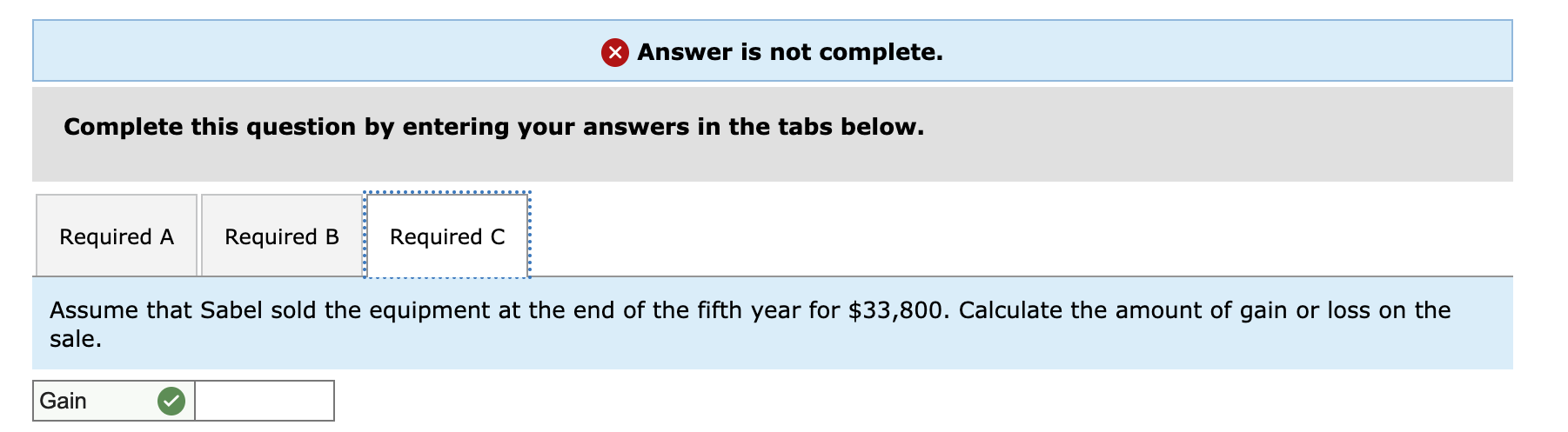

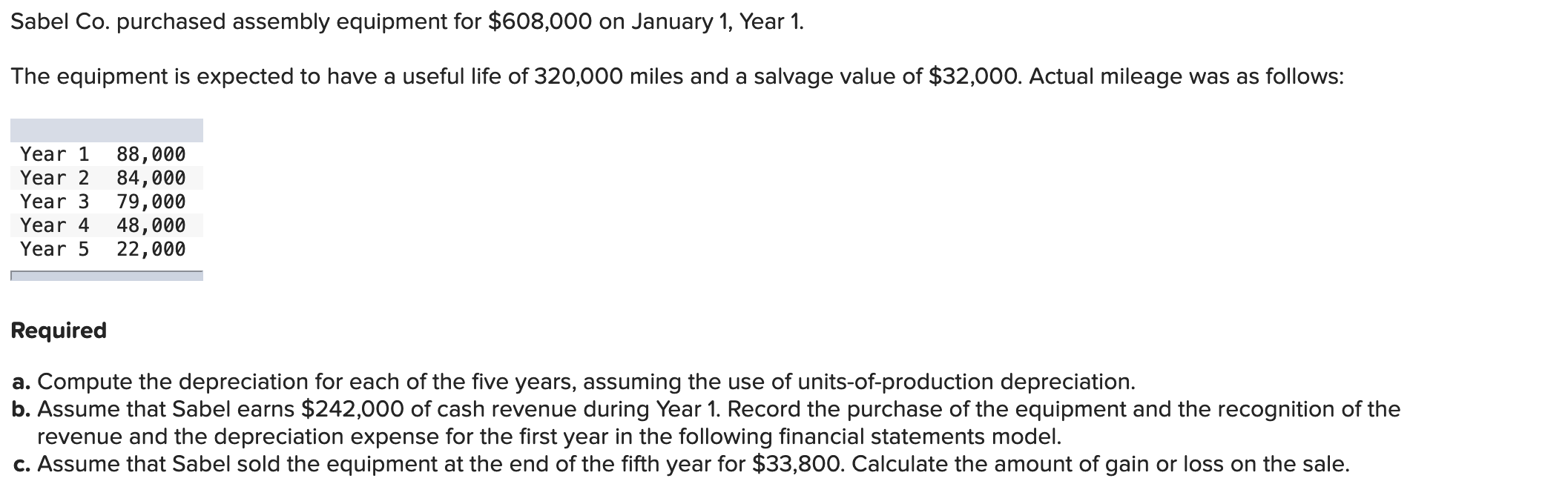

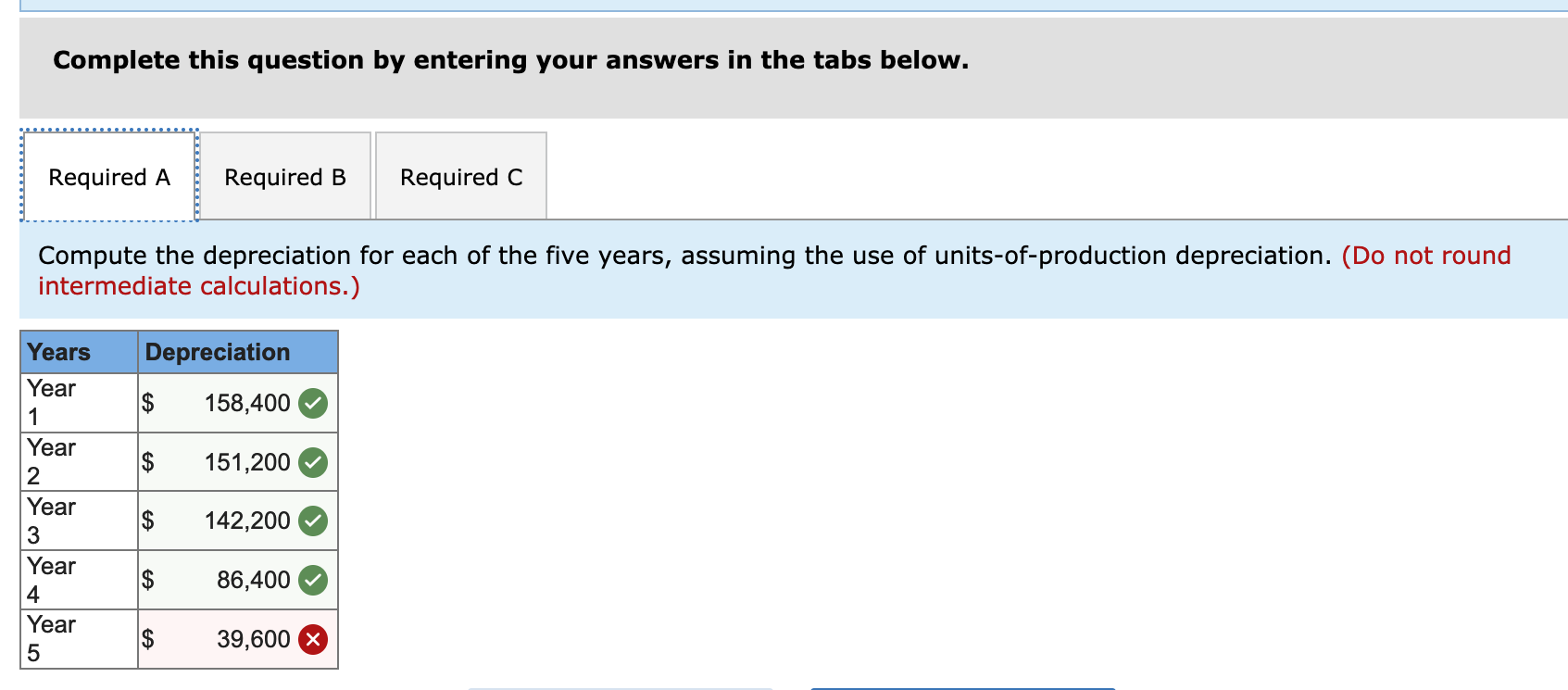

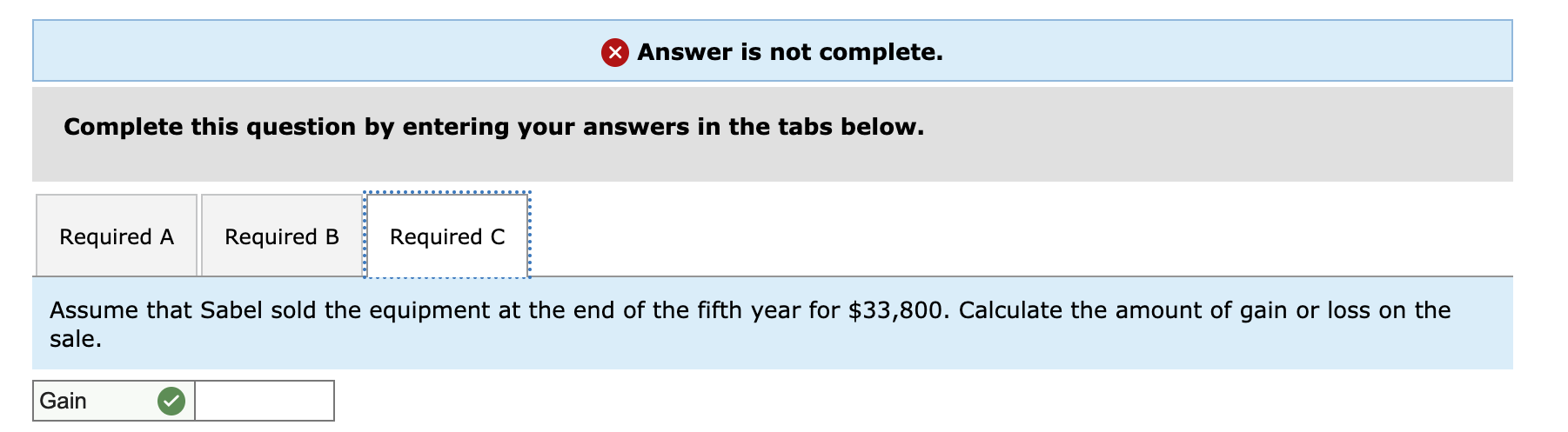

Sabel Co. purchased assembly equipment for $608,000 on January 1, Year 1. The equipment is expected to have a useful life of 320,000 miles and a salvage value of $32,000. Actual mileage was as follows: Year 1 Year 2 Year 3 Year 4 Year 5 88,000 84,000 79,000 48,000 22,000 Required a. Compute the depreciation for each of the five years, assuming the use of units-of-production depreciation. b. Assume that Sabel earns $242,000 of cash revenue during Year 1. Record the purchase of the equipment and the recognition of the revenue and the depreciation expense for the first year in the following financial statements model. c. Assume that Sabel sold the equipment at the end of the fifth year for $33,800. Calculate the amount of gain or loss on the sale. Complete this question by entering your answers in the tabs below. Required A Required B Required C Compute the depreciation for each of the five years, assuming the use of units-of-production depreciation. (Do not round intermediate calculations.) Years Depreciation 158,400 $ 151,200 Year 1 Year 2 Year 3 Year 4 Year 5 $ 142,200 $ 86,400 $ 39,600 X X Answer is not complete. Complete this question by entering your answers in the tabs below. Required A Required B Required C Assume that Sabel sold the equipment at the end of the fifth year for $33,800. Calculate the amount of gain or loss on the sale. Gain Sabel Co. purchased assembly equipment for $608,000 on January 1, Year 1. The equipment is expected to have a useful life of 320,000 miles and a salvage value of $32,000. Actual mileage was as follows: Year 1 Year 2 Year 3 Year 4 Year 5 88,000 84,000 79,000 48,000 22,000 Required a. Compute the depreciation for each of the five years, assuming the use of units-of-production depreciation. b. Assume that Sabel earns $242,000 of cash revenue during Year 1. Record the purchase of the equipment and the recognition of the revenue and the depreciation expense for the first year in the following financial statements model. c. Assume that Sabel sold the equipment at the end of the fifth year for $33,800. Calculate the amount of gain or loss on the sale. Complete this question by entering your answers in the tabs below. Required A Required B Required C Compute the depreciation for each of the five years, assuming the use of units-of-production depreciation. (Do not round intermediate calculations.) Years Depreciation 158,400 $ 151,200 Year 1 Year 2 Year 3 Year 4 Year 5 $ 142,200 $ 86,400 $ 39,600 X X Answer is not complete. Complete this question by entering your answers in the tabs below. Required A Required B Required C Assume that Sabel sold the equipment at the end of the fifth year for $33,800. Calculate the amount of gain or loss on the sale. Gain